EURUSD: markets await US inflation data

The EURUSD rate is correcting; buyers hold the pair above the 1.0900 support level. Find out more in our analysis dated 12 August 2024.

EURUSD trading key points

- Markets are preparing for the release of crucial US inflation data, which could influence the Federal Reserve’s further policy

- Annual core inflation is projected to fall to 3.2%, potentially marking the lowest level in recent years

- Federal Reserve chair signals potential monetary policy easing but emphasises that inflation remains above the target

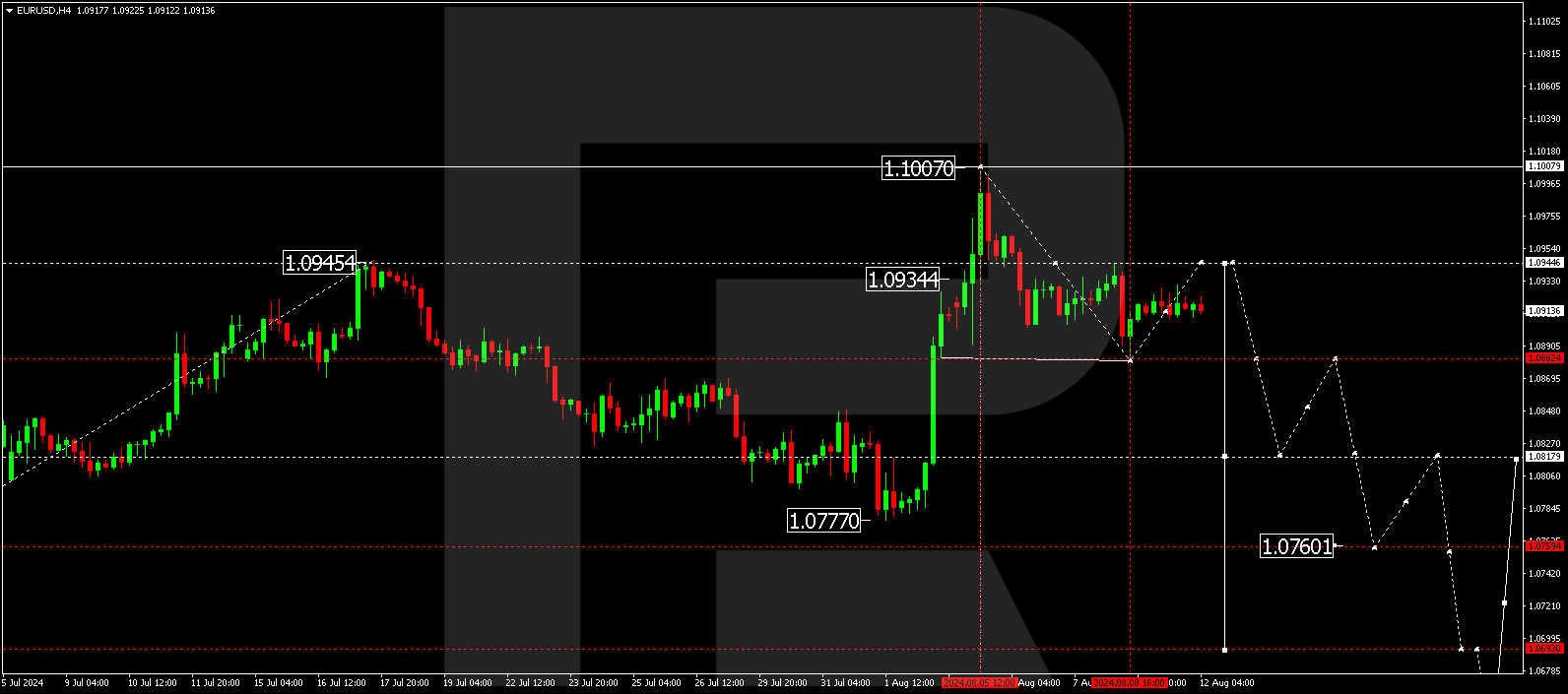

- EURUSD forecast for 12 August 2024: 1.0944, 1.0880, and 1.0820

Fundamental analysis

The EURUSD rate rose to a seven-month high last week, driven by a weak July employment report that heightened concerns about a recession and a potential Federal Reserve interest rate cut. However, the economic data calmed markets, partially recovering the US dollar.

Investors are now focused on US inflation data scheduled for release on Tuesday and Wednesday. Forecasts suggest a decrease in annual core inflation to 3.2%, which will mark the lowest reading since April 2021.

Meanwhile, Federal Reserve Board of Governors member Michelle Bowman noted that inflation remained above the target. Still, she acknowledged the possibility of a gradual interest rate reduction in the future if inflation continued to slow. Although markets reduced the likelihood of a sharp Federal Reserve interest rate cut to 54%, expectations of overall easing by over 100 basis points this year persist.

Significantly lower-than-expected inflation data may fuel concerns that the Federal Reserve is not reducing rates aggressively enough. Today’s EURUSD forecast suggests that such a scenario could prompt the regulator to accelerate the pace of monetary policy easing, thereby supporting the euro’s growth.

EURUSD technical analysis

The EURUSD H4 chart shows that the market continues to form a consolidation range around 1.0909. The price is expected to break above the range today, 12 August 2024, and maintain its upward trajectory, targeting 1.0944. This growth is considered a correction of the initial downward wave. Once the correction is complete, a new downward wave could start, aiming for 1.0880. A breakout below this level will open the potential for a decline towards 1.0820, the local estimated target.

Summary

This week’s inflation data release could catalyse new movements in the currency market as investors will assess the likelihood of further Federal Reserve monetary policy easing. Technical indicators in today’s EURUSD forecast suggest a correction towards 1.0944, followed by a potential decline to the 1.0880 and 10820 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.