EURUSD continues to correct after a surge

A decrease in France’s balance of trade and US initial jobless claims may fuel a continuation of the EURUSD correction. Find out more in our analysis dated 8 August 2024.

EURUSD trading key points

- France’s exports: previously at 50.4 billion EUR

- France’s imports: previously at 58.2 billion EUR

- France’s balance of trade: previously at -8.0 billion EUR, forecasted at -7.5 billion EUR

- US initial jobless claims: previously at 249 thousand EUR, forecasted at 241 thousand

- EURUSD forecast for 8 August 2024: 1.0860 and 1.0820

Fundamental analysis

France’s exports have remained relatively stable at around 50.0 billion over the past several years, compared to the previous reading of 50.4 billion.

France’s imports have also remained steady within the 56-60 billion range over the past year, with the previous reading at 58.2 billion.

The balance of trade shows the difference between the value of a country’s exports and imports. A trade surplus indicates that the country exports more than imports, while a negative trade balance means the opposite. The forecast suggests that the trade balance could decrease by 0.5 billion. This may have no significant impact on the EURUSD rate at present, but it could potentially help strengthen the euro in the long term.

US initial jobless claims represent the number of people who claimed unemployment benefits for the first time during the previous week. This indicator measures the employment market climate, with an increase in initial jobless claims indicating rising unemployment. Analysis for 8 August 2024 shows that initial jobless claims are projected to decrease to 241 thousand, which could positively impact the US dollar. If the actual reading exceeds the forecast, the EURUSD pair could continue its corrective wave.

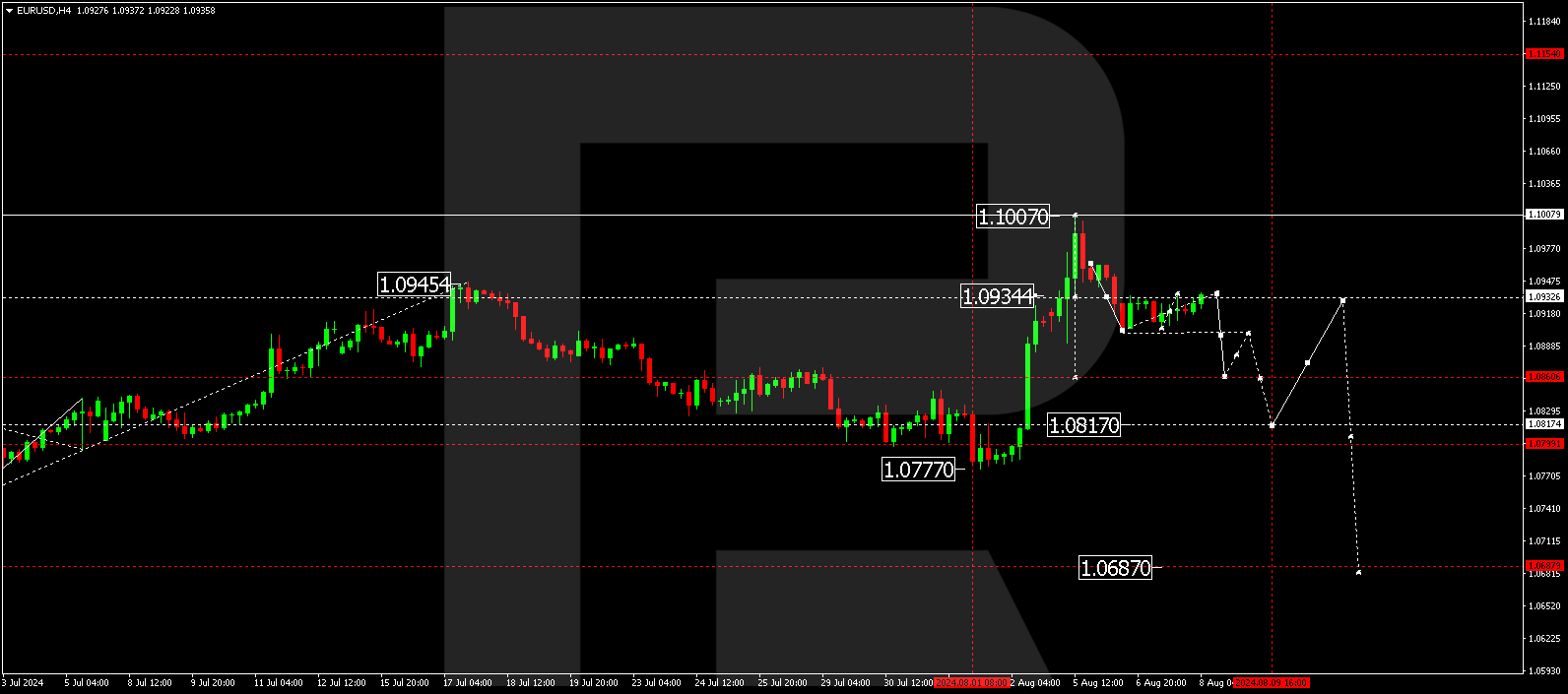

EURUSD technical analysis

The H4 chart shows that the EURUSD pair continues to form a consolidation range around 1.0920, potentially extending to 1.0940. The EURUSD forecast for today, 8 August 2024, suggests a breakout below the consolidation range towards 1.0860, with the movement potentially continuing to 1.0820, the initial target.

Summary

A decrease in US initial jobless claims could positively impact the US dollar. However, the EURUSD technical analysis suggests that a downward wave might continue to the 1.0860 and 1.0820 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.