EURUSD stabilises after reaching a seven-month high

The EURUSD rate has declined for the second consecutive session, failing to sustain the levels observed at the beginning of 2024. Find out more in our analysis dated 7 August 2024.

EURUSD trading key points

- The EURUSD pair has stabilised after reaching a seven-month high

- Germany’s trade balance surplus decreased to 20.4 billion EUR

- The US recorded a trade balance deficit of 73.1 billion USD

- Markets anticipate a Federal Reserve interest rate cut in September

- EURUSD forecast for 7 August 2024: 1.0880 and 1.0860

Fundamental analysis

The EURUSD rate has stabilised near 1.0910 after rising to 1.1007. Investor concerns about a slowdown in the US economy were the primary drivers of the euro’s strengthening, while weak employment data have heightened expectations for a more substantial interest rate cut from the Federal Reserve in September.

Meanwhile, Germany’s trade surplus fell to 20.4 billion EUR in June, missing expectations due to declining exports and rising imports. At the same time, an unexpected 3.9% increase in Germany’s factory orders in July provided a positive signal for the manufacturing sector, which has been facing challenges.

In June 2024, the US recorded a trade deficit of 73.1 billion USD, which, while lower than the previous month, exceeded analysts’ forecasts. Exports of goods and services increased by 1.5% to 265.9 billion USD, reaching a four-month high. Imports rose by 0.6% to 339 billion USD, marking the highest reading since June 2022.

Today’s EURUSD forecast suggests that markets anticipate a significant 50-basis-point interest rate cut from the Federal Reserve in September, with additional reductions of over 100 basis points throughout the year. However, most analysts consider the recent sell-off in the US dollar an overreaction to weak employment data and do not expect aggressive Federal Reserve action before September.

EURUSD technical analysis

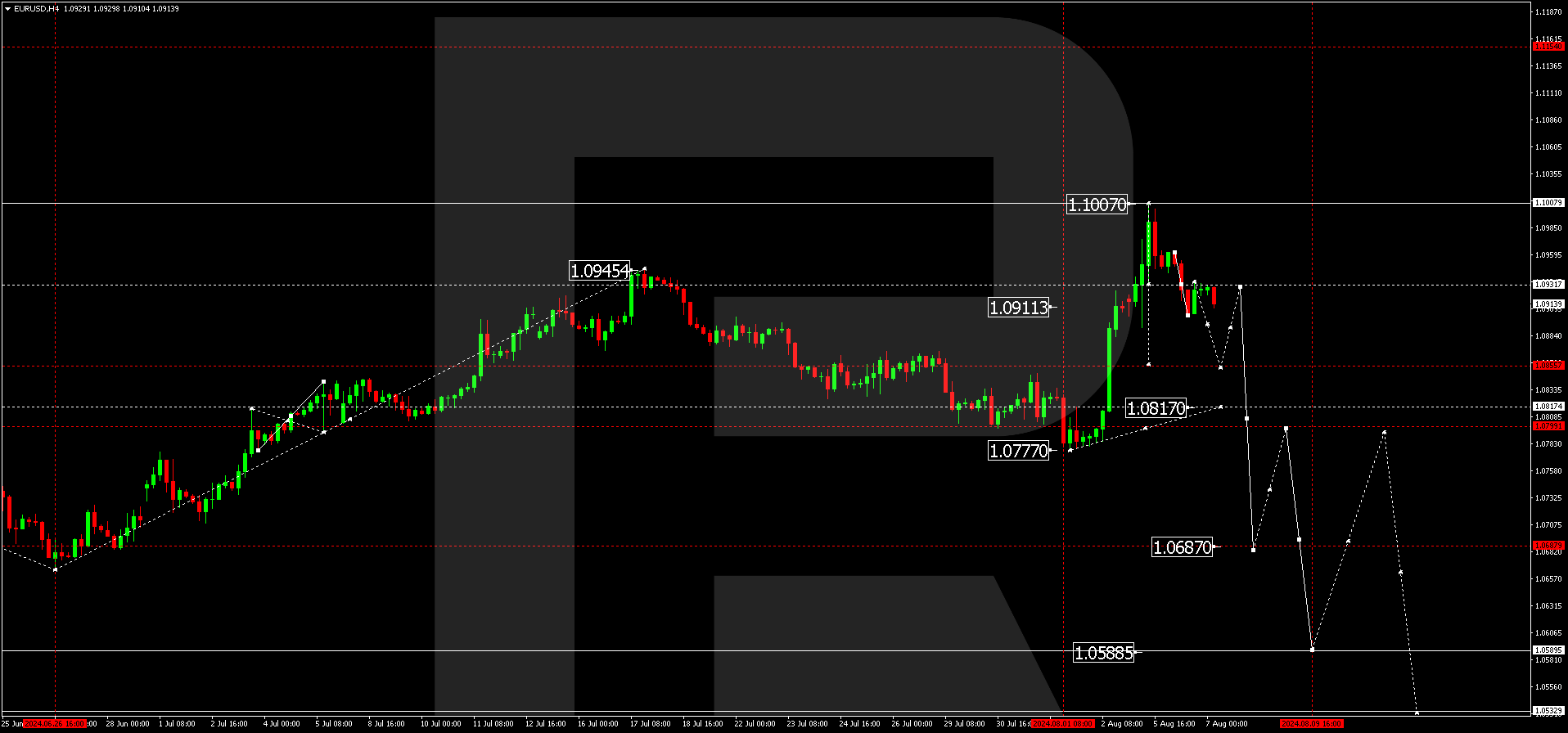

The H4 chart indicates that the EURUSD pair continues its downward momentum to 1.0880, potentially progressing towards 1.0860, the initial target. The EURUSD forecast for today, 7 August 2024, suggests this target will be reached. Subsequently, a correction might begin, aiming for 1.0930 (testing from below), followed by another downward movement towards 1.0808. A break below this level will open the potential for a further decline towards the local target of 1.0688.

Summary

Germany’s reduced surplus and increased US deficit could support the EURUSD rate temporarily, particularly in light of weak US economic data. Technical indicators in today’s EURUSD forecast suggest a further decline to 1.0880, potentially extending to 1.0860. A correction could follow after that.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.