USDJPY declines; the yen awaits an interest rate decision

The USDJPY pair continues to decline in anticipation of an interest rate decision. The Bank of Japan’s leadership is considering the most suitable rate decision. Find out more in our analysis dated 26 July 2024.

USDJPY trading key points

- Japan’s core Consumer Price Index (CPI) (y/y) in July: previously at 2.1%, currently at 2.2%

- CFTC JPY speculative net positions: previously at -182.0K

- The US core Personal Consumption Expenditures price index (y/y): forecasted at 2.5%, previously at 2.6%

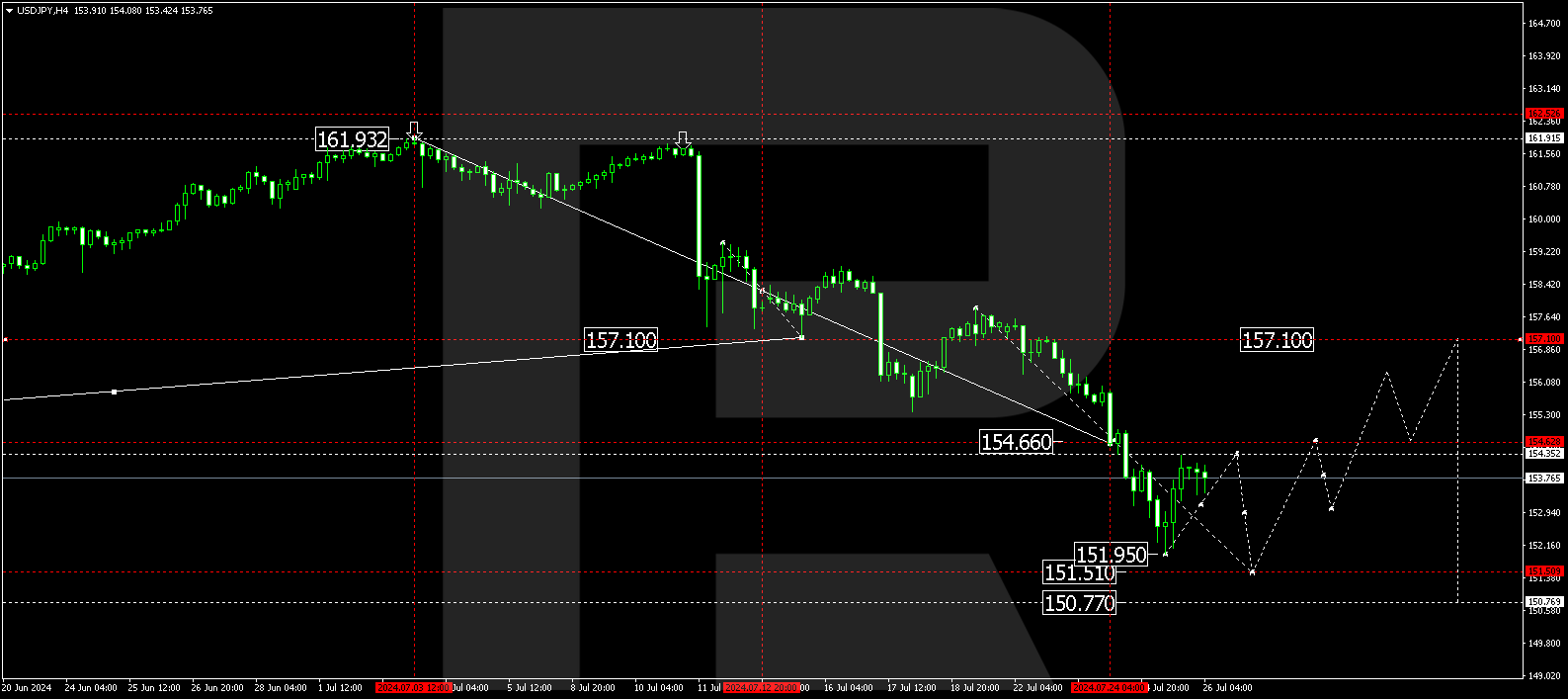

- USDJPY forecast for 26 July 2024: 154.35, 151.51, and 150.70

Fundamental analysis

Tokyo’s core Consumer Price Index reflects the difference in the price of goods and services on the consumer side, excluding energy and food. It indicates shifts in purchasing direction and the level of economic stagnation. A reading above the forecast positively impacts the national currency rate. The index was projected to be 2.2%, and it met that expectation. However, it rose by 0.1% compared to the previous reading. Although this is a slight increase, it has contributed to the yen’s strength.

CFTC JPY speculative net positions are expected to remain flat, which is neutral news, having no impact on the USDJPY rate.

The US core Personal Consumption Expenditures price index (y/y) is projected to decrease by 0.1%, potentially fuelling a further decline in the USDJPY rate.

Investors are awaiting the Bank of Japan’s interest rate decision, scheduled for revision on 31 July 2024. The central bank has yet to provide clear signals about changes in either direction. Regardless of the upcoming decision, volatility in the USDJPY pair is expected to increase.

USDJPY technical analysis

On the H4 chart, the USDJPY pair has completed a decline wave, reaching 151.95, and is currently forming a correction towards 154.35. The price is expected to reach this level today, 26 July 2024. Subsequently, another decline wave could develop, aiming for 151.51 and potentially continuing to 150.70, marking the completion of the downward move. The USDJPY pair is expected to either see rising quotes or consolidate.

Summary

Fundamental data, the anticipation of the BoJ’s interest rate decision, and the technical analysis of indicators for today’s USDJPY forecast suggest a further corrective wave towards 154.35, followed by a decline to the 151.51 and 150.70 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.