USDJPY declines amid anticipation of Bank of Japan meeting

The USDJPY rate has declined by over 0.75% today. The analysis dated 25 July 2024 outlines the main reasons for the Japanese yen’s strengthening.

USDJPY trading key points

- The USDJPY pair has reached multi-month lows

- Japan’s business activity is growing but unevenly

- The market anticipates changes in the Bank of Japan’s policy

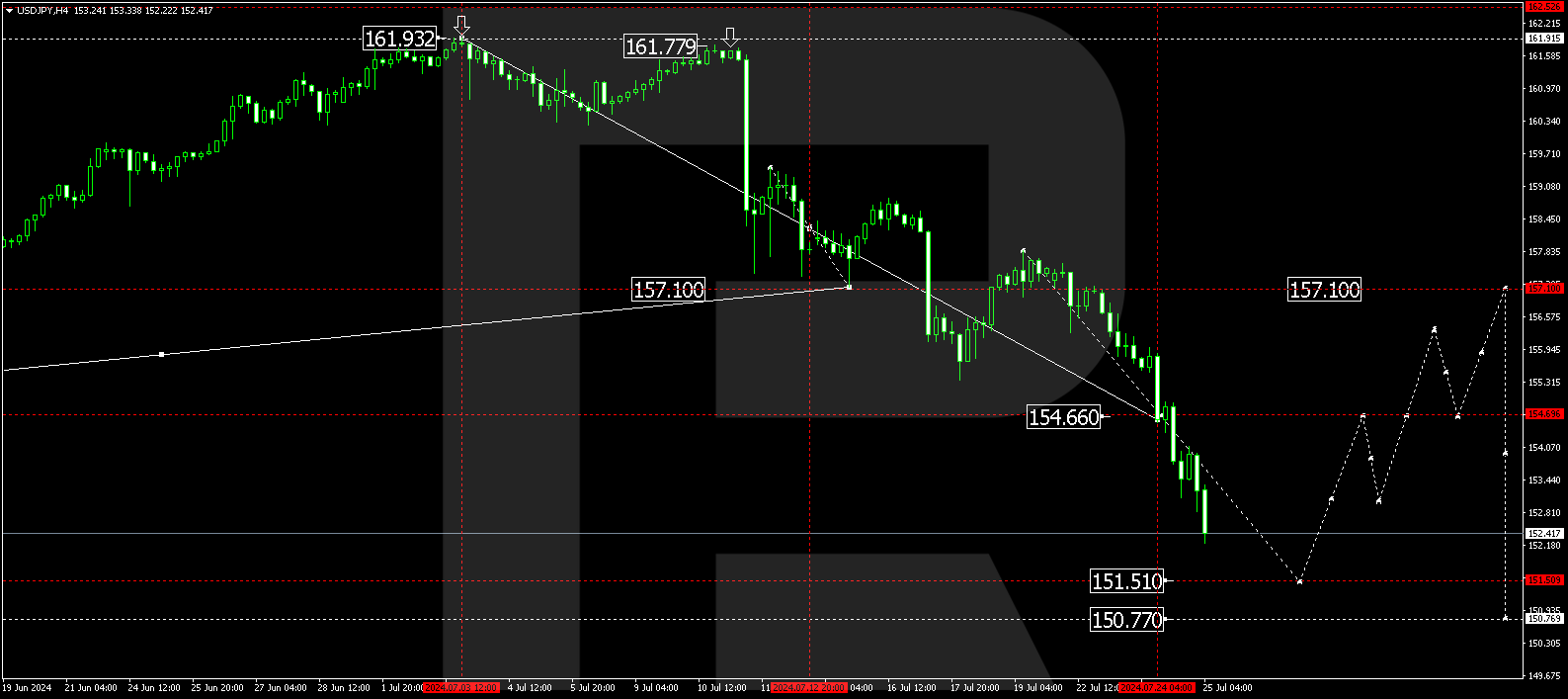

- USDJPY forecast for 25 July 2024: 151.51 and 150.70

Fundamental analysis

The Japanese yen reached its highest levels against the US dollar in the past two months, driven by the upcoming Bank of Japan meeting. Traders attribute current growth to several reasons.

First, investors have closed previously opened short positions on the yen, significantly strengthening the Japanese currency. This is driven by market participants’ expectations about potential changes in the BoJ’s monetary policy.

Secondly, Japan’s business activity data provided additional support for the yen. The composite PMI revealed an increase in July, indicating an expansion in business activity. However, the positive trend was primarily observed in the services sector, while the manufacturing sector unexpectedly contracted.

Japanese authorities refrained from commenting on the yen’s current strengthening. Minister of Finance Shunichi Suzuki and top currency diplomat Masato Kanda expressed concerns that public statements may cause unpredictable reactions in the financial markets.

USDJPY technical analysis

On the H4 chart, the USDJPY pair has completed a decline wave, reaching 154.66. A narrow consolidation range has formed around this level. With a downward breakout, the decline wave could extend to 151.51. The price is expected to reach this level today, 25 July 2024. Subsequently, a correction in the USDJPY pair could follow, aiming for 154.66 (testing from below).

Summary

Today’s USDJPY forecast reflects increasing expectations of changes in the Bank of Japan’s monetary policy, prompting investors to buy up the yen actively. These actions exert significant pressure on the USDJPY rate, and this trend may continue until the BoJ meeting. Technical indicators for today’s USDJPY forecast suggest the decline wave could continue towards the 151.51 and 150.70 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.