The threat of intervention prevents the yen from falling further

The Japanese yen reached 159.91 per US dollar on Monday, 24 June 2024. This is the pair's lowest level since 29 April, when it fell to a 34-year low.

Inflation in Japan has increased but remains within the target range

The yen's decline comes amid growing expectations of the tightening of US monetary policy. The Bank of Japan (BOJ), in turn, is in no hurry to raise rates, which creates additional pressure on the yen. Some policymakers call for a timely rate hike, but analysts doubt it will be aggressive enough to stop the yen's current decrease.

Inflation in Japan continues to rise, reaching 2.8% in May, the highest since February. Core inflation, which does not consider price volatility for food and energy, rose to 2.5% but remained below the forecasted 2.6%. It is worth noting that inflation in Japan has been around the Bank of Japan (BOJ) target for 26 months.

Investors generally believe that the USDJPY rate may continue to rise unless the BOJ gives stronger signals on rate hikes. The 160.00 level remains a psychologically important resistance for buyers.

USDJPY technical analysis

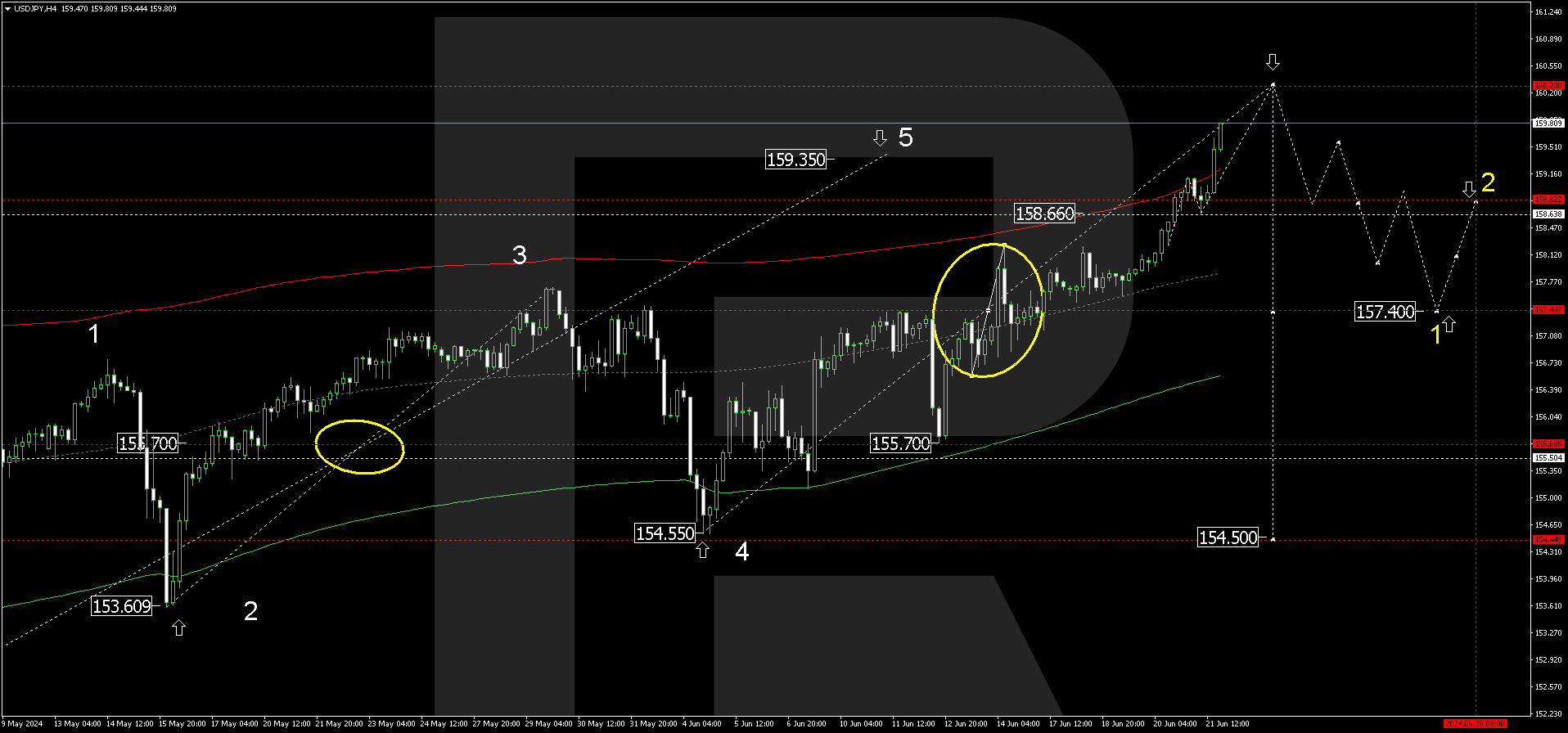

On the USDJPY H4 chart, the fifth growth wave to 159.35 has been completed. On this wave's structure, a trend continuation figure has formed around the 157.40 level, which is considered crucial for continued growth to 160.28. Practically, the market will renew the maximum of the growth wave. After this, a first corrective wave to the target level of 157.40 may appear.

USDJPY technical analysis 24.06.2024

This scenario is technically confirmed by the Elliott Wave structure and a correction matrix with a pivot point at 155.70. The market has received support at the centre line of the Envelope and continues to grow towards its upper boundary.

The beginning of a decline wave from 160.28 to the Envelope's centre at 158.80 can be expected. After that, the likelihood of a consolidation range forming around this level can be considered. If the price continues to decrease below the bottom of the range, the potential will open for the trend to continue to the Envelope's lower boundary at 157.40.

Summary

Possible intervention from the Bank of Japan currently plays the role of a stabiliser, preventing the yen from falling below the crucial resistance level. Technical analysis of USDJPY suggests further development of the growth wave towards the target at 160.28, followed by a decline to 157.40 and 154.50.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.