JPY is rising amid expectations of BoJ policy tightening

The USDJPY rate declines on Monday morning, 22 July 2024, after a two-day growth. The current USDJPY exchange rate is 156.55.

USDJPY trading key points

- Japan’s inflation continues to rise

- The Bank of Japan is expected to raise interest rates next week

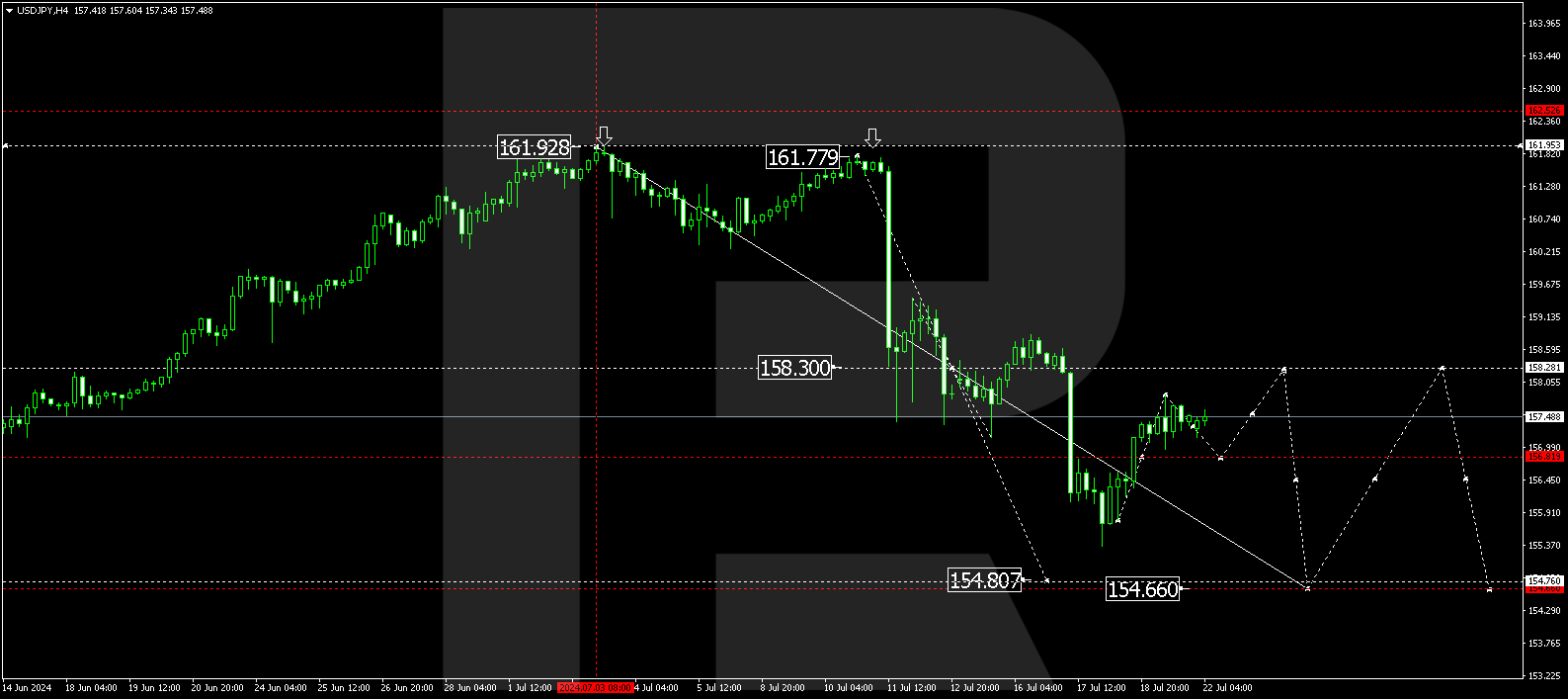

- USDJPY price targets: 158.28, 154.80, and 154.66

Fundamental analysis

The Japanese yen is rising after rebounding from the 157.60 resistance level. Investors expect the BoJ to raise interest rates next week amid rising inflation. Consequently, the USDJPY rate has fallen by more than 2% over the past two weeks.

Investors believe the Japanese government is already intervening in the currency market to support the national currency rate. The Bank of Japan’s data shows that the authorities could have purchased about 6 trillion yen a week ago.

Although Japan’s inflation remained at 2.8% in June, the core index, excluding food and energy prices, jumped to 2.6%. This data reinforces traders’ view that the BoJ may start tightening monetary policy despite potential risks for the country’s weak economy. The possibility of the yen’s rate rising further in the near term persists.

USDJPY technical analysis

On the USDJPY H4 chart, a consolidation range continues to develop around 156.82. Today, 22 July 2024, a correction is expected to continue to 158.28 (testing from below). Once the correction is complete, another decline wave could start, aiming for 154.80 and potentially continuing to 154.66.

Summary

The Japanese yen is strengthening against the US dollar in anticipation of the Bank of Japan’s potential interest rate hike next week. Technical analysis for today’s USDJPY forecast suggests a further correction towards 158.28, followed by a decline to the 154.80 and 154.66 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.