JPY struggles amid widespread decline

The Japanese yen is undergoing a correction after the release of the May core consumer price index. The likelihood of continued weakening remains high.

The yen continues to weaken

Japan released the nationwide core consumer price index for May. In the previous period, the index was 2.2%. Analysts had predicted a 2.6% rise, but the actual figure was 2.5%, indicating an improvement, although less than expected.

The positive trend did not save the yen from losing positions against the US dollar. A higher index value typically suggests a positive outlook and strengthens the yen. However, in the current situation, the data did not favour the yen’s exchange rate, which has led to its further weakening.

The US Federal Reserve’s report on monetary policy may “add fuel to the fire” and weaken the yen even more.

USDJPY technical analysis

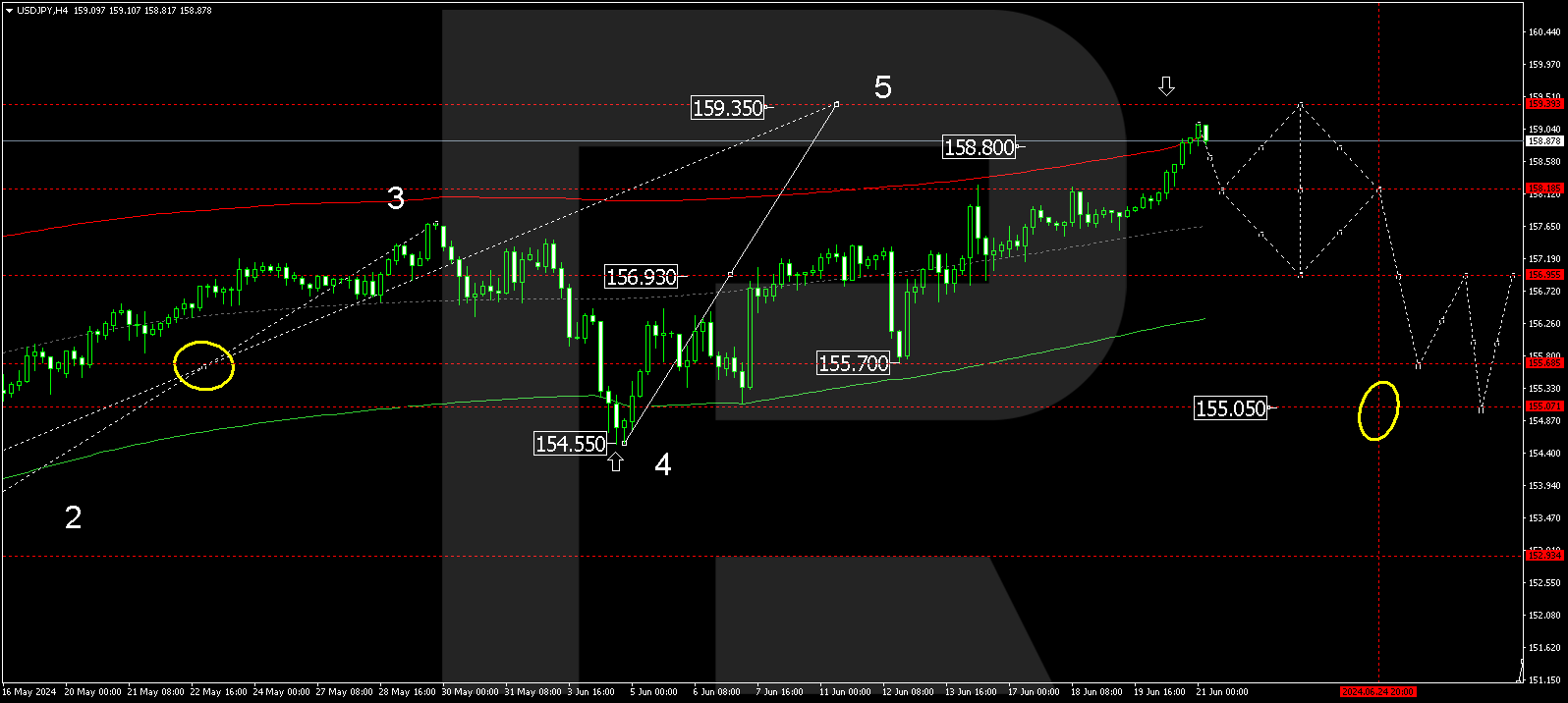

On the USDJPY H4 chart, the fifth corrective wave continues to develop, with a target at 159.35. The price has reached the local target of 158.80. Today, 21 June 2024, a consolidation range is expected to form around this level. A downward breakout of the range will open the potential for a decline to 158.20 (testing from above), followed by a rise towards 159.35, representing the main target for correction. Once the correction is complete, a decline wave might start, aiming for 155.50.

USDJPY technical analysis 21.06.2024

This USDJPY rate scenario is technically confirmed by the Elliott Wave structure and a correction matrix with a pivot point at 155.70. The market has completed a growth structure towards the Envelope’s upper boundary at 158.80. A decline wave is expected to begin, targeting its centre – 158.20, with an onward growth wave structure aiming for 159.35 as the main target.

Summary

The news landscape may help implement the scenario of the USDJPY technical analysis, suggesting a further potential corrective wave towards 159.35 with onward decline targets at 155.05 and 152.93.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.