USDJPY declines further, hitting a three-week low

The USDJPY pair is declining, pressured by the Federal Reserve’s soft tone. The Fed is expected to ease monetary policy in September. Find out more in our analysis dated 26 August 2024.

USDJPY forecast: key trading points

- The USDJPY pair dipped to a three-week low

- The Bank of Japan’s tight stance and the Fed’s dovish comments contribute to the strengthening of the yen

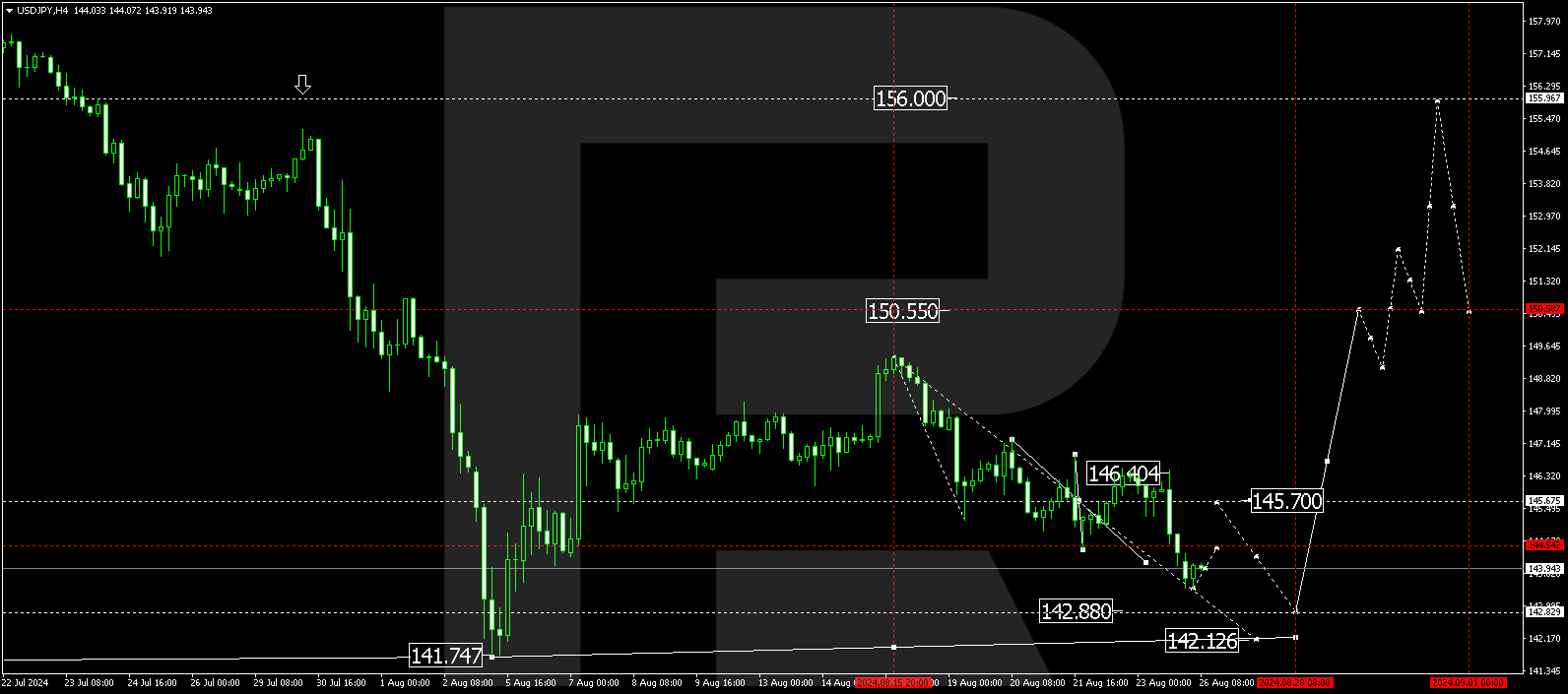

- USDJPY forecast for 26 August 2024: 142.88, 146.40, 150.55, and 156.00

Fundamental analysis

The USDJPY rate fell to 143.99 on Monday, approaching a three-week low. The pair is influenced by two vital factors: the Bank of Japan’s tight stance and the dovish tone of the US Federal Reserve’s comments.

Last Friday, Bank of Japan Governor Kazuo Ueda did not rule out a future adjustment of BoJ policy if economic forecasts align with actual data. So far, everything is in line with expectations: core inflation in Japan rose to 2.7% in July, marking the third consecutive month of increase. At the same time, the official CPI has remained steady at 2.8% for the three months.

US Federal Reserve Chair Jerome Powell stated at the Jackson Hole Symposium on Friday that monetary policy could be revised. In his view, risks in the employment market are about to emerge. A Federal Reserve interest rate cut is expected as early as September, marking the beginning of a new easing phase. This news has weakened the US dollar, keeping the USDJPY forecast unchanged.

USDJPY technical analysis

The USDJPY H4 chart shows the market continues to form a consolidation range around 145.70. The market has broken below the range’s lower boundary and completed a downward wave, reaching 143.44. The USDJPY rate could rise to 144.55 (testing from below) today, 26 August 2024, before declining to 142.88. Once the price reaches this level, a new growth wave could start, aiming for 146.40. A breakout above this level could follow, potentially continuing to 150.55, a local target for the USDJPY rate.

Summary

The USDJPY rate has declined further and shows no signs of stopping. Technical indicators in today’s USDJPY forecast suggest a potential decline to 142.88. Subsequently, a growth wave could begin, targeting the 146.40, 150.55, and 156.00 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.