USDJPY: the yen strengthens following the Bank of Japan governor’s speech

The USDJPY pair continues to decline following Kazuo Ueda’s statements on the interest rate hike in Japan. In contrast, the Federal Reserve is considering lowering interest rates. Find out more in our analysis dated 23 August 2024.

USDJPY forecast: key trading points

- Japan’s national Consumer Price Index (CPI), m/m: previously at 0.3%, currently at 0.2%

- Bank of Japan Governor Kazuo Ueda’s speech

- US Federal Reserve Chair Jerome Powell’s speech

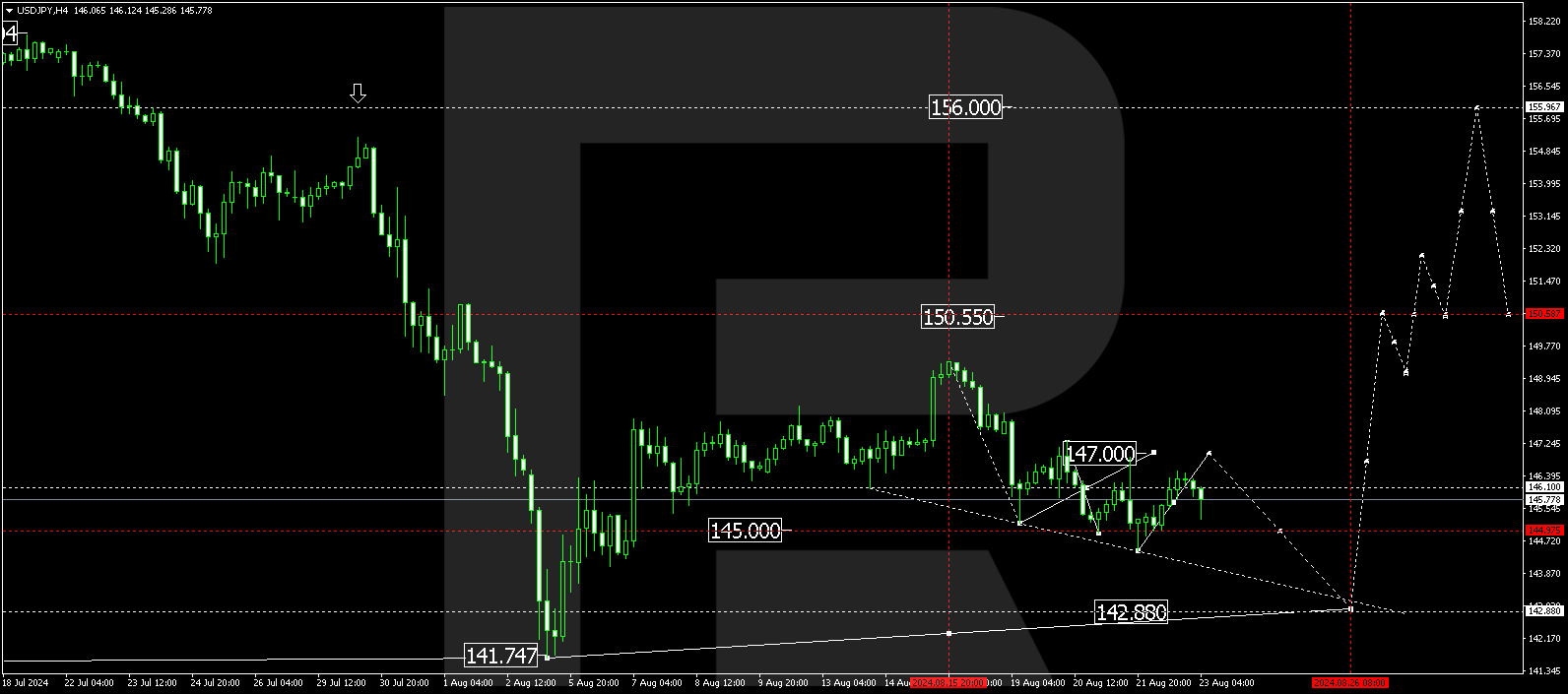

- USDJPY forecast for 23 August 2024: 147.77, 150.55, and 156.00

Fundamental analysis

The CPI index reflects changes in consumer prices of goods and services, indicating shifts in buying trends and economic stagnation. A higher-than-forecasted reading typically has a positive effect on the national currency. The current CPI reading was lower than the previous one, at 0.2%. Despite the lack of significant changes, the yen continued to strengthen against the US dollar.

Bank of Japan Governor Kazuo Ueda’s speech drew attention from investors. This morning, he made several strong statements regarding Japan’s future monetary policy. If economic indicators and inflation remain at their forecasted level, the Bank of Japan plans to raise the interest rate in September, which is currently at 0.25%. This hike could significantly impact future USDJPY forecasts.

Federal Reserve Chair Jerome Powell will deliver a speech at the Jackson Hole Symposium (Wyoming) after the US trading session opens. Investors are closely watching for any signals regarding an interest rate change from the Fed’s chair. This report could increase market volatility. Fundamental analysis for 23 August 2024 indicates that the Federal Reserve is serious about a September interest rate cut.

USDJPY technical analysis

The USDJPY H4 chart shows that the market continues to form a consolidation range above the 145.00 level. This range could extend up to 147.00 and down to 144.44 today, 23 August 2024. A breakout below the range could trigger a downward move towards 142.88. Conversely, an upward breakout could initiate new growth, aiming for 150.55 and potentially continuing to 156.00, the local target for the USDJPY rate.

Summary

The Bank of Japan governor’s statement, the upcoming speech by the Fed’s chair, and the USDJPY technical analysis in today’s USDJPY forecast suggest that a consolidation range above 145.00 could persist. A growth wave could develop, targeting the 147.77, 150.55, and 156.00 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.