USDJPY under pressure: investors await signals from the Fed and BoJ

The USDJPY rate is rebounding from the support level after declining over the last four trading sessions. Find out more in our analysis dated 22 August 2024.

USDJPY forecast: key trading points

- The release of the latest Federal Reserve meeting minutes signals a potential interest rate cut in the future

- Revised US employment data showed a decrease of 818,000 jobs, indicating a slowdown in the employment market

- Jerome Powell’s speech will be the key event of the trading week

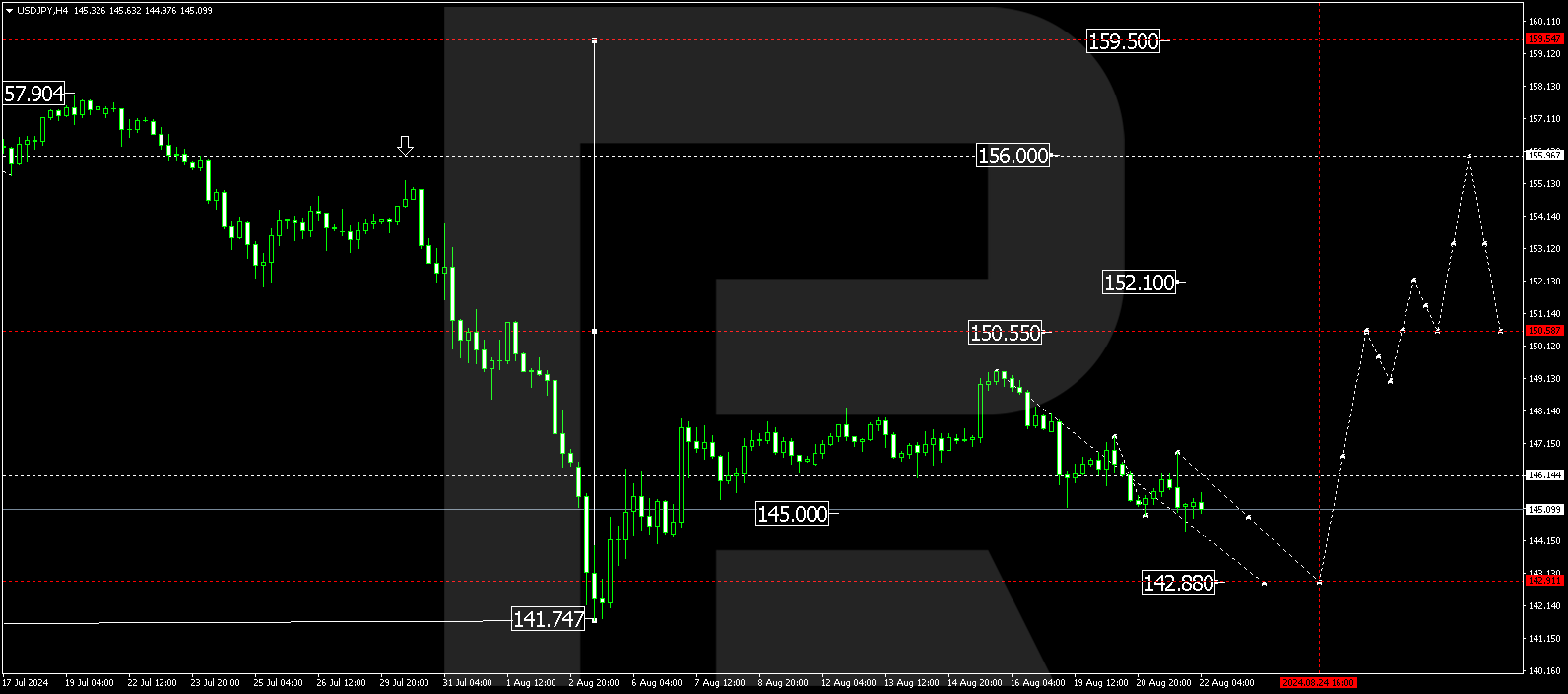

- USDJPY forecast for 22 August 2024: 142.88, 147.77, 150.55, and 156.00

Fundamental analysis

The USDJPY rate is correcting following a significant strengthening of the Japanese yen, which has reached the 144.55 level. The pair’s decline is driven by the latest Federal Reserve meeting minutes, which signal a possible monetary policy easing at the next meeting if current economic trends persist.

Meanwhile, US nonfarm payrolls were revised downward by 818,000, indicating slower growth in the employment market than expected. The number of jobs increased by 2.1 million over the past year, falling short of the expected 2.9 million. This has heightened market expectations for a 25-basis-point interest rate cut by the Federal Reserve and further monetary policy easing throughout the year.

Powell’s speech at the Jackson Hole Symposium will be a major development this week. Investors hope that the Federal Reserve chair will provide clearer guidance on the pace and extent of monetary policy easing. As part of today’s USDJPY forecast, this information will allow a more accurate assessment of the prospects for further weakening of the US dollar.

In Japan, all eyes are on Friday’s speech by BoJ Governor Kazuo Ueda before Parliament. Lawmakers will discuss the regulator’s decision to raise interest rates in July. Meanwhile, recent data shows that Japan’s private sector growth reached a 15-month high in August, thanks to sustainable development in the services sector.

USDJPY technical analysis

The USDJPY H4 chart indicates that the market has completed a corrective wave, reaching 145.00. A consolidation range could continue to form above this level today, 22 August 2024. A downward breakout of the range could lead to a decline to 142.88. Conversely, an upward breakout could signal the start of a new growth wave, aiming for 150.55 and potentially reaching 156.00, a local target for the USDJPY rate.

Summary

The USDJPY technical analysis suggests a correction following a decline amid expectations for Federal Reserve policy easing and revised US employment data. Traders are focused on Jerome Powell’s upcoming speech, which may shed light on the extent of the Federal Reserve monetary policy easing. Technical indicators in today’s USDJPY forecast suggest a decline in the USDJPY rate to 142.88, followed by a potential growth wave targeting the 147.77, 150.55, and 156.00 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.