USDJPY: the US dollar strengthens again; the yen loses ground

The USDJPY pair is attempting to regain ground after a decline. The Japanese prime minister elections are scheduled for 27 September. Find out more in our analysis dated 20 August 2024.

USDJPY forecast: key trading points

- A speech by Federal Open Market Committee (FOMC) member Raphael W. Bostic

- A speech by Vice Chair for Supervision of the Board of Governors of the Federal Reserve Michael S. Barr

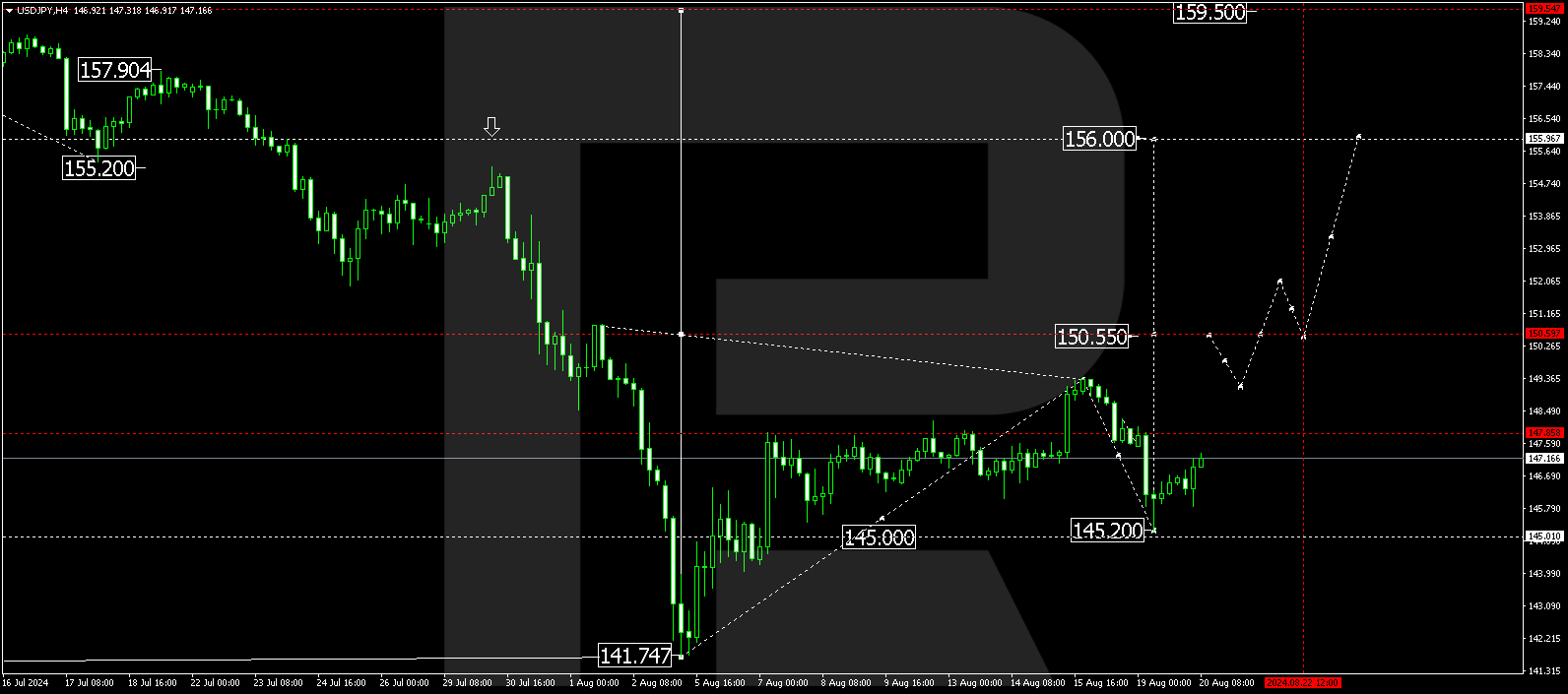

- USDJPY forecast for 20 August 2024: 150.55 and 156.00

Fundamental analysis

Federal Open Market Committee (FOMC) member and concurrently Atlanta Fed President Raphael W. Bostic will deliver a speech after the opening of the US trading session. His speech often serves as an unofficial source of information on future US monetary policy.

The Federal Reserve leadership will decide on changing interest rates in September, presumably downwards. Bostic’s speech may provide information that will give investors insights into the future of the US dollar against the yen.

FOMC member’s speech will be followed by a speech by Vice Chair for Supervision of the Board of Governors of the Federal Reserve Michael S. Barr, which will also shed light on US monetary policy.

The yen could weaken against the US dollar again ahead of the upcoming Japanese prime minister elections and changes in the Federal Reserve interest rates. Following a correction, the USDJPY rate may hit new highs.

USDJPY technical analysis

The forecast for 20 August 2024 shows that the market has corrected towards 145.20 on the USDJPY H4 chart. This level is considered a minimum for the correction, with a decline to 145.00 being possible. A growth wave could start forming today, 20 August 2024, aiming for 150.55. A breakout above this level will open the potential for a growth wave towards the local target of 156.00.

Summary

The FOMC member’s speech, the elections in Japan, and the USDJPY technical analysis in today’s USDJPY forecast suggest a growth wave towards the 150.55 and 156.00 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.