USDJPY declines amid Japanese economic recovery

The USDJPY rate has been falling for the second consecutive trading session, breaking below the 145.80 support level. Find out more in our analysis dated 19 August 2024.

USDJPY forecast: key trading points

- Federal Reserve Bank of Chicago chief warns of potential challenges in the US employment market due to an increase in credit card arrears

- The Japanese economy shows signs of recovery: machinery orders increased by 2.1% in June and the Q2 GDP rose by 3.1%

- Market participants are confident that the Federal Reserve will cut the interest rate by 25 basis points in September

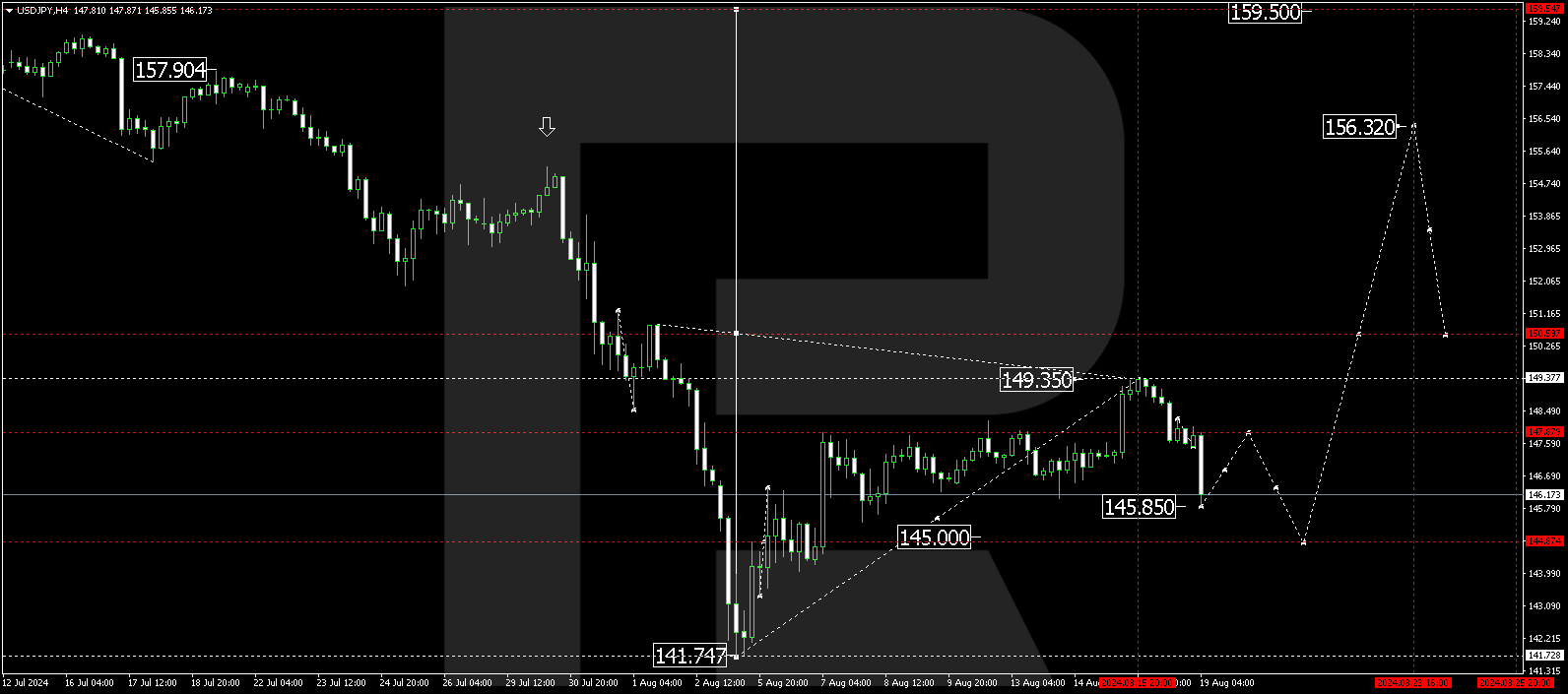

- USDJPY forecast for 19 August 2024: 145.00, 150.60, and 156.30

Fundamental analysis

Investors explain the strengthening of the USDJPY pair by heightened expectations of the Federal Reserve monetary policy easing. Federal Reserve Bank of Chicago President Austan Goolsbee warned of potential challenges in the US employment market due to an increase in credit card arrears. This statement strengthened expectations for a US interest rate cut and exerted pressure on the USDJPY rate.

Meanwhile, the Japanese economy is showing signs of recovery. A 2.1% increase in machinery orders in June and a 3.1% rise in the Q2 GDP indicate reviving investment activity. However, investors are still awaiting inflation data to assess the stability of this recovery and the BoJ’s possible actions to support economic growth. In any case, the positive dynamics of the Japanese economy support the yen as part of today’s USDJPY forecast.

Market participants are pricing in an imminent 25-basis-point Federal Reserve interest rate cut in September but are not ruling out more aggressive measures. This week, investors will focus on a speech by Jerome Powell and the release of the Federal Reserve minutes, which should provide insight into the future outlook for the regulator’s monetary policy.

USDJPY technical analysis

The USDJPY H4 chart shows that the market has completed a growth wave towards 149.35. A correction is forming towards 145.00 (testing from above) today, 19 August 2024. Once this correction is complete, a growth structure could start, aiming for 150.60. A breakout above this level will open the potential for a growth wave towards 156.30, the local target.

Summary

Amid rising concerns about the US economic slowdown and growing dovish sentiment of the Federal Reserve policy, the USDJPY rate is temporarily declining. Technical indicators in today’s USDJPY forecast suggest that a correction could extend to 145.00, with the growth wave potentially continuing to 150.60 and 156.30 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.