USDJPY has risen: the US dollar is in a strong position, while the yen is afraid of the news

The USDJPY pair is in positive territory. The market evaluates a variety of news. Find out more in our analysis dated 16 August 2024.

USDJPY forecast: key trading points

- The USDJPY pair is actively rising

- The yen rate comes under pressure from domestic news

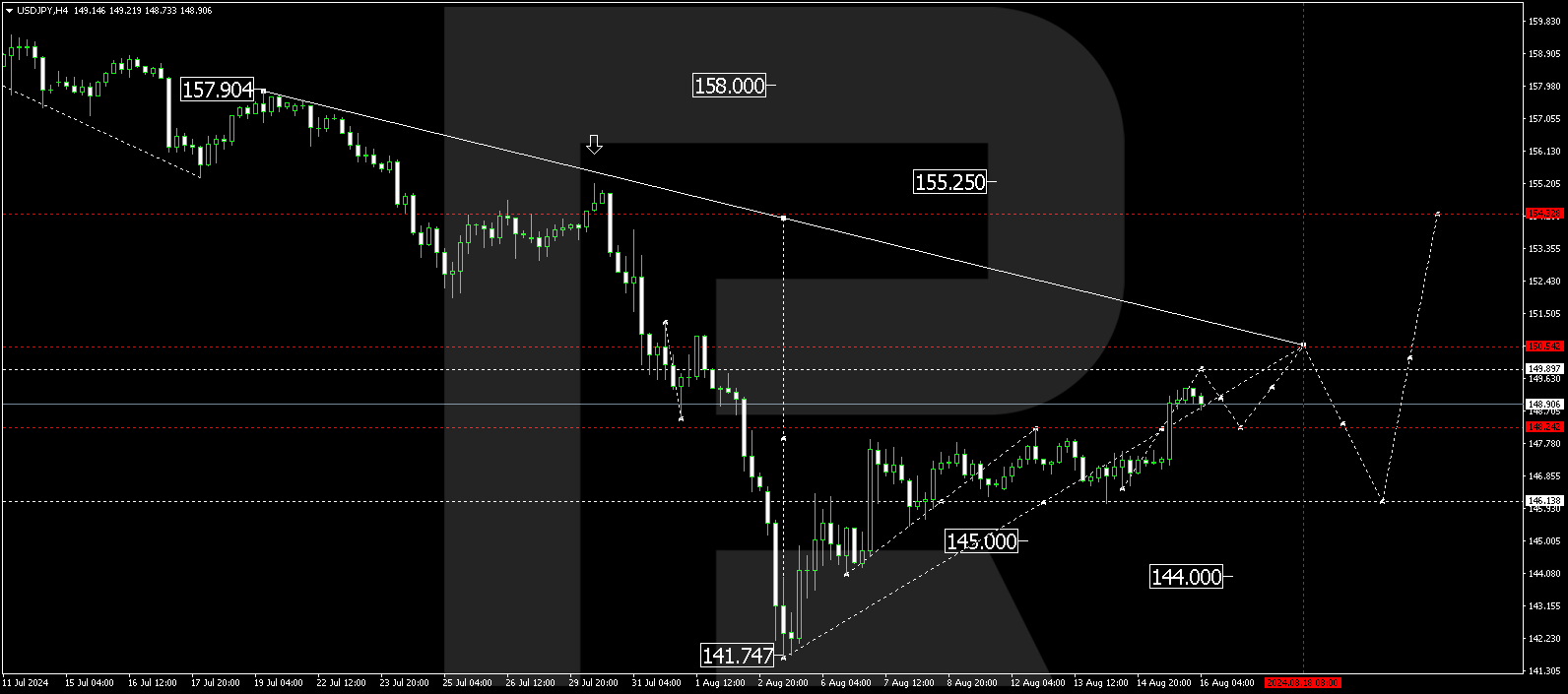

- USDJPY forecast for 16 August 2024: 149.89 and 150.55

Fundamental analysis

The USDJPY rate rose significantly and tested the 149.00 level on Friday morning, resulting in the yen’s fall to a two-week low.

The US dollar strengthened on the back of stronger-than-expected US statistics. The released reports somewhat eased stock market concerns about a recession in the world’s major economy.

The JPY is under some pressure from domestic political news. It was announced yesterday that Japan’s Prime Minister Fumio Kishida will not seek another term as his party’s leader in September. In fact, this will mark the end of his tenure as the country’s prime minister. A local imbalance is not favourable news for the yen. The USDJPY forecast suggests persistent pressure on the yen.

The previously released statistics showed that the Japanese economy has grown by 0.8% quarter-over-quarter in Q2 2024, exceeding expectations of a 0.5% increase. The GDP rose by 3.1% year-over-year after declining by 2.3% at the beginning of the year.

USDJPY technical analysis

On the USDJPY H4 chart, the market received support at 146.24. The price broke above the 148.24 level today, 16 August 2024, aiming for 149.89. Once the USDJPY rate reaches this level, a corrective phase could follow, targeting 148.24 (testing from above). Subsequently, another growth structure is expected to form, aiming for 150.55 as the first target.

Summary

The USDJPY pair reached a new two-week high, supported by the strong US dollar. Technical indicators in today’s NZDUSD forecast suggest a growth wave towards the 149.89 and 150.55 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.