USDJPY is rising again: yen loses support

The USDJPY rate is experiencing moderate gains. The US dollar has strengthened due to stable data. Find out more in our analysis dated 13 August 2024.

USDJPY forecast: key trading points

- The USDJPY pair maintains its upward trajectory

- Investors overlook statistics supporting the JPY

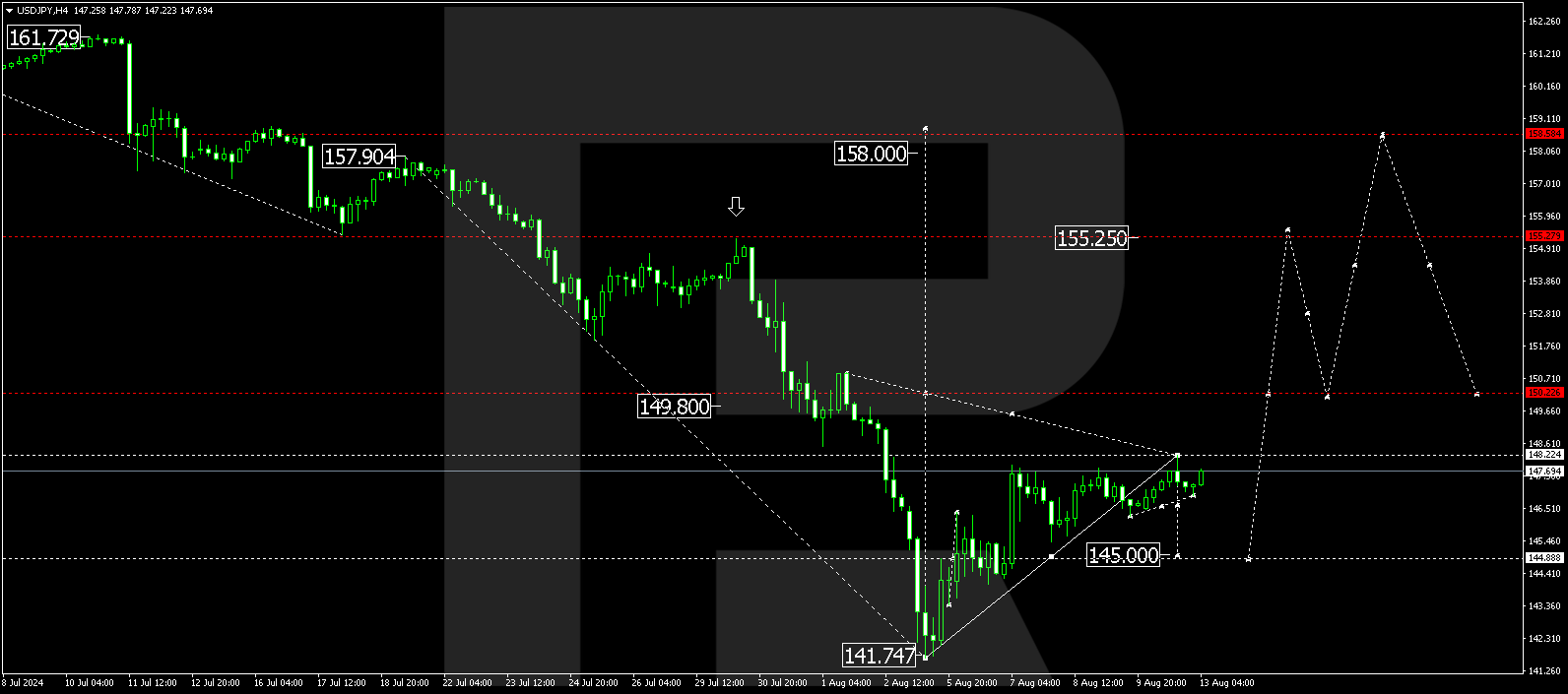

- USDJPY forecast for 13 August 2024: 145.00 and 155.25

Fundamental analysis

The USDJPY pair rose to 147.70 on Tuesday.

The JPY rate declined in five of the last six trading sessions as the unwinding of carry trade transactions lost momentum, while the US dollar strengthened on stronger-than-expected statistics.

The USDJPY forecast indicates that even positive statistics are not helping the yen at present. The data revealed that Japan’s Producer Price Index rose in July at its fastest pace in 11 months, directly signalling that inflationary pressure remains high. However, the market is currently disregarding such factors.

Investors remain focused on Japan’s interest rates. Last week, monetary policymaker Shinichi Uchida stated that the Bank of Japan will unlikely raise the interest rate while market conditions are uncertain. At the same time, some BoJ members believe that raising rates is necessary, with discussions suggesting that the indicator should reach 1.00%.

USDJPY technical analysis

The USDJPY H4 chart shows that the market has completed a growth wave, reaching 148.20. The price is expected to correct to 145.00 today, 13 August 2024. Once the correction is complete, a new growth wave in the USDJPY rate is anticipated, aiming for 150.00. With an upward breakout of this level, the wave might continue to 155.25, the local estimated target.

Summary

The USDJPY pair is gradually rising. However, technical indicators in today’s USDJPY forecast suggest a correction to 145.00, followed by growth to 150.00, with the trend potentially continuing towards 155.25.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.