New US unemployment data supports USDJPY

The USDJPY rate is correcting on Friday following three days of growth. Find out more in our analysis dated 9 August 2024.

USDJPY trading key points

- US initial jobless claims fell to the lowest level in a year

- US positive employment market statistics weakened expectations of Federal Reserve monetary policy easing

- The likelihood of a 50-basis-point Federal Reserve interest rate cut decreased from 69% to 54%

- BoJ’s deputy governor stated that the regulator would not raise interest rates amid market uncertainty

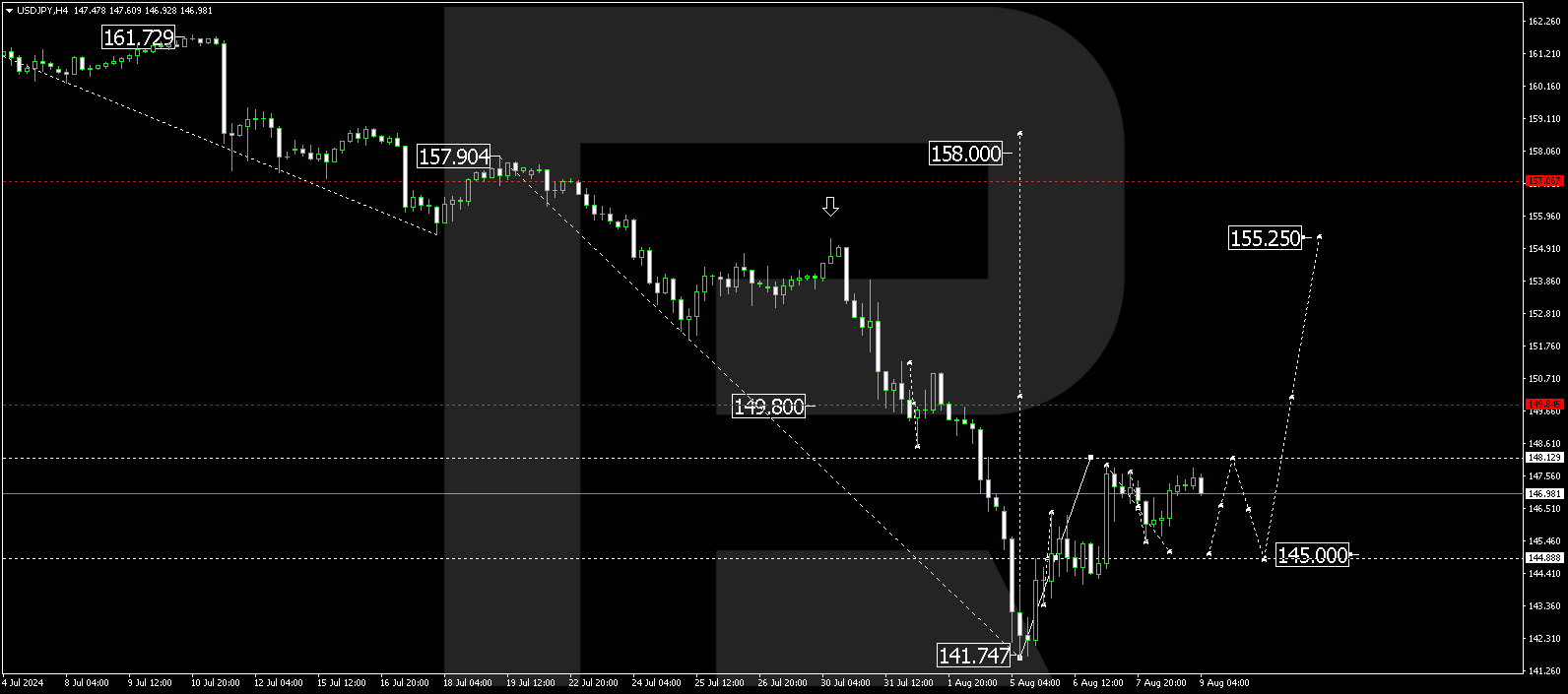

- USDJPY forecast for 9 August 2024: 149.80 and 155.25

Fundamental analysis

The market responded positively to the published data, which reflected the lowest US initial jobless claims in the past year. This development prompted the USDJPY rate to test a weekly high again. Encouraging US employment market statistics have reduced the likelihood that the Federal Reserve will ease monetary policy in the near term.

US initial jobless claims decreased by 17 thousand, reaching 233 thousand, falling below analysts’ forecasts. This low reading indicates that the US employment market remains stable, supporting the US dollar in the USDJPY forecast for today.

Investors have adjusted their expectations for the Federal Reserve’s September meeting in this context. The likelihood of an aggressive 50-basis-point interest rate cut has decreased from 69% to 54%, while the chance of a more moderate (25-basis-point) reduction is estimated at 46%.

Meanwhile, investors are closely watching the Bank of Japan’s actions. Comments from BoJ Deputy Governor Shinichi Uchida, stating that the regulator will not rush to raise rates amid market uncertainty, have significantly affected market expectations. The decision not to tighten monetary policy is pushing up the USDJPY pair.

USDJPY technical analysis

The USDJPY H4 chart shows that the market continues developing a consolidation range around 146.54, potentially extending to the 145.00 and 148.13 levels today, 9 August 2024. Considering a subsequent upward breakout of the range towards 149.80 will be relevant. If this level also breaks, a growth wave is expected to continue to the local target of 155.25.

Summary

Reduced US initial jobless claims and the Bank of Japan’s statement that the rates will remain unchanged contribute to further strengthening of the US dollar. Technical indicators in today’s USDJPY forecast suggest that the price could break above the consolidation range, aiming for 149.80 and potentially continuing the trend to 155.25.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.