USDJPY is in negative territory again: the market bets on the yen

The USDJPY pair is under pressure again. The market is deciding on a further action scenario. Find out more in our analysis dated 8 August 2024.

USDJPY trading key points

- The USDJPY pair is declining again

- Bank of Japan members call for an interest rate hike

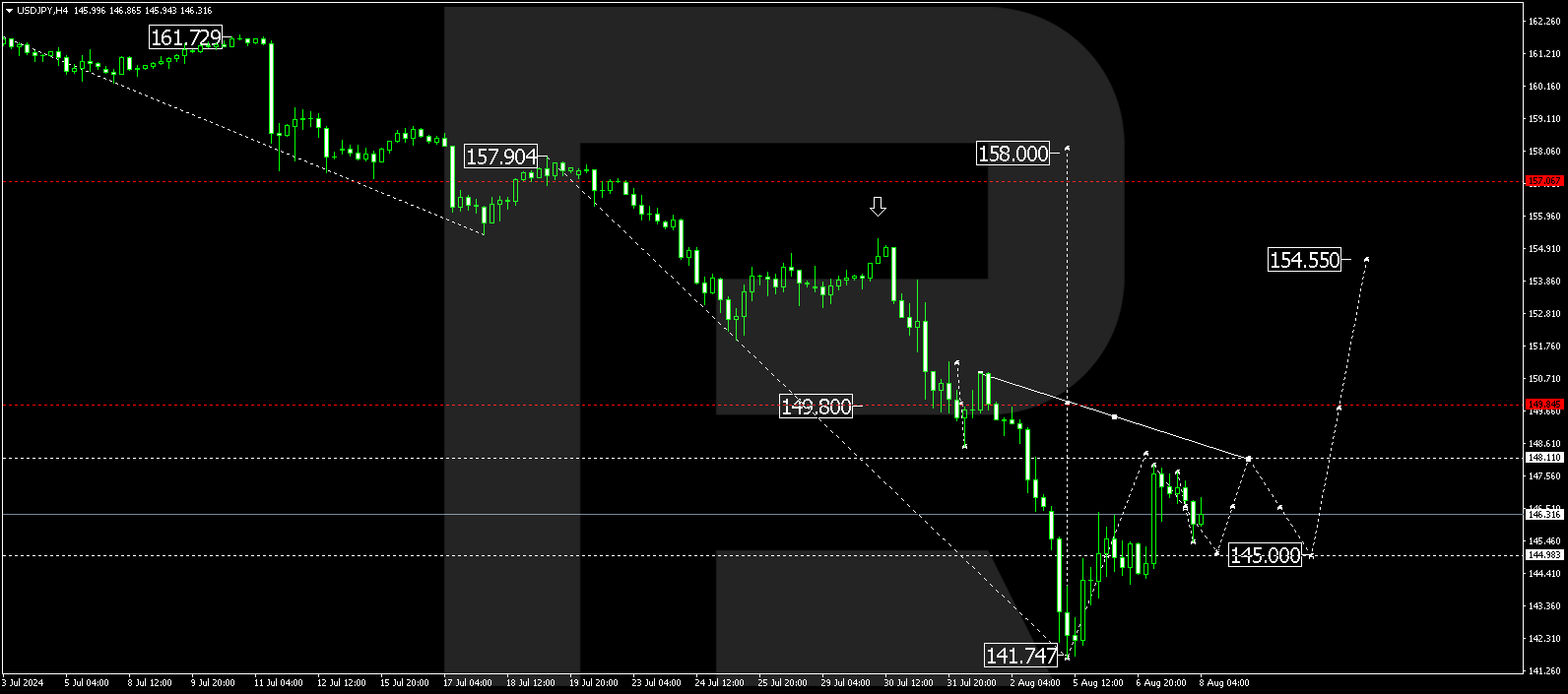

- USDJPY forecast for 8 August 2024: 145.00 and 148.11

Fundamental analysis

The USDJPY rate is declining to 146.20 on Thursday, with the Japanese yen appreciating again. This movement appears normal after two days of decline.

The JPY lost nearly 2% yesterday after Bank of Japan Deputy Governor Shinichi Uchida stated that the regulator would not raise interest rates during market instability. Meanwhile, a previously published summary of the Bank of Japan’s last meeting indicated that some members of the Policy Board were calling for further interest rate hikes, with one suggesting that the rate should eventually approach 1%.

This week, the USDJPY pair fell to a seven-month low amid the large-scale closure of carry trade positions in the yen. This was due to the Bank of Japan’s shift to a more decisive stance, which the market had anticipated for several months.

USDJPY technical analysis

The H4 chart shows that the USDJPY pair has completed a growth wave, reaching the local target of 147.89. The USDJPY forecast for today, 8 August 2024, suggests a correction towards 145.00 (testing from above). Once this correction is complete, the USDJPY rate could rise to 148.11, the initial target of the growth wave.

Summary

The USDJPY pair is falling; the market is gathering information. The USDJPY technical analysis suggests a corrective decline to 145.00, followed by a growth wave towards 148.11.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.