USDJPY attempts to recover after a decline

The reduction in Japan’s foreign reserves may be due to the BoJ’s attempts to strengthen the yen. Find out more in our analysis dated 7 August 2024.

USDJPY trading key points

- Japan’s foreign reserves (USD): previously at 1231.5 billion, currently at 1219.1 billion

- Japan’s leading economic index: previously at 111.2, currently at 108.6

- Japan’s coincident index (m/m): previously at 1.9%, currently at -3.4%

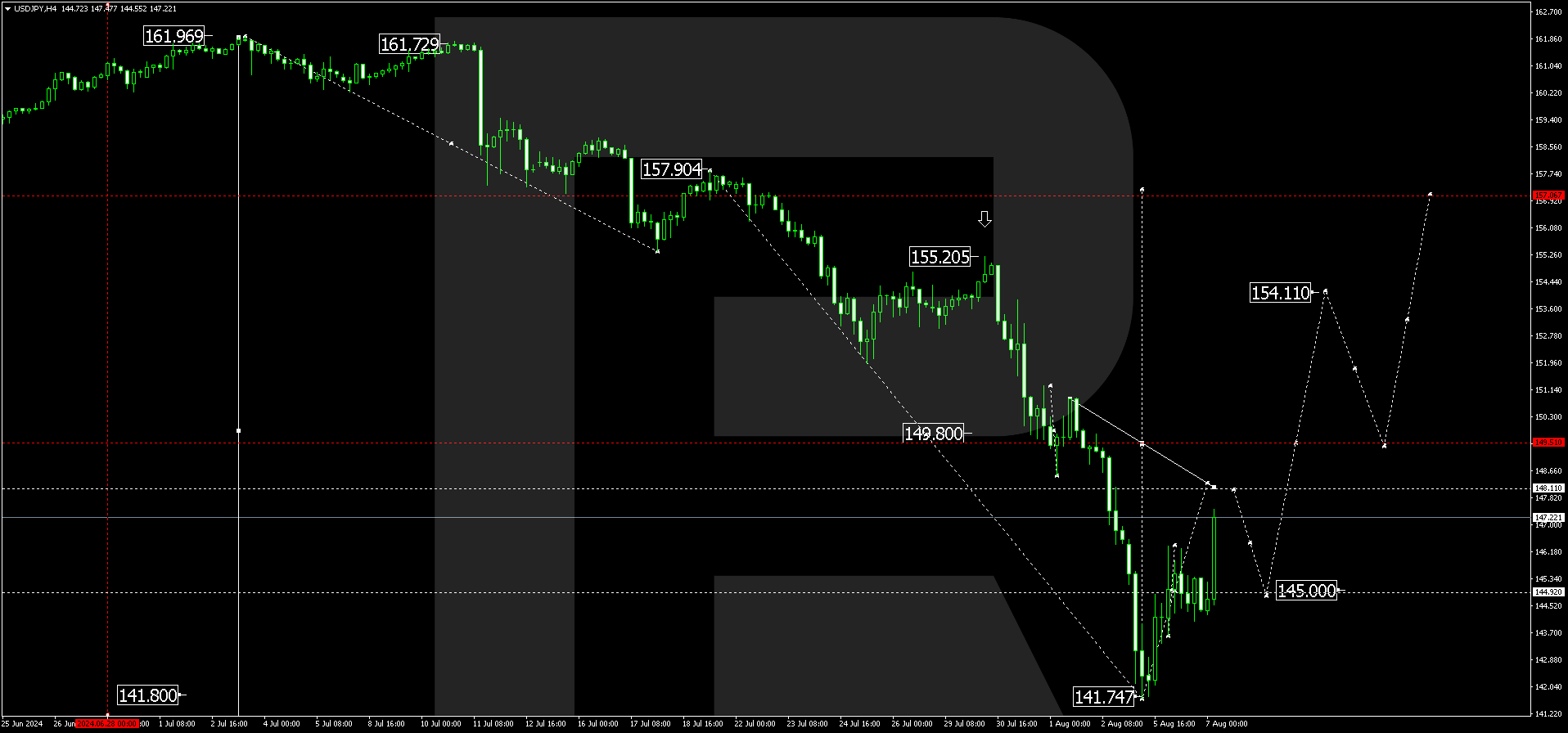

- USDJPY forecast for 7 August 2024: 148.11 and 149.50

Fundamental analysis

Japan’s foreign reserves show the total value of currency reserves that the government and the central bank need to implement monetary policy. According to updated data, US dollar reserves decreased from the previous value to 1219.1 billion. A drop in reserves negatively affects the yen, which continues to lose ground against the US dollar.

Japan’s leading economic index estimates the overall economic climate, combining 12 indicators, including machinery orders and stock exchange quotations. A reading below 50 shows that most indicators are negative, while a reading above 50 suggests positive changes in most indicators. Actual data demonstrates that the index stands at 108.6, decreasing compared to the previous period. This could be attributed to the Bank of Japan’s decision to strengthen the yen.

The coincident index measures the current economic climate and forecasts its further development. A decrease in this indicator may point to challenges in the Japanese economy and forthcoming difficulties, the country will be forced to face in the near term. Actual data shows that the indicator has fallen to -3.4%.

USDJPY technical analysis

The H4 chart shows that the USDJPY pair maintains its upward momentum to the first target of 148.11, expected to be reached today, 7 August 2024. Subsequently, the USDJPY rate could start to correct towards 145.00 (testing from above). Once the correction is complete, a growth wave could begin, aiming for 149.51 and potentially continuing to the local target of 154.11.

Summary

Decreased currency reserves and negative indicator data helped the US dollar strengthen its position against the yen. The fundamental analysis for 7 August 2024 and the USDJPY technical analysis suggest a growth wave towards the 148.11 and 149.50 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.