Positive US macroeconomic data drives USDJPY upwards

The USDJPY rate is rising amid increased business activity in the US. Find out more in our analysis dated 6 August 2024.

USDJPY trading key points

- The US services PMI increased to 51.4 points, exceeding previous readings and analysts’ forecasts

- Federal Reserve Bank of San Francisco President emphasised the importance of preventing a decline in the employment market

- The strongly oversold USDJPY pair makes the Japanese yen vulnerable to positive US economic data

- USDJPY forecast for 6 August 2024: 148.20 and 149.20

Fundamental analysis

The Japanese yen dipped to 145.75 per US dollar, retreating from seven-month highs. This decline is caused by a statement from Federal Reserve Bank of San Francisco President Mary Daly and a stronger-than-expected services report.

The US ISM services PMI rose to 51.4 points in July 2024, up from the previous reading of 48.8 and exceeding analysts’ forecasts. The increase is driven by a rise in new orders, which reached 52.4 points in July, up from 47.3 the previous month. This indicator signals increased demand for services and the general strengthening of business activity.

The President of the Federal Reserve Bank of San Francisco, Mary Daly, underscored the critical need to prevent a decline in the employment market. She expressed readiness to lower interest rates if necessary and emphasised the need for a proactive policy.

Traders now expect the Federal Reserve to ease monetary policy by 110 basis points this year, with the likelihood of a 50-basis-point interest rate cut in September estimated at 75%.

Today’s USDJPY forecast indicates that the strongly oversold pair makes the Japanese yen vulnerable to positive US macroeconomic data, prompting investors to shift their preference towards the US currency.

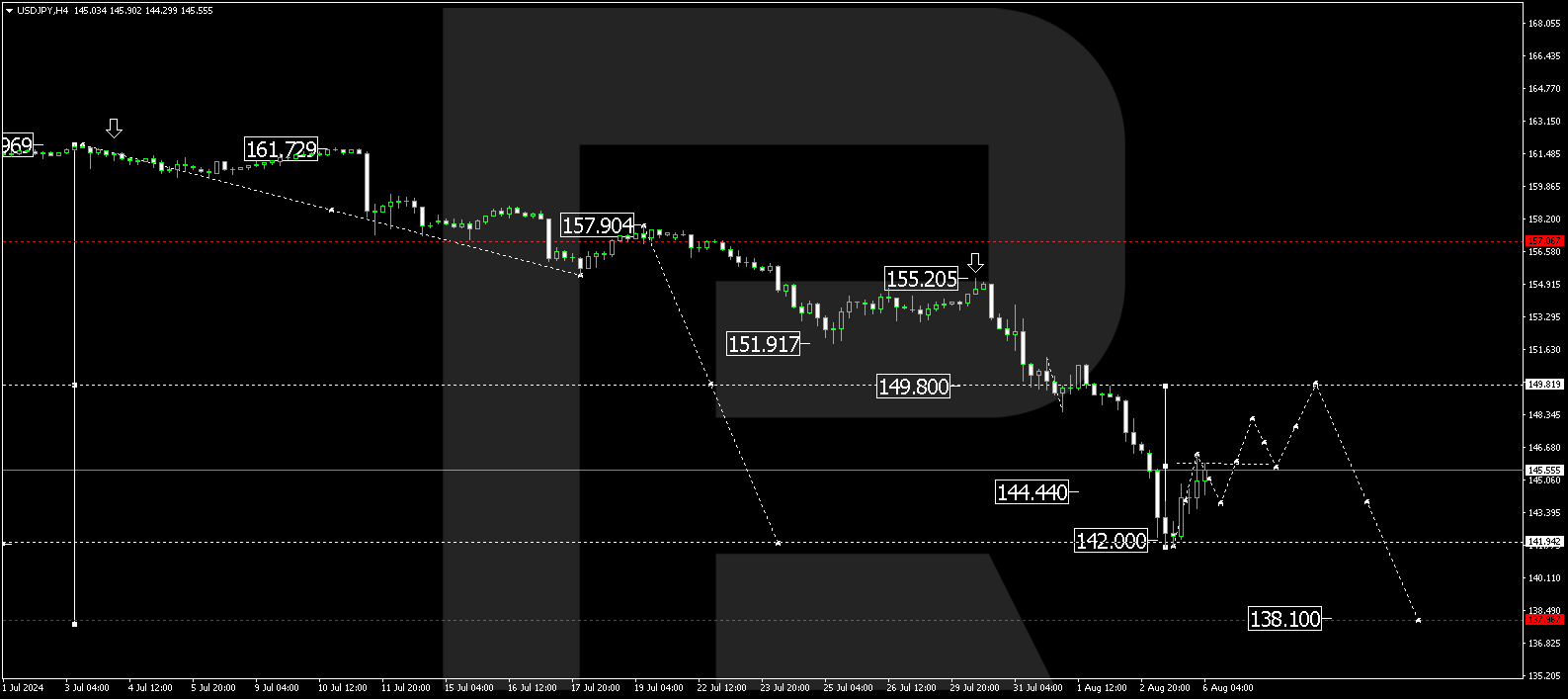

USDJPY technical analysis

The H4 chart shows that the USDJPY pair has completed a downward wave, reaching 141.70. Today, 6 August 2024, the USDJPY rate rose to 146.36 and is expected to decline to 143.63. A new consolidation range could develop between these levels. An upward breakout from this range would open the potential for a growth wave, targeting 148.20 and potentially continuing to 149.20.

Summary

Positive US macroeconomic data has driven up the USDJPY rate, while the strongly oversold pair makes the yen vulnerable to any surprises in the US economy. Technical indicators in today’s USDJPY forecast suggest that the growth wave could develop towards the 148.20 and 149.20 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.