USDJPY continues to decline; the yen gains momentum

The USDJPY pair continues to decline following a BoJ interest rate hike and a reduction in the yen’s speculative positions. Find out more in our analysis dated 2 August 2024.

USDJPY trading key points

- Japan’s monetary base (y/y): previously at 0.6%, currently at 1.2%

- CFTC JPY speculative net positions: previously at -107.1K

- US nonfarm payrolls: previously at 206K, forecasted at 176K

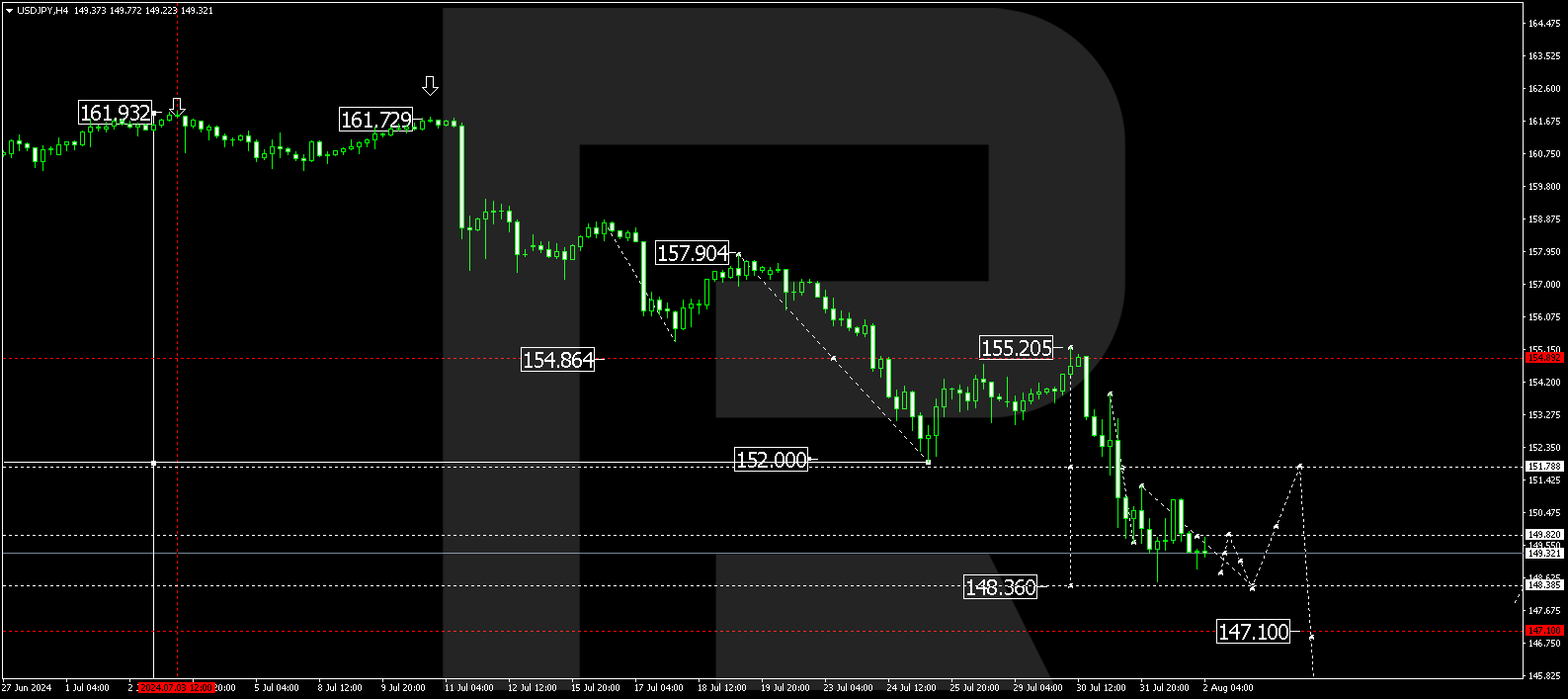

- USDJPY forecast for 2 August 2024: 148.36, 147.10, and 141.80

Fundamental analysis

Japan’s monetary base, which measures the value of all liquid foreign currency holdings of the population, has increased to 1.2%. This increase in the money supply significantly impacts the national currency’s exchange rate. As a result, the interest rate hike and increased money supply have markedly contributed to the yen strengthening against the US dollar.

CFTC JPY speculative net positions are projected to decrease as investors lock in profits and close positions.

A decrease in US nonfarm payrolls may trigger further weakening of the US dollar. The forecast for 2 August 2024 suggests that the yen has a strong chance of strengthening further in this environment.

USDJPY technical analysis

On the H4 chart, the USDJPY pair has completed a decline wave, reaching 148.50, and has corrected towards 150.85. The USDJPY rate could fall to 148.36 today, 2 August 2024. After reaching this level, the price might correct towards 151.78. Subsequently, the USDJPY rate is expected to dip to 147.10, potentially continuing the trend towards 141.80.

Summary

The interest rate change and today’s USDJPY forecast comprising the USDJPY technical analysis suggest that the decline wave could continue to the 148.36, 147.10, and 141.80 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.