USDJPY continues its ascent. Will it hit new highs?

The USDJPY analysis for 19 July 2024 shows that weak economic indicators in Japan allowed the US dollar to strengthen against the yen.

USDJPY trading key points

- Japan’s nationwide core consumer price index (y/y): previously at 2.5%, currently at 2.6%

- Japan’s nationwide consumer price index (m/m): previously at 0.5%, currently at 0.3%

- A speech by FOMC’s John C. Williams

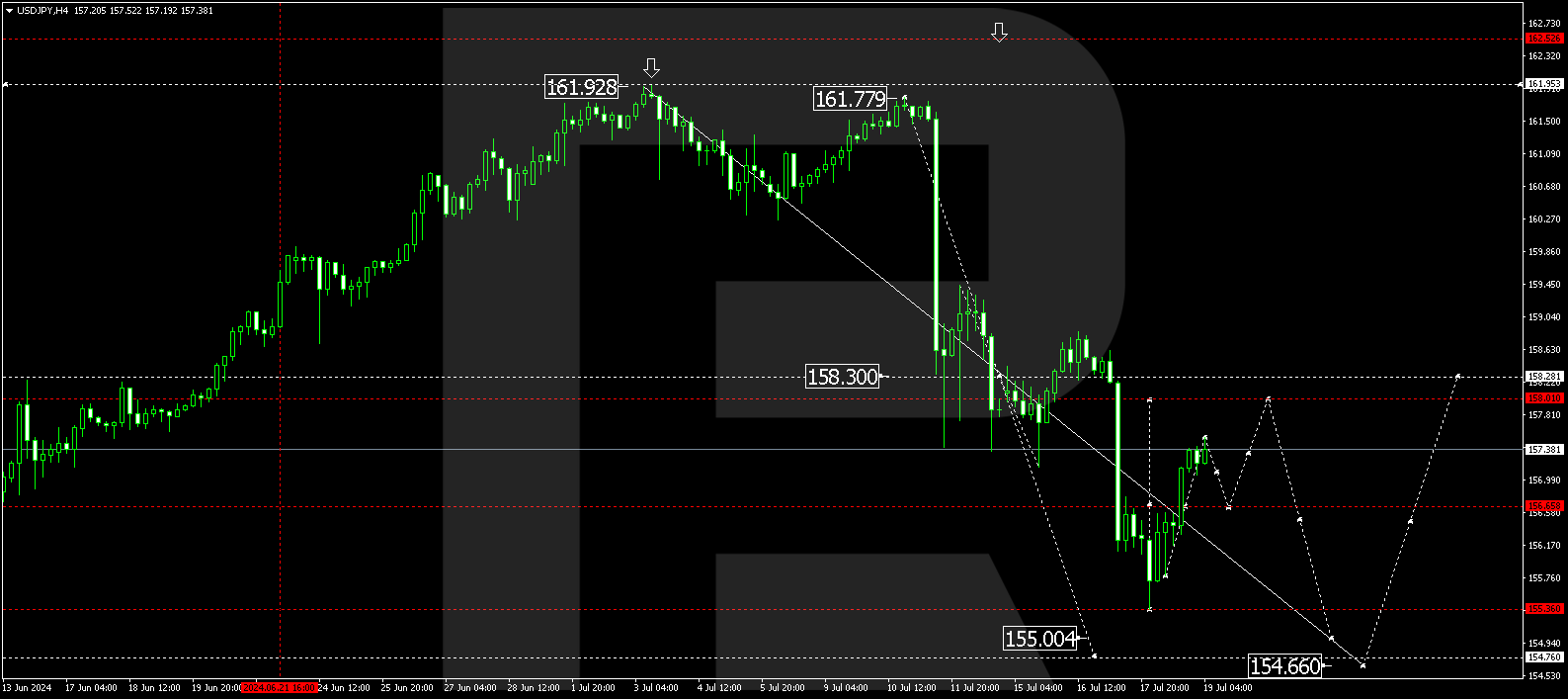

- USDJPY price targets: 158.00, 155.00, and 154.66

Fundamental analysis

Following its attempt to strengthen against the US dollar, the yen begins losing ground again. Japan’s nationwide core consumer price index (y/y) came in at 2.6%, 0.2% lower than forecasted but 0.1% higher than the previous reading.

Japan’s nationwide consumer price index (m/m) currently stands at 0.3%, falling short of expectations. The lack of growth here is the initial signal for a change in the interest rate.

Other economic indicators have lower actual values compared to the previous period. Japan’s negative data enabled the US dollar to start strengthening its position.

A speech by FOMC’s Williams, due at the beginning of the US trading session, may add to the volatility in the USDJPY pair.

USDJPY technical analysis

On the H4 chart, the USDJPY pair completed a decline wave, reaching 155.36. A correction could follow today, 19 July 2024, aiming for 158.00 (testing from below). Subsequently, the price might fall to 155.00 before rising to 158.28. Once the price reaches this level, another corrective wave could develop, targeting (at least) 154.66.

Summary

A speech by FOMC’s John C. Williams may lead to adjustments in Friday’s trading. Meanwhile, technical analysis for today’s USDJPY forecast suggests a downward movement to the 155.00 and 154.66 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.