JPY rises amid speculations about new BoJ interventions

The USDJPY rate slightly corrected on Thursday morning, 18 July 2024, following another decline wave.

USDJPY trading key points

- Japan’s imports increased by 3.2% in June 2024, falling short of the forecasted 9.3% and 9.5% in May

- Japan’s exports rose by 5.4% in June 2024, below the forecast of 6.4%, marking the smallest gain in seven months

- Japan posted a trade balance surplus of 224.04 billion yen in June 2024, exceeding forecasts of a deficit of 240.00 billion

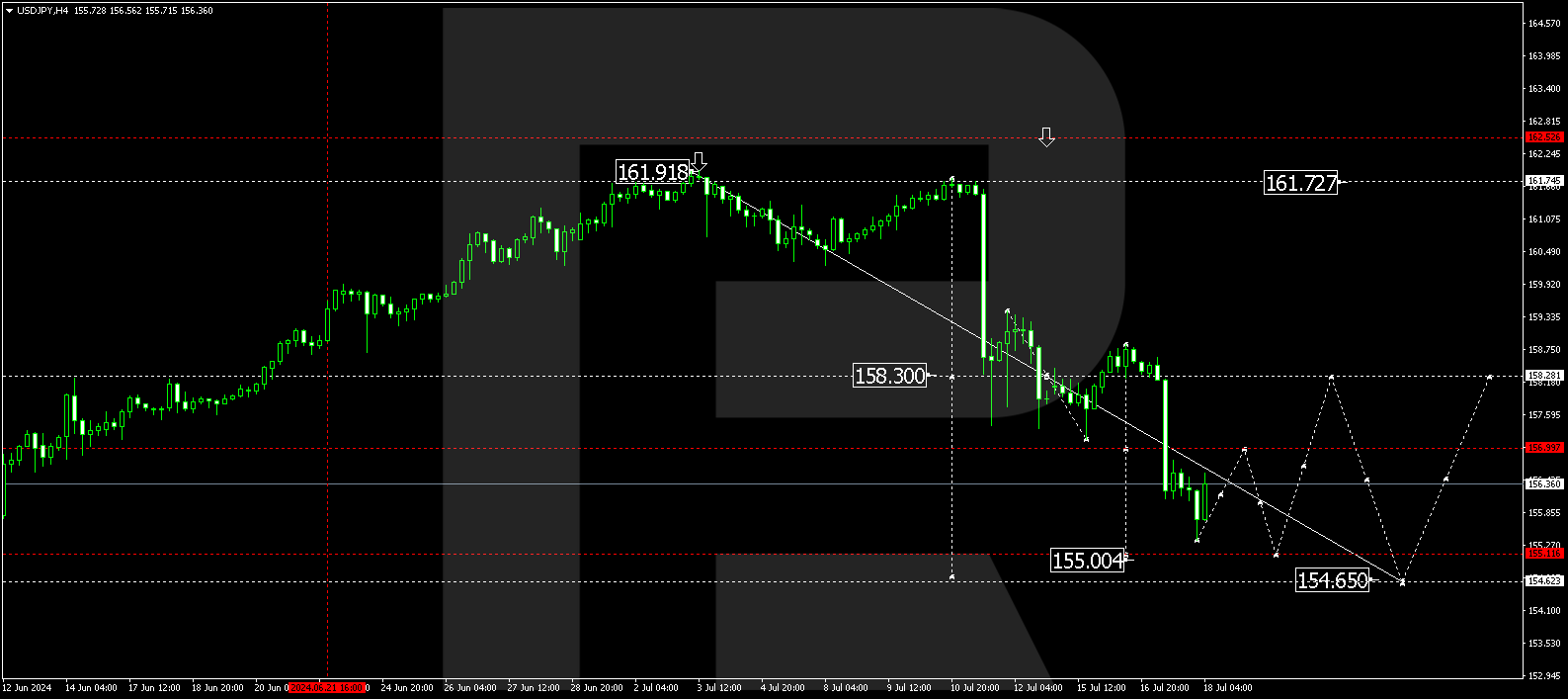

- USDJPY price targets: 155.00 and 154.65

Fundamental analysis

The Japanese yen is strengthening for the second consecutive trading session, rising by 1.4% against the US dollar and testing the 155.35 yen-per-dollar level. This is the highest yen rate in more than a month. Analysts believe such a sharp increase may be due to another intervention by the Japanese authorities in the currency market. The reason behind financial interventions could be the weakness of the national currency, which has declined to multi-year lows in recent months.

An analysis of the Bank of Japan’s data released on Tuesday suggests that the authorities may have spent 2.14 trillion yen on currency interventions last Friday. Given last week’s financial injections, the total expenses for supporting the yen may have reached about 6.00 trillion yen.

Despite the yen’s current growth, some experts believe it remains undervalued. For this reason, increasing BoJ activity in the currency market justifies adjusting the national currency’s rate.

USDJPY technical analysis

On the H4 chart, the USDJPY pair has completed a decline wave, reaching 155.40. Today, 18 July 2024, the price could rise to 157.00 (testing from below) before falling to 155.00. Subsequently, a rise to 158.28 is possible. Once the price reaches this level, another corrective wave may follow, aiming for (at least) 154.65.

Summary

Despite the recent aggressive yen strengthening, some experts consider the Japanese currency undervalued. While understanding the actions of the monetary authorities, market participants do not rule out a further decline in the pair. Technical analysis for today’s USDJPY forecast suggests a further correction towards the 155.00 and 154.65 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.