JPY loses ground after strengthening

Yen’s attempts to strengthen failed. The Japanese currency continues to lose ground against the US dollar.

USDJPY trading key points

- Japan’s services PMI (m/m): previously at 2.2%, currently at -0.4%

- US core retail sales index (m/m): previously at -0.1%, forecasted at 0.1%

- US retail sales (m/m): previously at 0.1%, forecasted at -0.3%

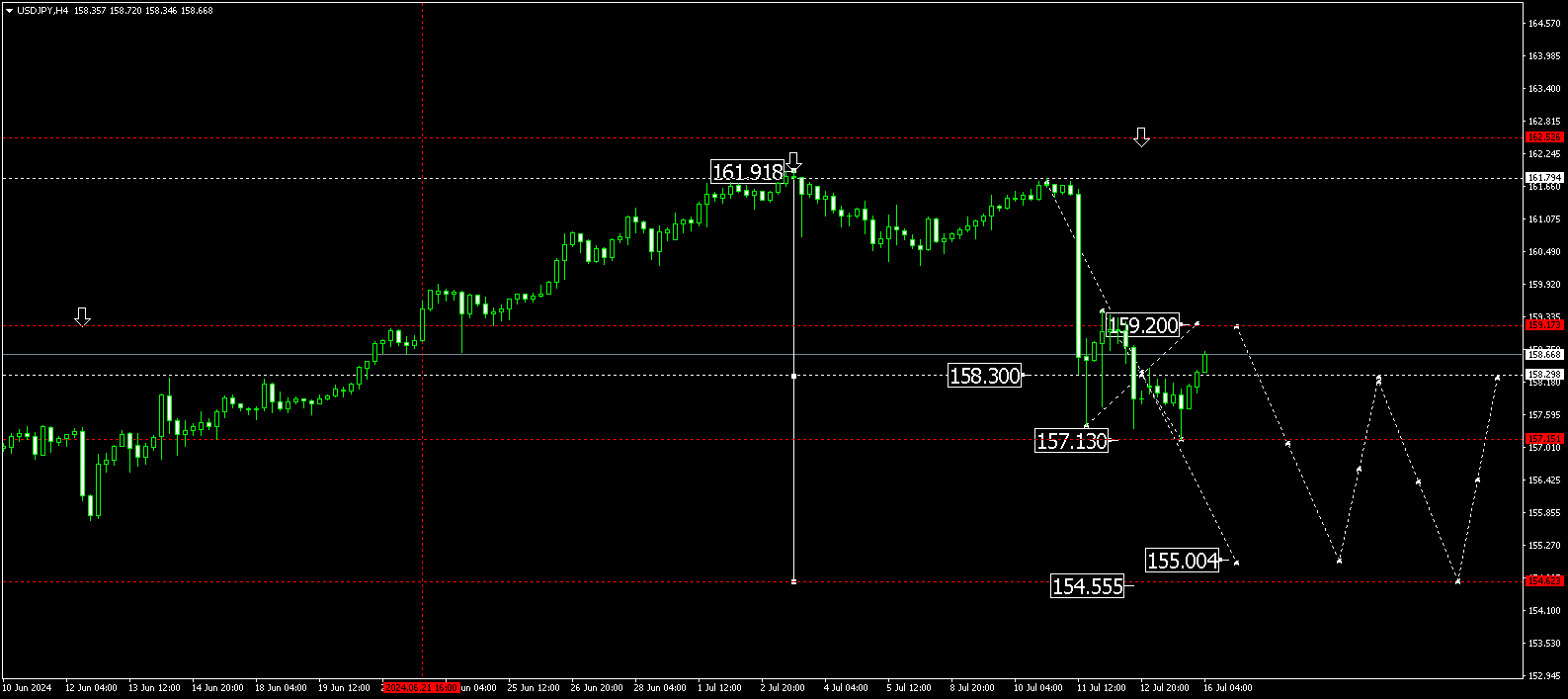

- USDJPY price targets: 155.00 and 154.55

Fundamental analysis

After attempting to strengthen against the US dollar, the yen begins to lose ground. Japan’s services PMI (m/m) was forecasted to be positive but decreased to -0.4%, affecting the USDJPY rate not in favour of the yen.

The US core retail sales index and retail sales are projected to rise slightly. After the release of actual data, this may help strengthen the US dollar against the yen. However, actual values could be worse than forecasted. In this case, the USDJPY rate may continue to decline as part of a corrective wave.

Hopes for the yen’s strengthening and stabilisation are fading away every day. Although currency intervention can save the yen, the Bank of Japan is not yet ready for it.

USDJPY technical analysis

On the USDJPY H4 chart, a consolidation range is forming around 158.30, extending down to 157.15. Today, 16 July 2024, the price is expected to rise to 159.20 before declining to the local target of 155.00. A corrective wave is forming, with the main target at 154.55. At this level, the potential for a correction will be over.

Summary

The news landscape and technical analysis for today’s USDJPY forecast suggest a further correction to the 155.00 and 154.55 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.