USDJPY is stabilising after declining for two days

The USDJPY rate stabilised around 157.94 on Monday morning, 15 July 2024, after a two-day decline of more than 2%.

USDJPY trading key points

- The Bank of Japan is said to spend up to 3.57 trillion yen on 11 July 2024 to support the national currency exchange rate

- Low liquidity may prompt the Japanese regulator to carry out new currency intervention

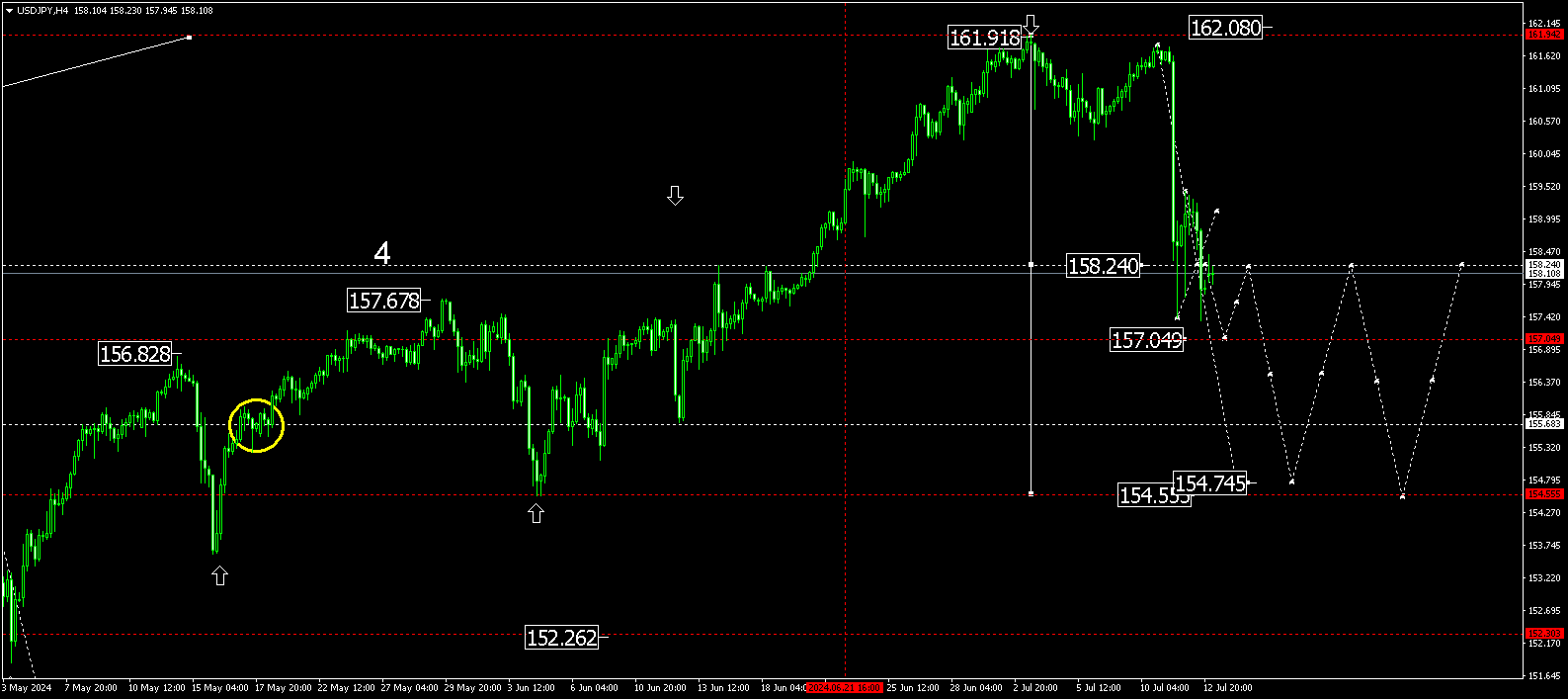

- USDJPY price targets: 157.05, 154.74, and 154.54

Fundamental analysis

The Japanese yen shows sluggish dynamics in Monday trading due to the Marine Day public holiday.

The yen’s recent rise was driven by a combination of factors such as weak US inflation data and speculations about the Bank of Japan’s possible intervention. The Japanese regulator could reportedly have spent up to 3.57 trillion yen on Thursday, 11 July, to support the yen’s rate. However, Bank of Japan officials, including top currency official Masato Kanda refused to comment. Kanda noted that a one-way speculative movement in the market cannot be ignored.

According to analysts, low liquidity due to the holiday may prompt the Bank of Japan to start another financial intervention. The market saw a similar situation in late April when the regulator allegedly entered the market to halt the yen’s sharp decline.

Investors are focused on the Bank of Japan’s upcoming meeting, where the regulator is expected to decide to reduce the bond purchase program and probably raise interest rates. These measures could lead to renewed pressure on the USDJPY pair and further strengthening of the yen.

USDJPY technical analysis

On the USDJPY H4 chart, a consolidation range is forming around 158.24. A decline to 157.05 is expected today, 15 July 2024. Subsequently, the price could rise to 158.24 (testing from below) before falling to the local target of 154.74. A corrective wave is forming, with the main target at this level. In this case, the potential for a correction will be over.

Summary

The decline in the USDJPY rate slowed down due to the public holiday in Japan. However, speculations about the Bank of Japan’s potential intervention and the upcoming meeting, at which an interest rate hike is likely, create conditions for further strengthening of the yen. Technical analysis for today’s USDJPY forecast suggests a further correction to the 157.05, 154.74, and 154.54 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.