USDJPY is rising amid uncertainty about the BoJ’s actions

The USDJPY rate closely approached weekly highs on Thursday, 11 July 2024. The current USDJPY exchange rate is 161.68.

USDJPY trading key points

- Uncertainty about the BoJ’s actions: traders awaiting a rate hike

- Japan’s machinery orders: unexpected decrease of 3.2% in May

- USDJPY price targets: 162.00 and 162.52

Fundamental analysis

Intrigue regarding the pace of monetary policy normalisation by the Bank of Japan remains. Markets anticipate that the BoJ may raise interest rates in late July in an attempt to curb the yen’s weakening. Analysts’ opinions vary, with some believing this will not be enough to halt USDJPY growth in the long term.

Japan’s Ministry of Finance officials reiterated their readiness for currency market interventions. Although they currently have a limited effect, they help to keep the yen weakening slowly and moderately.

Recent data showed an unexpected 3.2% (m/m) decline in Japan’s core machinery orders in May, indicating a potential economic slowdown. This is another signal favouring a further decline in the yen’s rate.

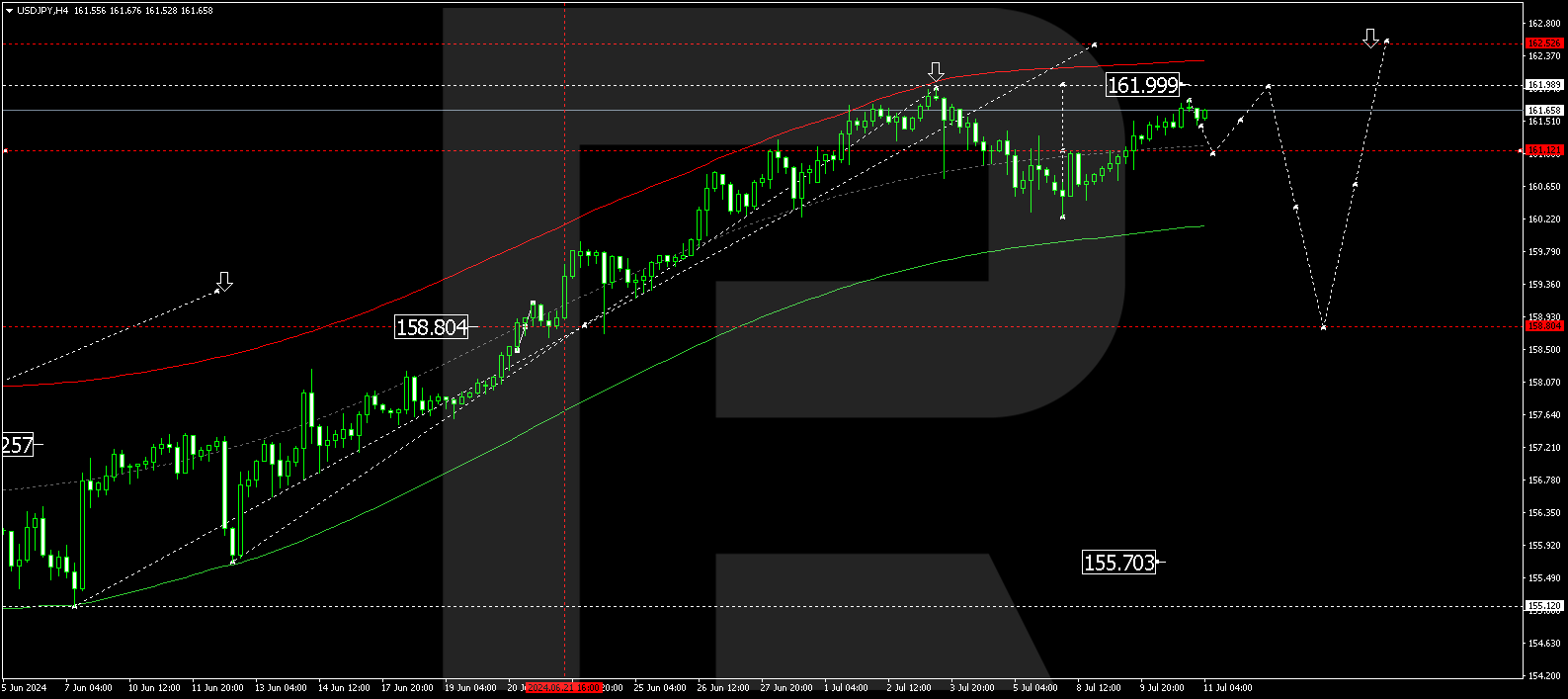

USDJPY technical analysis

On the USDJPY H4 chart, a consolidation range has formed around 161.12. Today, 11 July 2024, the market extended it towards 161.79. A decline to 161.12 (testing from above) is possible. Subsequently, a growth wave could develop towards 162.00, potentially continuing to the local target of 162.52.

Summary

Uncertainty about the BoJ’s actions plays a vital role in the USDJPY’s further growth and may easily cause the price to rise above a weekly high. Technical analysis for today’s USDJPY forecast suggests growth to the 162.00 and 162.52 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.