USDJPY continues to correct; will a new surge follow?

Japan’s news landscape positively contributes to a correction in the USDJPY rate. The yen is temporarily headed for strengthening in anticipation of an interest rate decision.

USDJPY trading key points

- Japan’s M2 monetary aggregate (y/y): currently at 1.5% compared to the previous reading of 1.9%

- The 5-year Japanese government bond (JGB) auction: currently at 0.612% compared to the previous reading of 0.512%

- Japan’s machine tool orders (y/y): currently at 9.7% compared to the previous reading of 4.2%

- US Federal Reserve Chair Jerome Powell’s speech

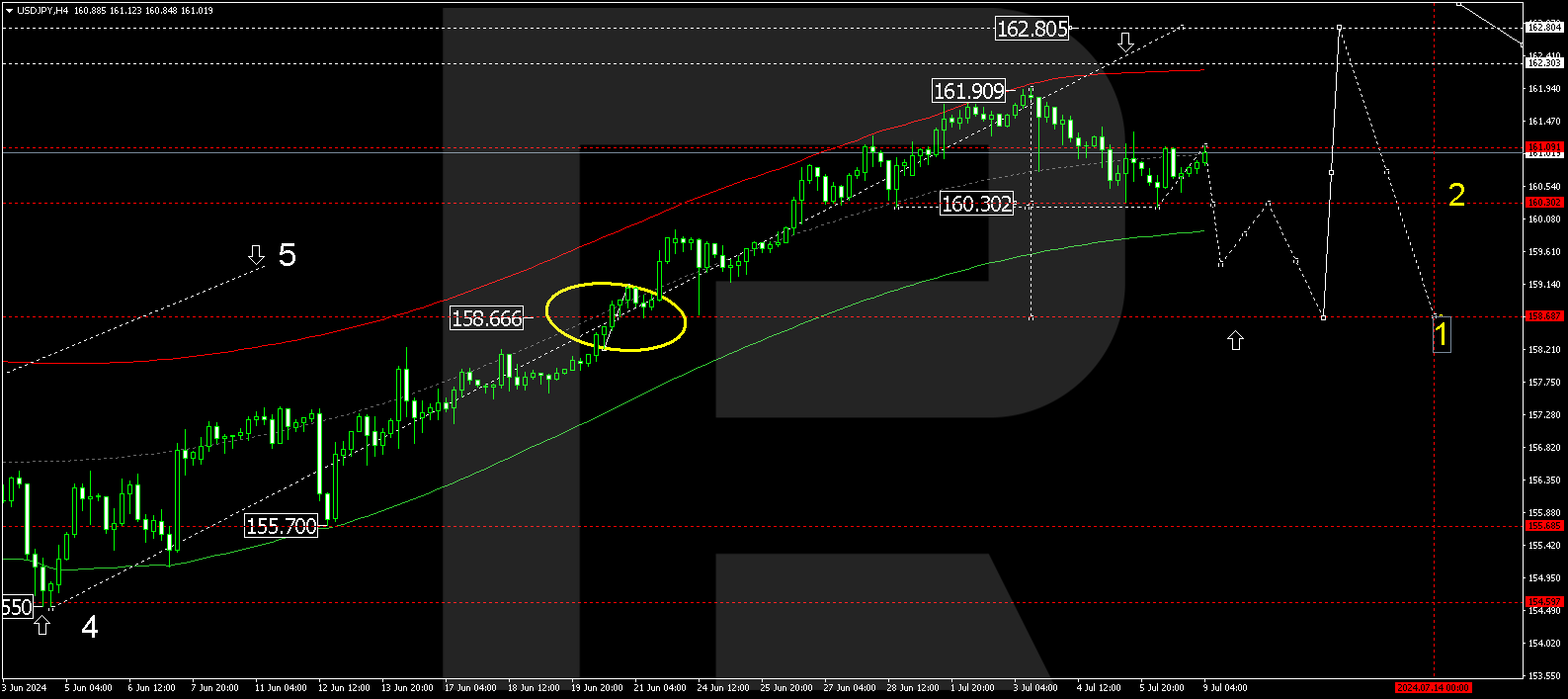

- USDJPY price targets: 160.30, 159.30, and 158.70

Fundamental analysis

Following Japan’s economic data release, the USDJPY rate continues to correct amid an uptrend. The news was positive, helping the yen to strengthen further against the US dollar.

After the US trading session opens, US Federal Reserve Chair Jerome Powell will deliver a speech that may significantly impact the USDJPY rate. If investors and traders perceive a negative sentiment from the Federal Reserve towards the US dollar, the USDJPY pair will continue its corrective wave. The Fed chair’s speech and any proposals for a favourable monetary policy outlook will give the US dollar a chance to strengthen against the yen. Market sentiment is sceptical, with the USD losing ground against the JPY.

The Bank of Japan has yet to determine its monetary policy, particularly regarding the interest rate decision, which will be made in late July 2024.

USDJPY technical analysis

On the USDJPY H4 chart, a consolidation range is developing below 161.09. Today, 9 July 2024, the price is expected to decline to 160.30, a crucial level for the USDJPY pair. A downward breakout will open the potential for a decline wave towards 159.30, potentially continuing to 158.70.

Summary

The Federal Reserve chair’s speech may negatively impact the US dollar. Technical analysis for today’s USDJPY forecast suggests a decline to the 160.30, 159.30, and 158.70 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.