Wage growth in Japan accelerates

The USDJPY rate is correcting on Monday amid the highest US employment rate since November 2021. The pair could not drop below the 160.20 support level.

USDJPY trading key points

- Earnings in Japan reached their highest level since January

- US job growth decreased to the lowest seen since November 2021

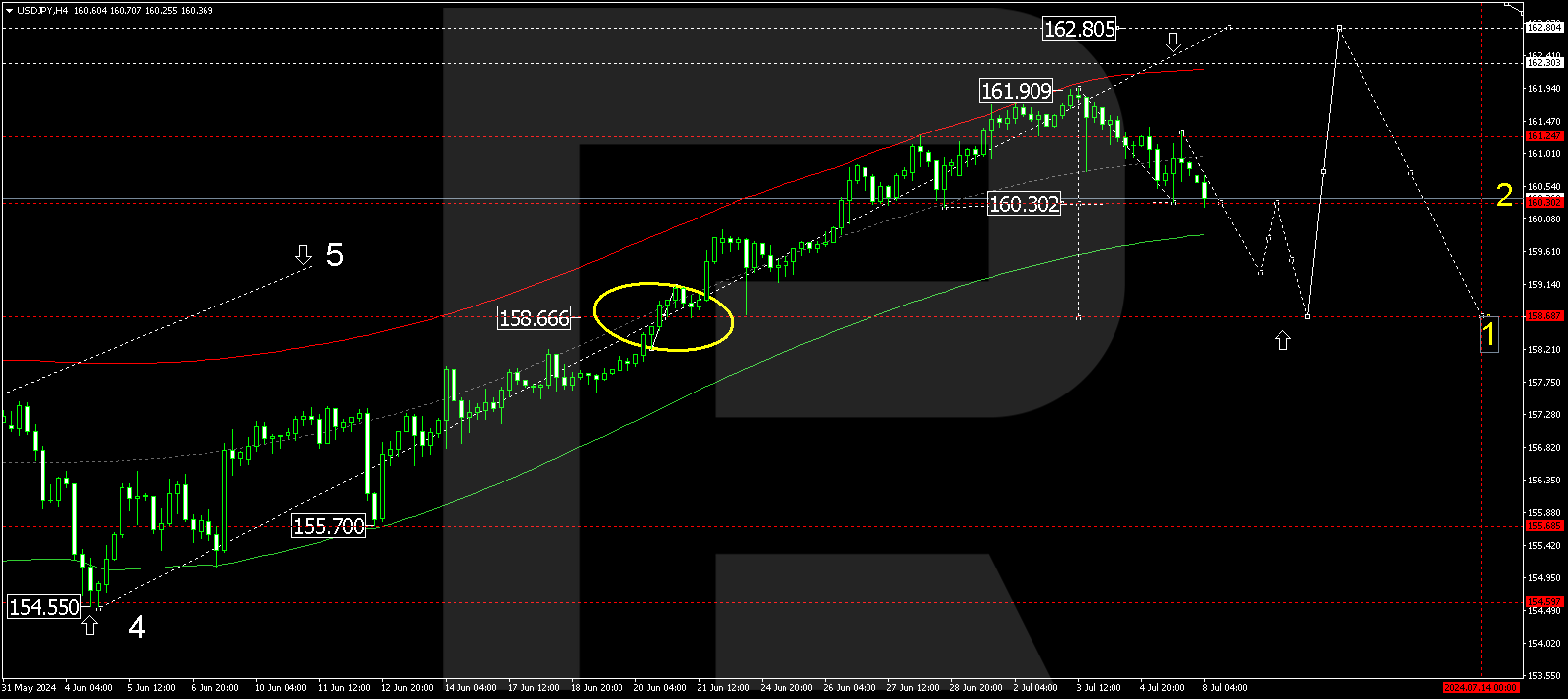

- USDJPY price targets: 160.00, 159.30, and 158.70

Fundamental analysis

Earnings in Japan increased by 1.9% year-over-year in May 2024, marking the highest reading since January. However, the indicator is yet to catch up with inflation. As a result, real wages in the country continued to decrease for 26 consecutive months, preventing the BoJ from achieving the desired rise in prices and earnings and impeding the normalisation of monetary policy.

The revised Q3 data on US job growth may negatively impact the dollar-to-yen exchange rate. In June, the unemployment rate reached its highest level since November 2021. Traders expect the first Federal Reserve interest rate reduction in September, followed by further quarterly cuts to a final rate of 3.25-3.50%.

USDJPY technical analysis

On the H4 chart, USDJPY has completed a decline wave, reaching 160.30, and then corrected to 161.25. Today, 8 July 2024, the price is expected to decline to 160.00, a crucial level for the USDJPY pair. A breakout of this level will open the potential for a decline wave towards the local target of 159.30. After reaching this target, the price could rise to 160.00 (testing from below). Subsequently, the trend might continue to 158.70.

Summary

A sharp decline in US job growth and the expected Federal Reserve interest rate cut may support the yen. Technical analysis for today’s USDJPY forecast suggests a decline to the 159.30 and 158.70 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.