The yen is deteriorating: JPY continues to depreciate

The USDJPY pair is hitting 37-year highs, with the Bank of Japan’s inaction working against the yen.

USDJPY trading key points

- The USDJPY pair reached 37-year highs

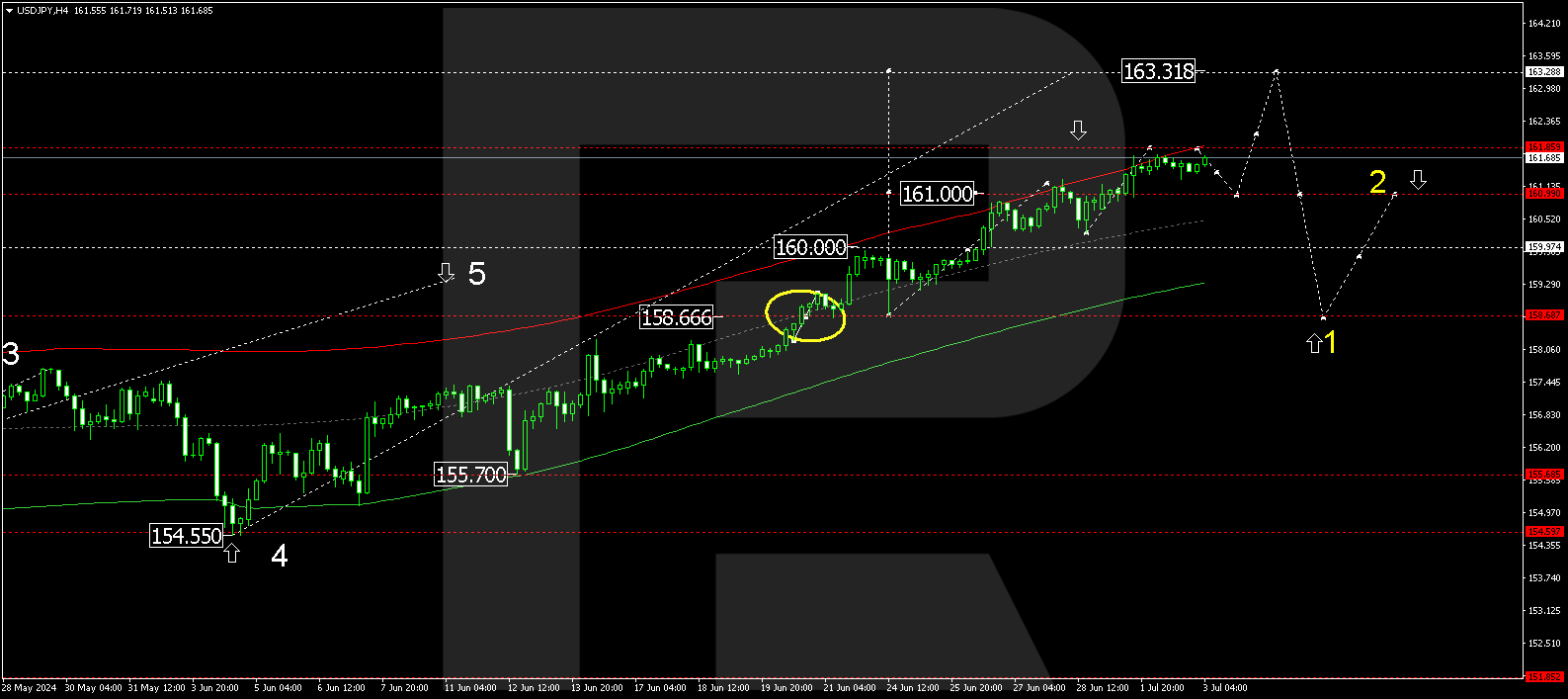

- USDJPY targets: 161.85, 163.30, 158.70

USDJPY fundamental analysis

The Japanese yen is suffering considerably from this depreciation. Following financial interventions in May by the Japanese government and regulator, the yen stabilised for some time. However, it started weakening on 6 May, and the USDJPY pair has continuously risen since then.

The primary reason for the yen’s weakness is the significant difference in monetary approaches and interest rates between the Bank of Japan and the US Federal Reserve. The BoJ interest rate remains at zero. The Bank of Japan’s inaction on the interest rate issue and the lack of a plan to normalise monetary policy exert pressure on the JPY. At the same time, the market speculates that the BoJ may raise the rate or give respective instructions at its meeting in late July.

The weak yen negatively impacts household consumption, increasing import costs and heightening inflationary pressure.

Japanese authorities make verbal interventions, reiterating daily as a mantra that they are monitoring the situation. Nevertheless, the yen does not respond to this.

USDJPY technical analysis

On the USDJPY H4 chart, a support level formed at 161.00, with the wave continuing to develop towards 161.85. Today, 3 July 2024, the price might reach this level and correct to 161.00 (testing from above). Subsequently, the quotes could rise to 163.30, representing the main target of this growth wave.

Summary

The yen’s depreciation remains the main scenario. The USDJPY technical analysis suggests the growth wave extension to the 163.30 level, followed by a decline to the 158.90 and 157.40 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.