Tankan’s growth does not offset Japan’s overall economic downturn

The USDJPY rate is correcting on Monday, 1 July 2024, remaining near highs amid Japan’s weak GDP data. The current USDJPY exchange rate is 160.97.

USDJPY trading key points

- Japan’s economy contracted by 2.9% year-over-year

- The Tankan index increased by 2 points in Q2

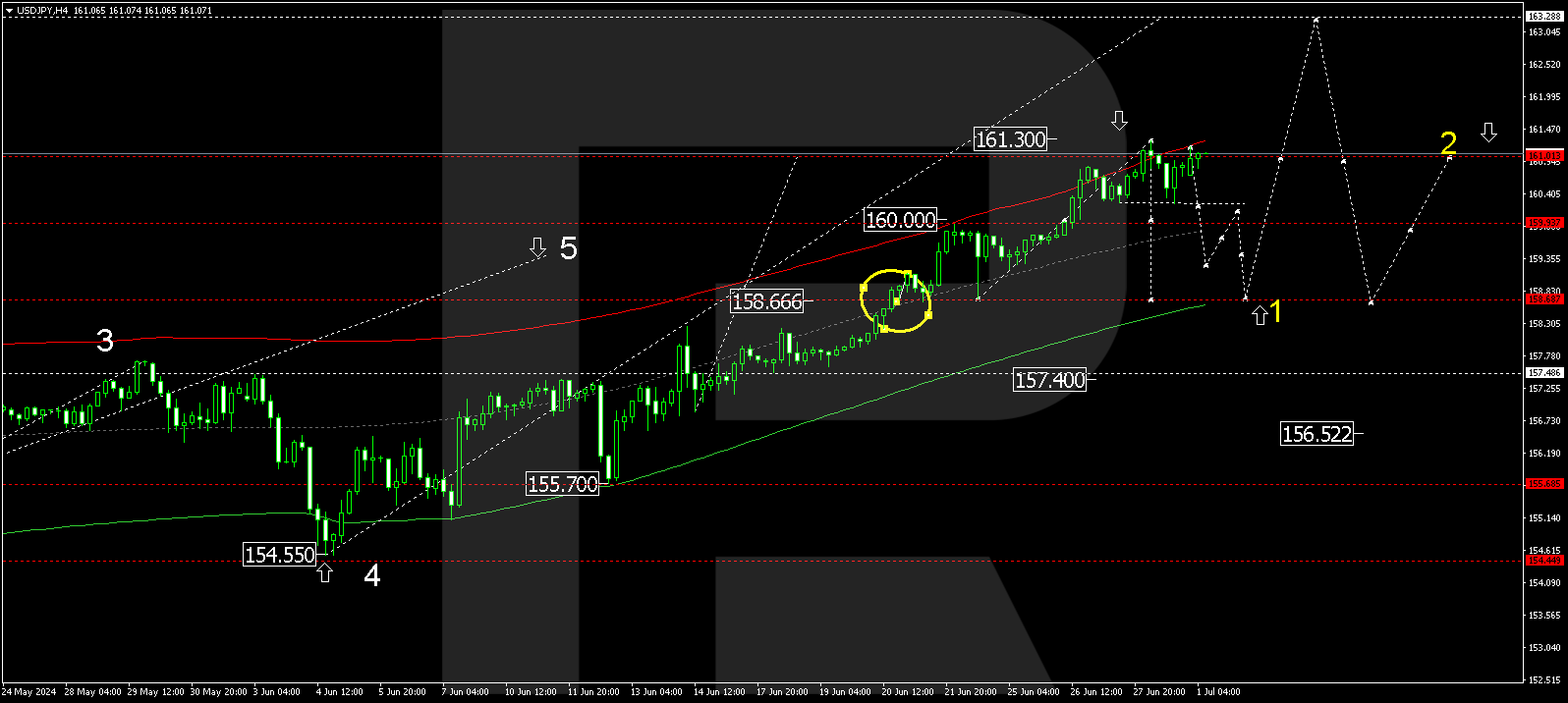

- Target levels: 158.90, 163.30

- Resistance level: 161.20. Support level: 160.25

USDJPY fundamental analysis

According to the BoJ data, Japan’s Tankan index, reflecting sentiment among large manufacturing companies, increased to 13 points in Q2 2024, marking a two-point gain compared to the previous quarter. However, the second GDP revision showed that Japan’s economy contracted by 2.9% year-over-year in Q1, considerably worse than the latest estimate of -1.8%. Despite the improvement in the Tankan index, Japan’s economic indicators remain weak, potentially exerting pressure on the yen rate.

USDJPY technical analysis

On the H4 chart, the USDJPY pair has completed a growth wave, reaching 161.30. The price has performed a downward impulse towards 160.25 and corrected to 160.95. Today, 1 July 2024, the USDJPY pair might experience a further correction towards 158.90. Once this correction is complete, a growth wave could start, aiming for 163.30.

Summary

If the price rises to 163.30, Japanese authorities may take urgent action to stabilise the yen rate. The USDJPY technical analysis points to a price reversal from the 163.30 level, followed by a decline to the 158.90 and 157.40 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.