USDCHF is poised for growth; the franc is retreating rapidly

The USDCHF pair has been rising, with this trend persisting for the third consecutive day due to the strength of the US dollar. Find out more in our analysis dated 30 July 2024.

USDCHF trading key points

- The USDCHF pair depends on US dollar movements

- Switzerland’s domestic statistics have minimal impact on USDCHF dynamics

- USDCHF forecast for 30 July 2024: 0.8888 and 0.8761

Fundamental analysis

The USDCHF pair has risen for three consecutive days and is now approaching 0.8866.

This movement follows a fairly noticeable decline in the pair in July. The US dollar is clearly rebounding, supported by forecasts that the US Federal Reserve will keep the interest rate unchanged at today’s meeting. The rate is expected to remain within the 5.25-5.50% range. Investors are primarily anticipating signals regarding the next meeting scheduled for September.

The USDCHF pair is forced to react to external factors. However, Switzerland’s domestic statistics are not robust enough to capture investor attention.

Today, Switzerland will release the report on the KOF leading indicators index for July, which is expected to decrease slightly to 102.6 points from the previous 102.7.

The ZEW economic sentiment index data for July is due later this week. The previous reading was 17.5 points.

USDCHF technical analysis

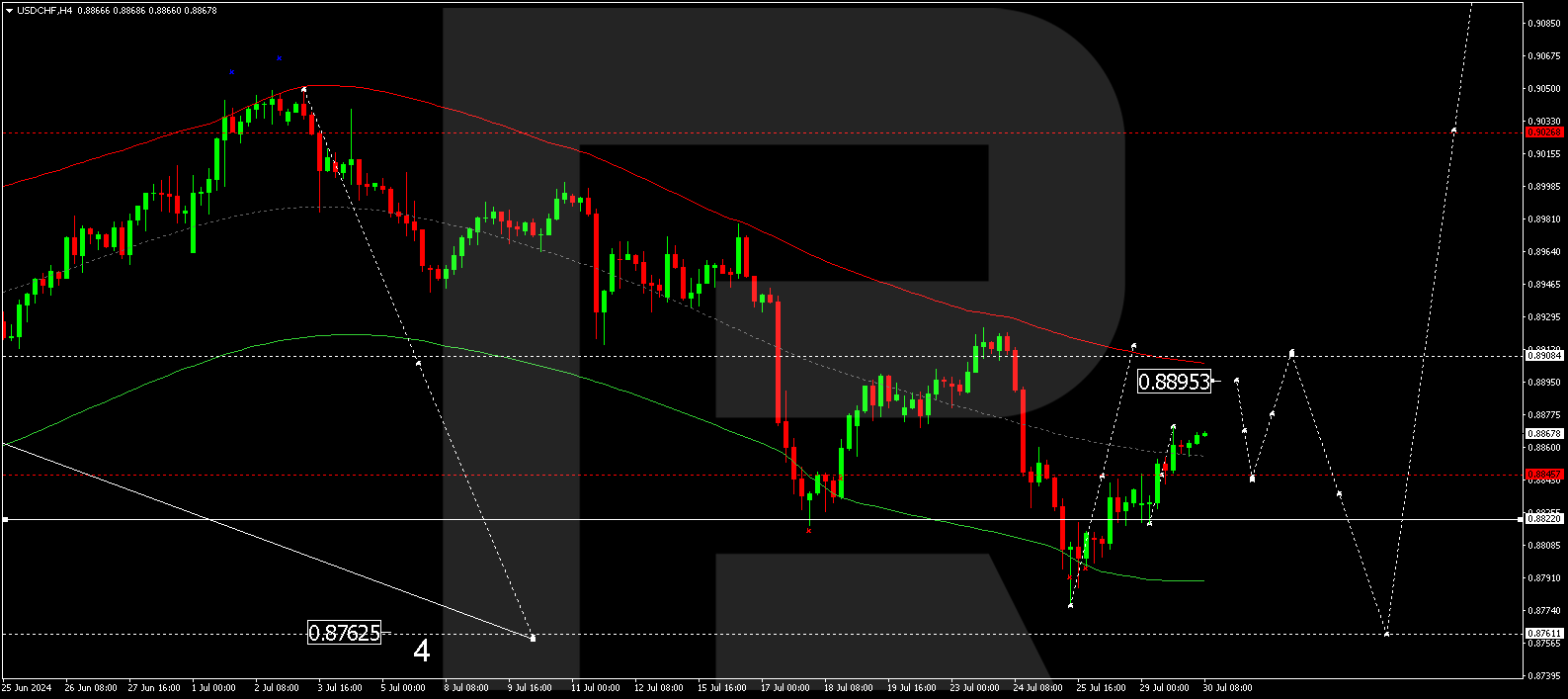

On the H4 chart, the USDCHF pair continues its correction towards 0.8888. Today, 30 July 2024, a rise to 0.8870 is expected, followed by a decline to 0.8833 (testing from above). Subsequently, the USDCHF rate could rise to 0.8888, with the correction potentially extending to 0.8900. Once the correction is complete, a new decline wave could begin, aiming for 0.8761 as the wave’s main target.

Summary

The USDCHF pair has been rising for the third consecutive day. Technical indicators for today’s USDCHF forecast suggest a further correction towards 0.8888, followed by a decline to 0.8761.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.