CHF declines: SNB takes action

The USDCHF pair began to rise after the Swiss National Bank lowered the rate again. The regulator is monitoring currency rates.

The Swiss franc declined against the US dollar. The USDCHF pair rose to 0.8911 on Friday. This marks the third consecutive day of growth.

Yesterday, the Swiss National Bank cut the interest rate by 25 basis points, bringing it to 1.25% per annum. This triggered the rise in USDCHF. SNB Chairman Thomas Jordan explained that the franc had strengthened well in recent weeks. The regulator is prepared to take measures to regulate the currency market.

This is the Swiss National Bank's second consecutive interest rate reduction. The market speculates that there could be a third rate cut in September. For the SNB, this is the best way, among other things, to curb the strengthening of the CHF rather than currency interventions in the open market. At the same time last year, the regulator was buying francs to weaken the market.

The CHF exchange rate had previously risen to a 16-week high against the euro and a three-month peak against the US dollar.

Inflation in Switzerland is expected to be 1.3% this year, 1.1% in 2025, and 1.0% in 2026 – below the previous forecast. Meanwhile, inflation in the domestic services sector is the only driver of price growth risk.

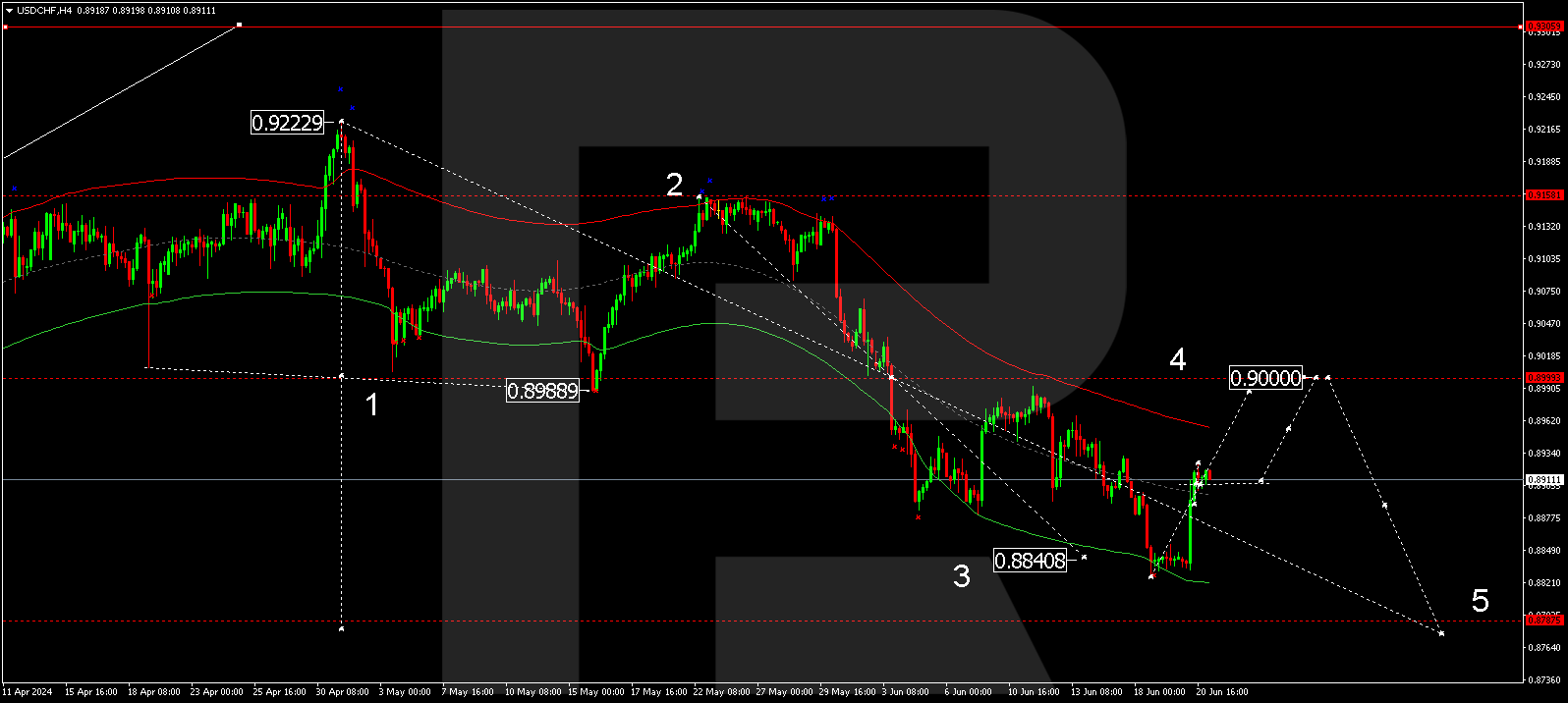

USDCHF technical analysis

The USDCHF Н4 chart analysis for 21 June 2024 shows upward momentum towards 0.8912, with a consolidation range currently forming around this level. Today, the range is expected to extend to 0.8936. Subsequently, the price might decline to 0.8912 (testing from above). If the USDCHF rate exits the current range upwards, this will create the potential for growth to 0.9000. After reaching this level, the price could fall to 0.8787, representing the main target for correction.

USDCHF technical analysis 21.06.2024

This scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 0.9000. This level is considered crucial for a corrective wave in the USDCHF pair. The market has received an upward rebound from the Envelope’s lower boundary at 0.8840. Today, the quotes are hovering above its centre. A consolidation range is expected to develop. An upward breakout of this range might enable a growth structure, aiming for the Envelope’s upper boundary. Subsequently, the USDCHF rate might fall further to its lower boundary at 0.8787.

Summary

The USDCHF technical analysis points to a potential corrective wave towards 0.8787 with an onward rise to the targets of 0.9015 and 0.9300.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.