USDCHF is strengthening amid a mixed situation in Switzerland

Although the USDCHF rate is rising for the second consecutive session, it has yet to secure a position above the resistance level. Find out more in our analysis dated 13 August 2024.

USDCHF forecast: key trading points

- Switzerland’s consumer confidence index increased to -32.4 points in July 2024

- Retail sales in the Swiss economy fell by 2.2% year-over-year in June

- Unemployment numbers increased in July 2024, reaching a four-month high

- USDCHF forecast for 13 August 2024: 0.8645 and 0.8505

Fundamental analysis

The US dollar shows moderate strength. Tomorrow’s US Consumer Price Index could significantly influence forecasts for future Federal Reserve interest rate changes and increase volatility in the USDCHF rate. Analysts note that high CPI readings might limit an interest rate cut to 25 basis points, while low readings could lead to a reduction of 50 basis points or more in September.

Switzerland’s consumer confidence index rose to -32.4 points in July 2024, up by 4.2 points from the previous value and significantly above analysts’ forecasts. This indicates increased optimism among the population, although the overall sentiment remains negative.

Meanwhile, Switzerland’s retail sales unexpectedly decreased by 2.2% year-over-year in June 2024, marking a significant decline compared to the projected 0.5% growth and the previous reading.

The number of unemployed people rose by 3,198 in July 2024, reaching a four-month high of 107,716. Although the unemployment rate remained low at 2.3%, this raised concerns among investors. According to the USDCHF forecast for today, Switzerland’s weak economic data may support the growth of the US dollar.

USDCHF technical analysis

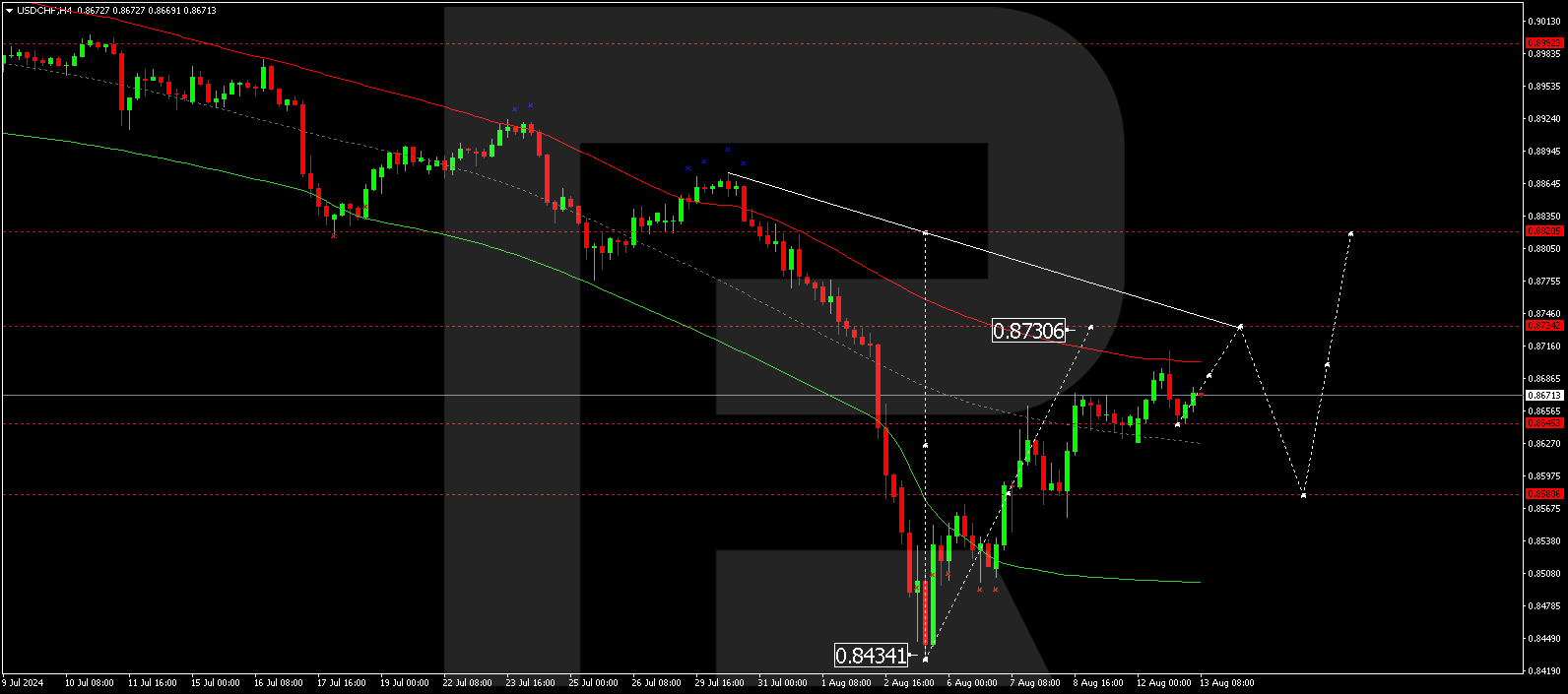

The USDCHF H4 chart shows that the market has received support at 0.8645 and continues its upward momentum towards 0.8730, the initial target. The price is expected to reach this target level today, 13 August 2024. Once the initial growth wave is complete, a correction might begin, targeting 0.8505. Subsequently, a new growth wave could follow, aiming for 0.8820.

Summary

Switzerland’s weak economic data, including a decline in retail sales and increased unemployment, may contribute to the USDCHF pair’s further strengthening. Technical indicators in today’s USDCHF forecast suggest a growth wave could continue towards 0.8645, and a correction towards 0.8505 might begin.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.