USDCHF: the news landscape does not prevent the franc from losing ground

Investors expect the Swiss franc to continue losing ground, so the USDCHF pair continues its ascent.

USDCHF trading key points

- Switzerland’s non-seasonally adjusted unemployment rate: currently at 2.4% compared to the previous reading of 2.4%

- Switzerland’s consumer price index (m/m, June): currently at 0.0% compared to the previous reading of 0.3%

- Switzerland’s consumer price index (y/y, June): currently at 1.3% compared to the previous reading of 1.4%

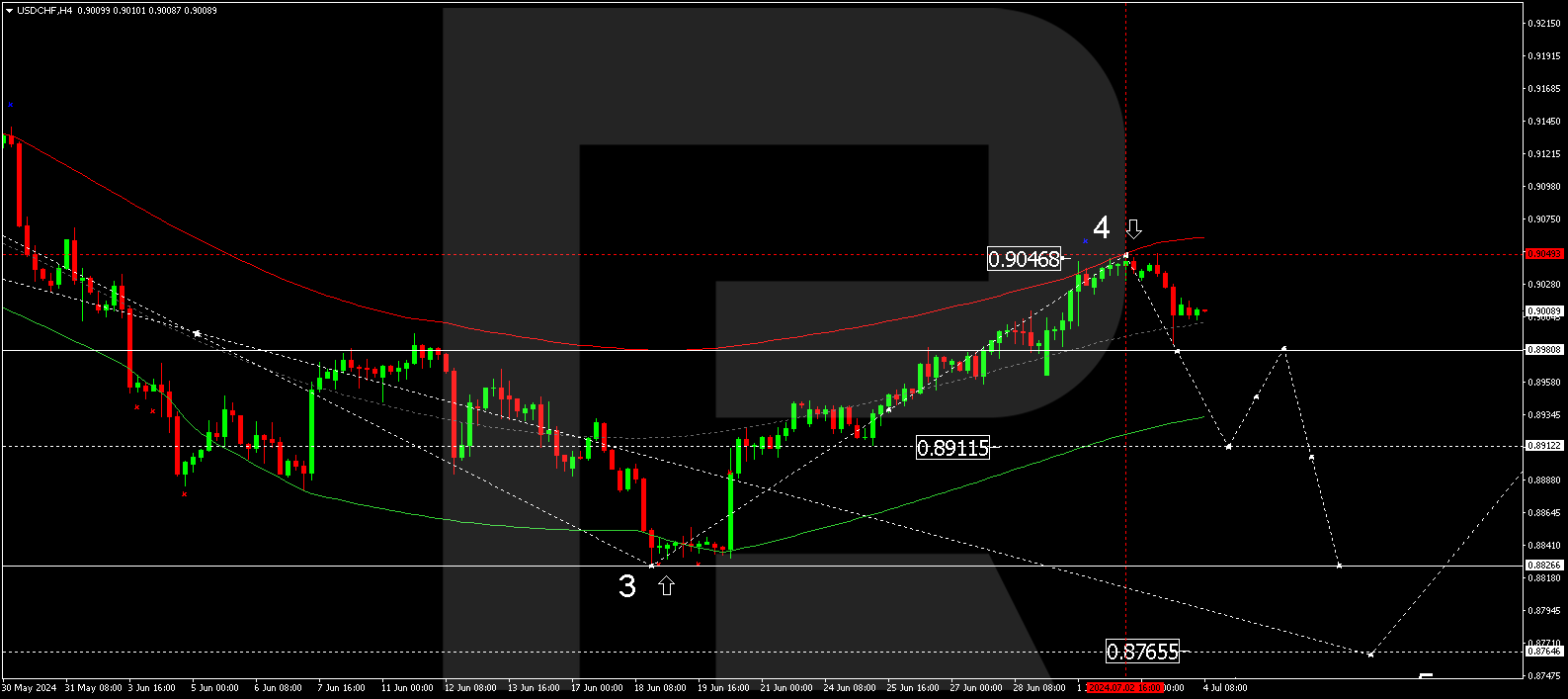

- USDCHF targets: 0.8911, 0.8822, 0.8787

USDCHF fundamental analysis

The USDCHF rate started to rise gradually following the news released today, 4 June 2024. Switzerland’s non-seasonally adjusted unemployment rate remained flat at 2.4%, which can be interpreted both positively and negatively. On the one hand, unemployment remained at the same level, but on the other hand, it did not decrease, leading to mixed reactions among market participants.

The year-over-year and month-over-month consumer price indices decreased, favouring market participants betting on a decline in the Swiss franc.

Overall, investors expect the franc to continue losing ground and the USDCHF rate to continue growing after a correction.

USDCHF technical analysis

Technical analysis of the USDCHF pair on the H4 chart as of 4 July 2024 indicates the completion of a correction at 0.9050. The pair is expected to continue a decline wave to 0.8911. After reaching this level, the price could correct to 0.8980. Subsequently, another decline structure might develop, aiming for 0.8822 and potentially continuing to 0.8787.

Summary

Although technical analysis for today’s USDCHF forecast points to a decline wave towards the 0.8911, 0.8822, and 0.8787 targets, the news landscape suggests a further development of the uptrend.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.