USDCAD remains weak as the market tests lows last seen on 8 March 2024

The USDCAD pair fell to a six-month low, primarily driven by the weakness of the US dollar. However, current developments are not particularly favourable for the Canadian dollar either. Find out more in our analysis dated 28 August 2024.

USDCAD forecast: key trading points

- The USDCAD continues to decline

- Investors await Friday’s GDP data from Canada, with expectations of steady growth

- USDCAD forecast for 28 August 2024: 1.3366 and 1.3263

Fundamental analysis

The USDCAD rate fell to 1.3452; the market last saw such levels in March 2024. The Canadian dollar appears resilient but only amid the weakness of its US counterpart.

While the extent of CAD strengthening looks somewhat excessive, this is due to the sluggish summer markets. The situation may become more stable once the new business season starts. On a global scale, foreign exchange rate movements are influenced by the prospect of a future US Federal Reserve interest rate cut. This will almost certainly happen at the September meeting when interest rates will be lowered by 25 or 50 basis points.

As for Canadian reports, all eyes are on Friday when the Q2 GDP data is due. It is expected that the Canadian economy could have grown by 1.6%, exceeding the Bank of Canada’s baseline forecast of 1.5%. Robust figures may support the CAD position.

The near-term USDCAD forecast may remain in favour of the Canadian dollar.

USDCAD technical analysis

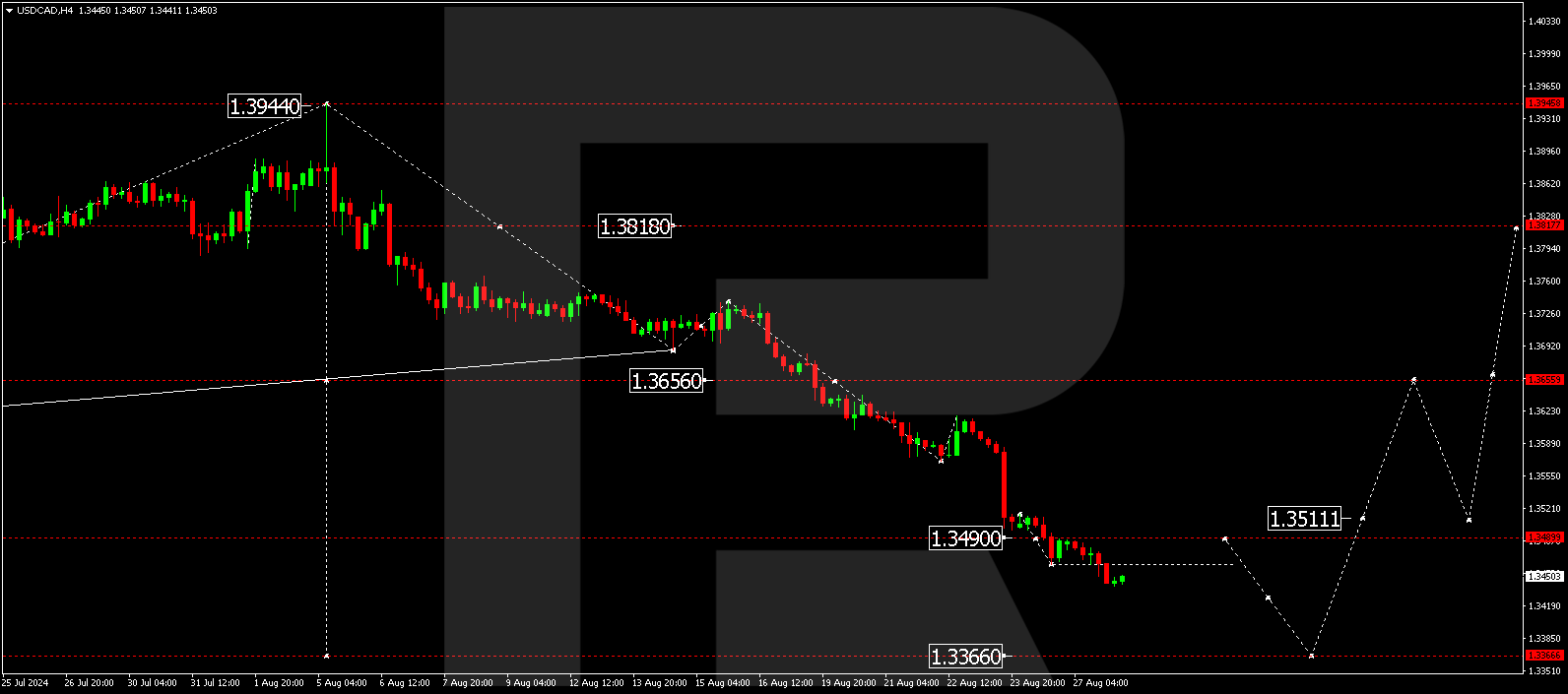

The USDCAD H4 chart shows that the market maintains its downward trajectory without a significant correction. The market has formed a consolidation range around 1.3485 and broke below its lower boundary today, 28 August 2024, pushing the USDCAD rate down to 1.3440. The price is expected to retest the previously breached 1.3460 level from below. Subsequently, the downward wave could continue to 1.3366, potentially extending to 1.3263, the first target.

Summary

The USDCAD pair fell to a six-month low and is poised for a further decline. Technical indicators in today’s USDCAD forecast suggest that the downward wave could continue to the 1.3366 and 1.3263 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.