USDCAD declines: the market requires a correction before resuming an uptrend

The USDCAD pair is easing off, with the market adjusting positions. Find out more in our analysis dated 7 August 2024.

USDCAD trading key points

- The USDCAD pair is declining as part of a correction

- Fundamental factors signal CAD weakness

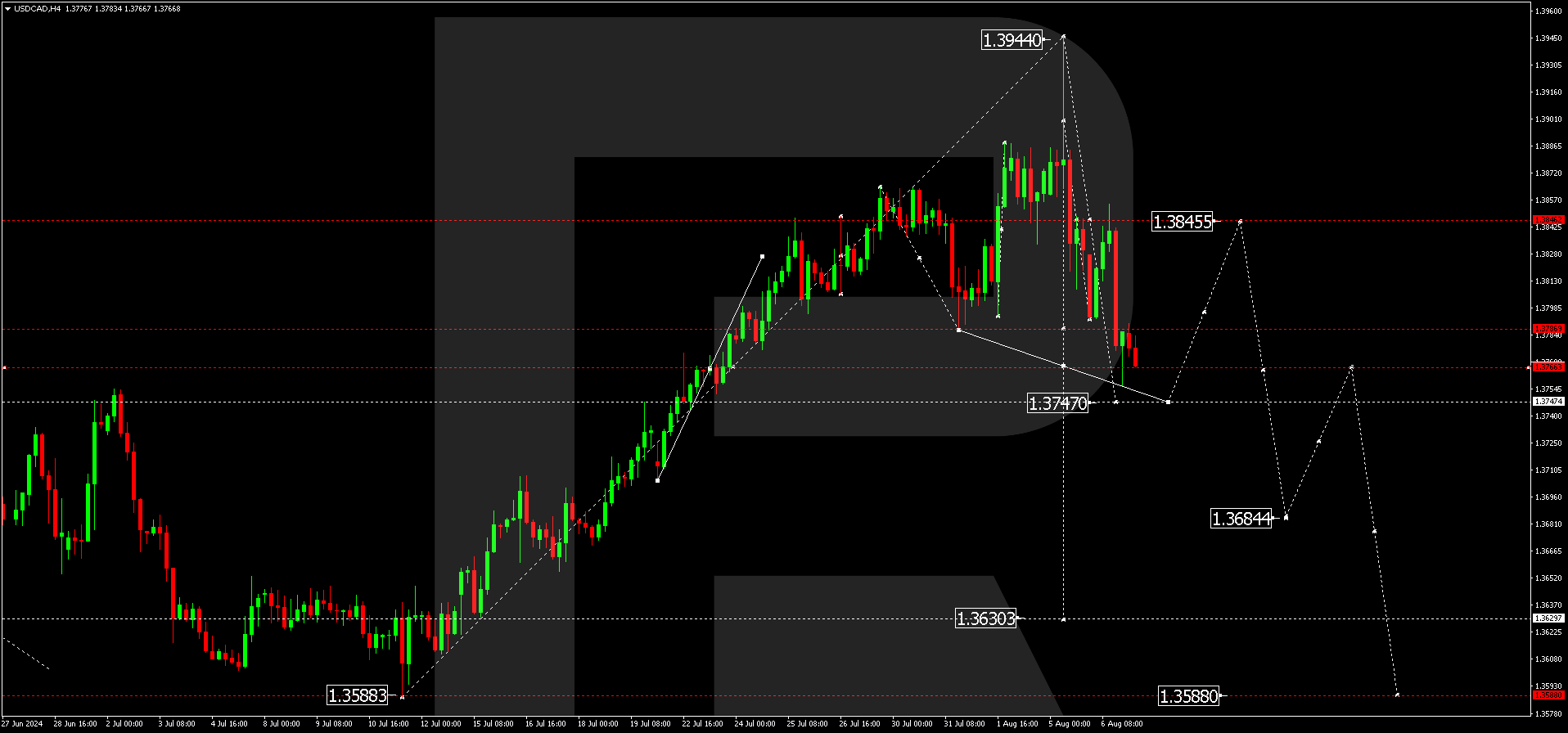

- USDCAD forecast for 7 August 2024: 1.3747 and 1.3855

Fundamental analysis

The USDCAD rate has fallen for the fourth consecutive trading day, with key movements around the 1.3773 level.

Current movements are part of a corrective phase, though the broader fundamental environment does not favour risk appetite. Investors remain focused on slowing global growth, as reflected in falling oil prices and other commodities.

The Canadian real estate market is also showing warning signs. It is gradually weakening, with increasing indications that consumers are depleting their resources. The likelihood of a 50-basis-point interest rate cut in Canada is relatively high, even more so than in the US. However, if the Federal Reserve acts first to reduce borrowing costs, the Bank of Canada is expected to follow suit swiftly.

Fundamentally, the CAD has the potential to weaken. However, this may occur later as investors anticipate emerging threats.

USDCAD technical analysis

Analysis for 7 August 2024 indicates that the USDCAD pair continues its downward momentum towards the initial target of 1.3747. The price is expected to reach this target today, with a correction towards 1.3845. A further decline could develop once the correction is complete, targeting 1.3684 and potentially extending towards 1.3600.

Summary

The USDCAD pair is undergoing a correction, but this movement appears to be short-term. Technical indicators in today’s USDCAD forecast suggest a further decline towards 1.3747, followed by a potential correction towards 1.3855.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.