Investors await signals from the Bank of Canada

The Canadian dollar has slightly strengthened against the US dollar, recouping losses after the weak US retail sales data release. Investors are awaiting signals from the Bank of Canada about a potential interest rate cut.

Oil prices bolster the Canadian dollar

Weaker-than-expected US retail sales data have prevented the US currency from rising. Consequently, the USDCAD quotes remain near the lower boundary of the range, where they have been hovering for the last six days.

On 5 June 2024, the Bank of Canada lowered the interest rate, marking the first reduction in four years. Today, investors will focus on the minutes of the Bank of Canada’s monetary policy meeting, which might provide insights into the bank’s future interest rate plans. It is particularly interesting to know whether the Bank of Canada considers the Canadian dollar’s weakness in its decision-making process.

Some traders have already increased short positions in the USDCAD pair at a record pace, indicating pessimistic sentiments in anticipation of the central bank’s minutes. This comes amid rising prices of oil, one of Canada’s primary export goods, which are currently bolstering the CAD.

USDCAD technical analysis

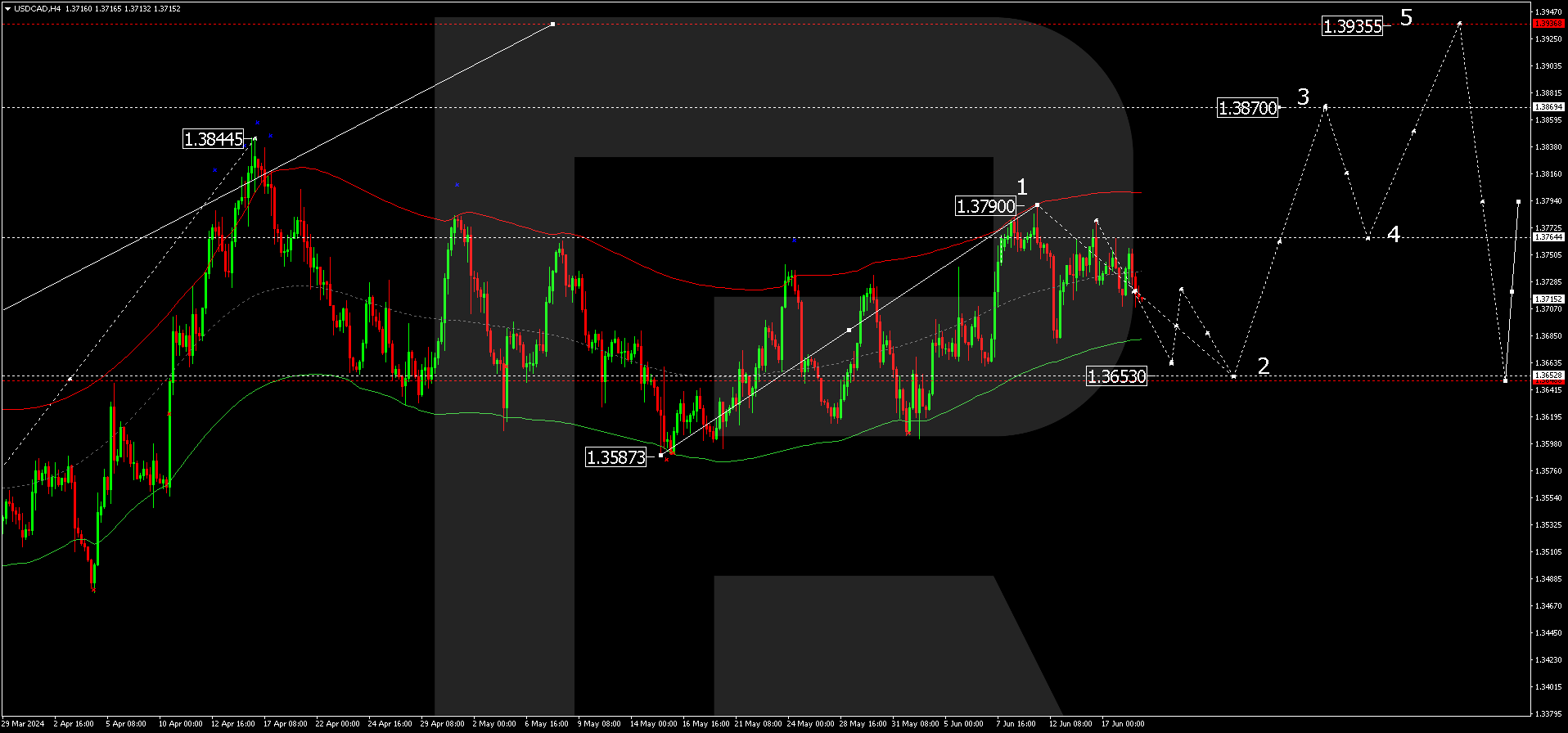

The USDCAD Н4 chart analysis for 19 June 2024 shows a growth wave towards 1.3790. Today, a correction continues to develop towards 1.3650. Once the correction is complete, a new growth wave might start, aiming for 1.3760. A breakout of this level will open the potential for a wave towards the local target of 1.3870. After reaching this level, the price could decline to 1.3760 (testing from above). Subsequently, a rise to 1.3935 is expected, representing the main target of this growth wave.

USDCAD technical analysis 19.06.2024

This scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 1.3760. This level is considered crucial for an upward wave in the USDCAD pair. The market has received a downward rebound from the Envelope upper boundary. The quotes are currently below the Envelope’s centre. There is a possibility of a decline in the USDCAD rate to the Envelope’s lower boundary.

Summary

Although the Canadian dollar is rising in anticipation of the Bank of Canada’s minutes, investor sentiment remains pessimistic. The USDCAD technical analysis points to a potential corrective wave towards 1.3650 with an onward rise to the targets of 1.3870 and 1.3935.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.