EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD technical analysis and forecast for 26-30 August 2024

Here is a detailed forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 26-30 August 2024.

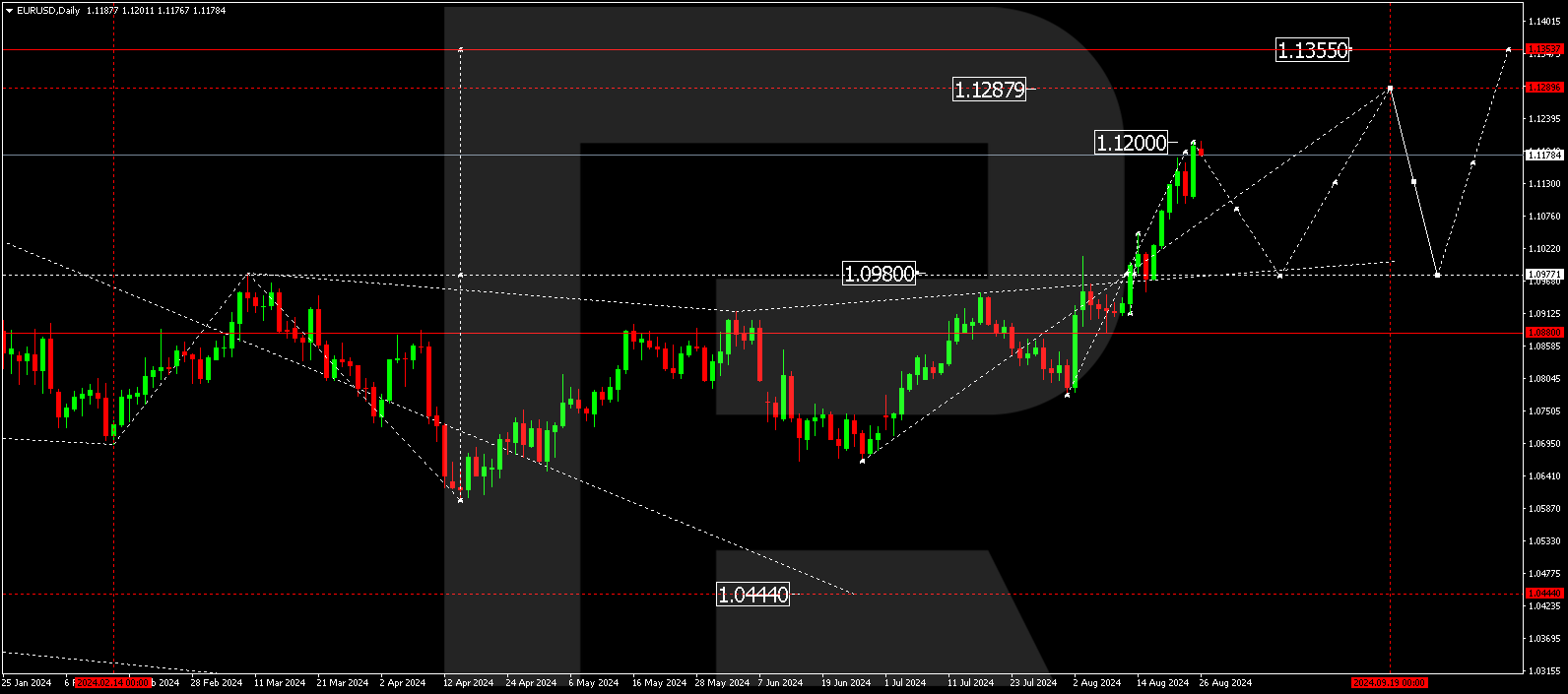

EURUSD forecast

The EURUSD pair has reached the growth wave’s local target of 1.1200. The forecast suggests that a consolidation range could form at the current highs. If the price breaks below this range, it could signal the beginning of a downward wave towards 1.0980. Once this level is reached, the EURUSD analysis suggests the growth wave could extend to 1.2878. Subsequently, the price is projected to fall to 1.1130, potentially continuing the trend towards 1.0980.

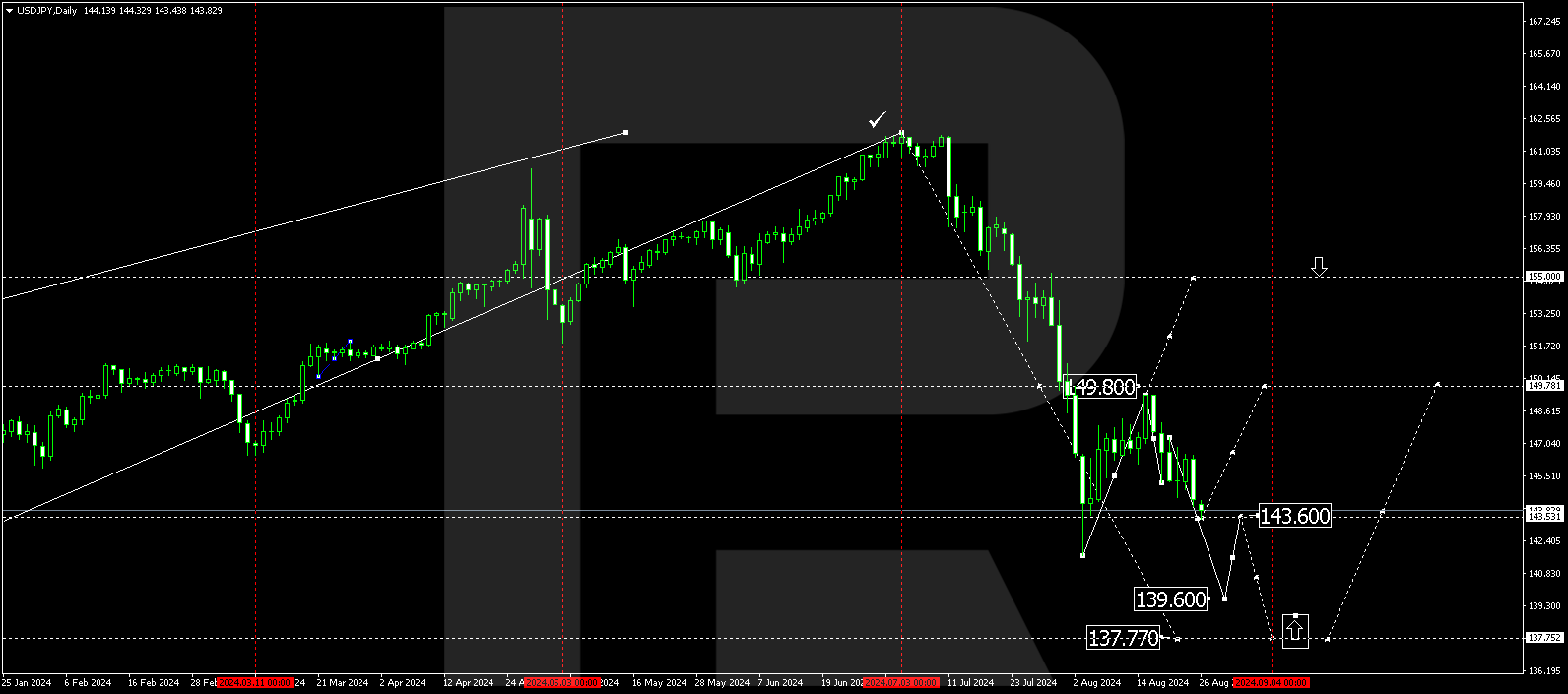

USDJPY forecast

The USDJPY pair has completed a downward wave, reaching 143.60. Today’s analysis indicates that a consolidation range is forming above this level. The signal suggests a potential rise towards 149.80 if the price breaks upwards. Conversely, a breakout below the range could lead to a downward wave extending to 139.60, potentially continuing to 137.77. Once this level is reached, the USDJPY analysis signals a potential growth wave towards at least 149.80.

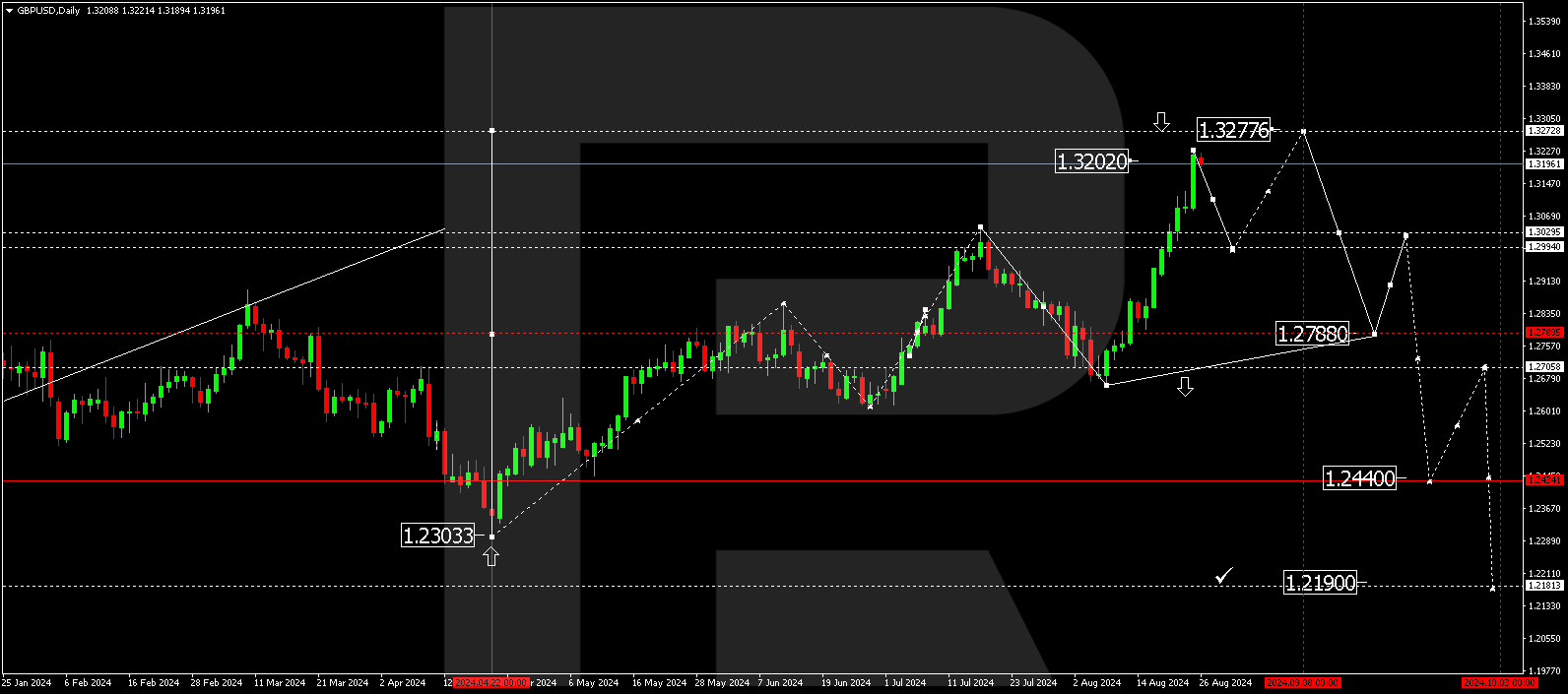

GBPUSD forecast

The GBPUSD pair has completed a growth wave, reaching 1.3200. Today, the market is forming a consolidation range at the current highs. In case of an upward breakout, the GBPUSD forecast suggests the wave could extend to 1.3277. If the price breaks below the range, the analysis points to a downward wave towards 1.2994 (testing from above). Subsequently, a growth wave could begin, targeting 1.3277.

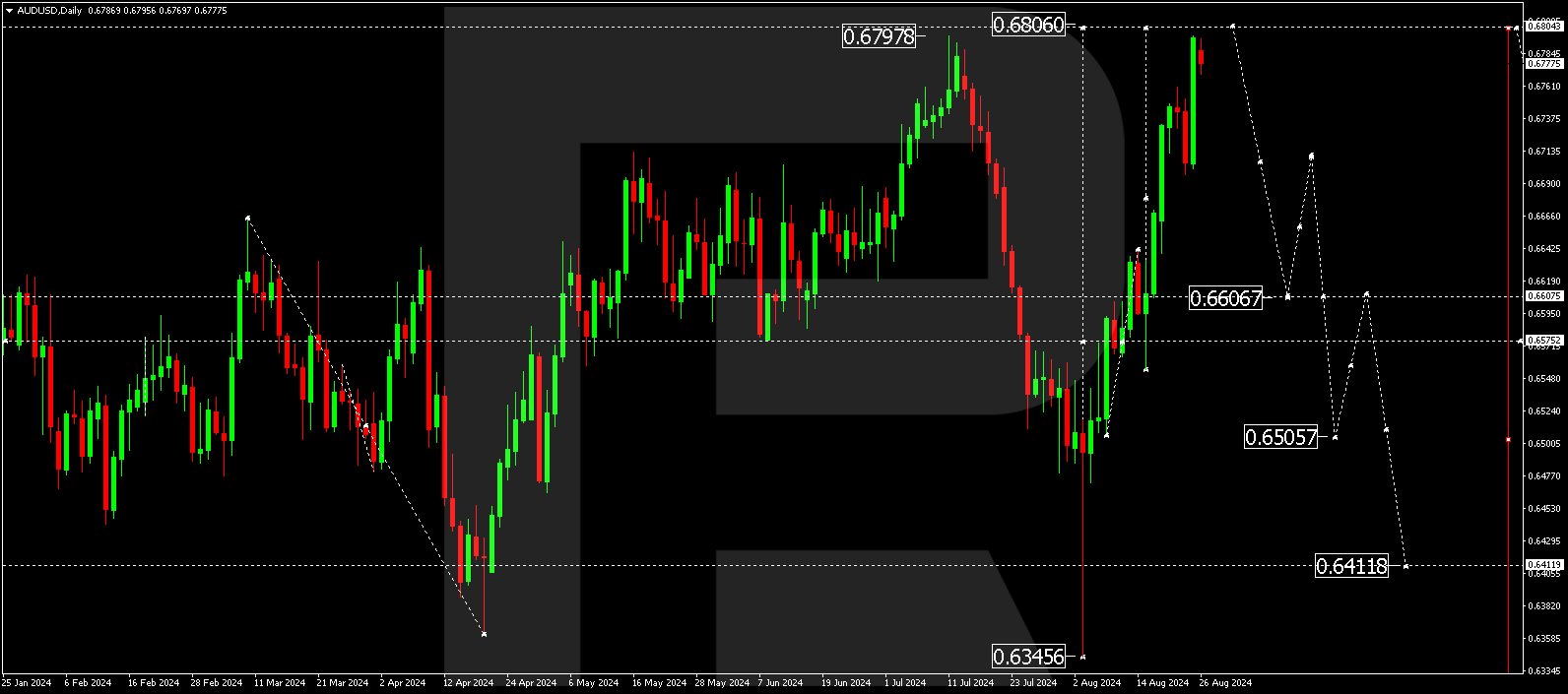

AUDUSD forecast

The AUDUSD pair has formed a consolidation range around 0.6575 and, after breaking above it, completed a growth structure towards 0.6795. The AUDUSD forecast suggests a consolidation range could form at the current highs. In case of an upward breakout, the signal indicates a potential rise to 0.6806. Conversely, the analysis suggests that a downward breakout could trigger a correction towards 0.6606, potentially continuing towards the 0.6505 and 0.6411 levels.

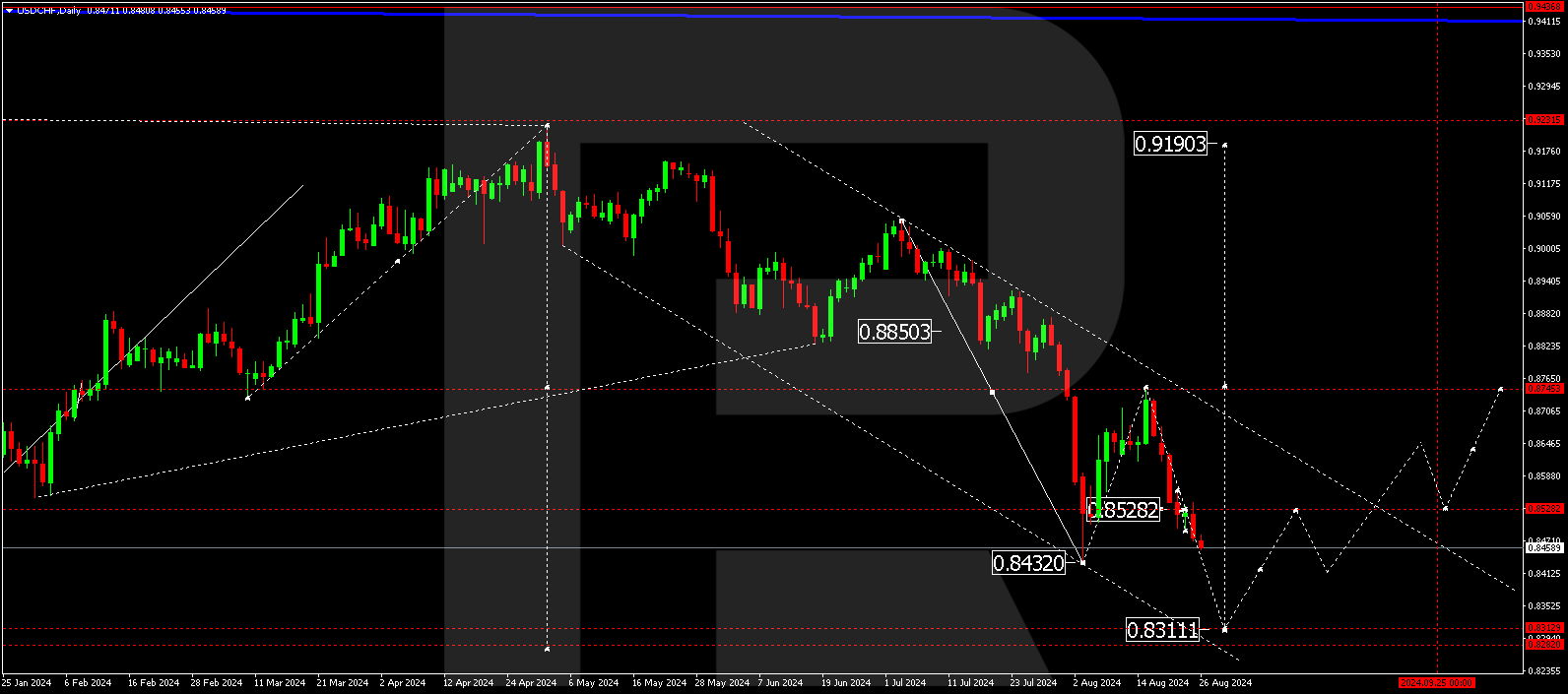

USDCHF forecast

The USDCHF pair has completed a downward wave, reaching 0.8538. The analysis shows that a consolidation range has formed around this level. Today, the signal points to a breakout below the range. According to the forecast, a further downward wave towards at least 0.8311 is likely. Once this descending wave is complete, the USDCHF analysis shows another growth wave could begin, targeting 0.8528 and potentially continuing to the 0.8646 and 0.8747 levels.

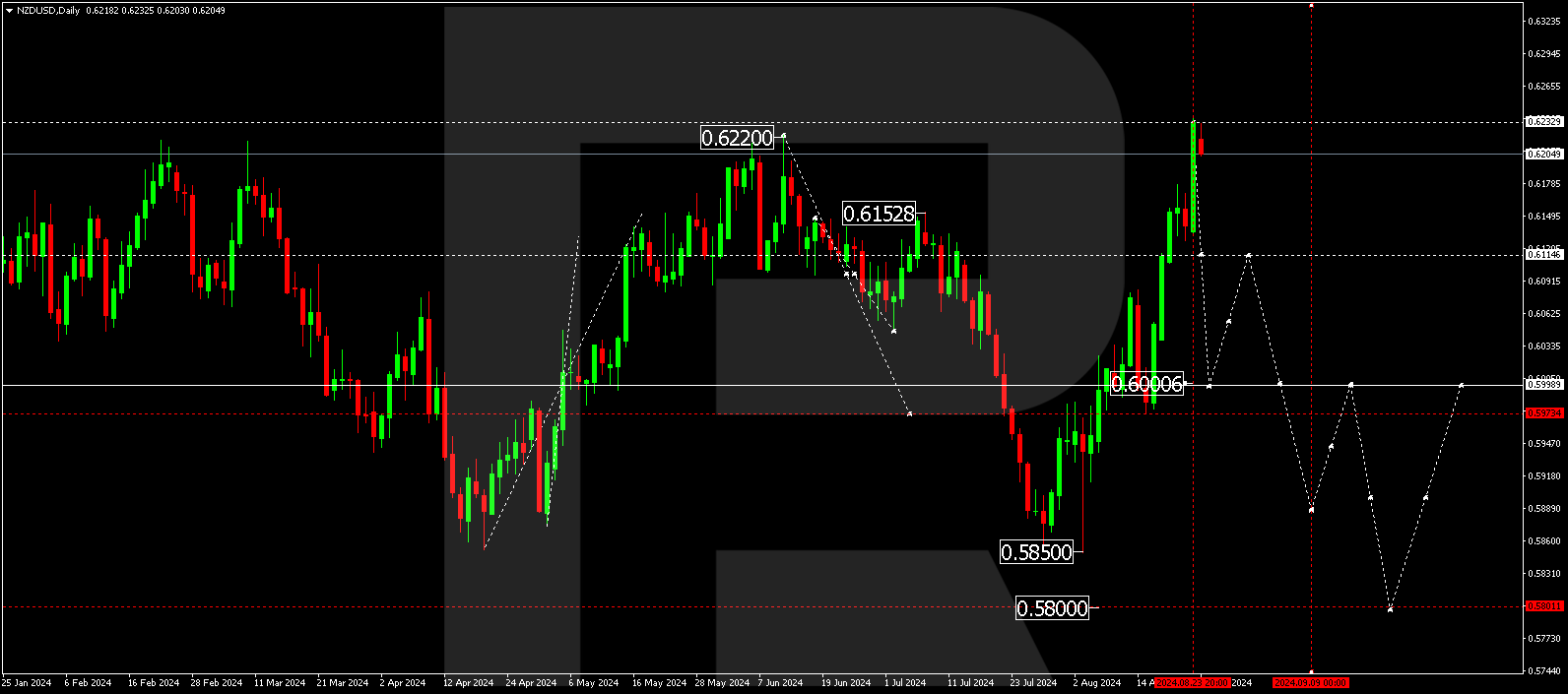

NZDUSD forecast

The NZDUSD pair has formed a consolidation range around 0.6000 and, after breaking above it, has reached the growth wave’s target of 0.6232. Today’s NZDUSD forecast suggests that a consolidation range could form at the top of this wave. In case of a breakout below this range, the signal indicates the beginning of a new downward wave, targeting 0.6000 and possibly continuing to the 0.5888 and 0.5800 levels.

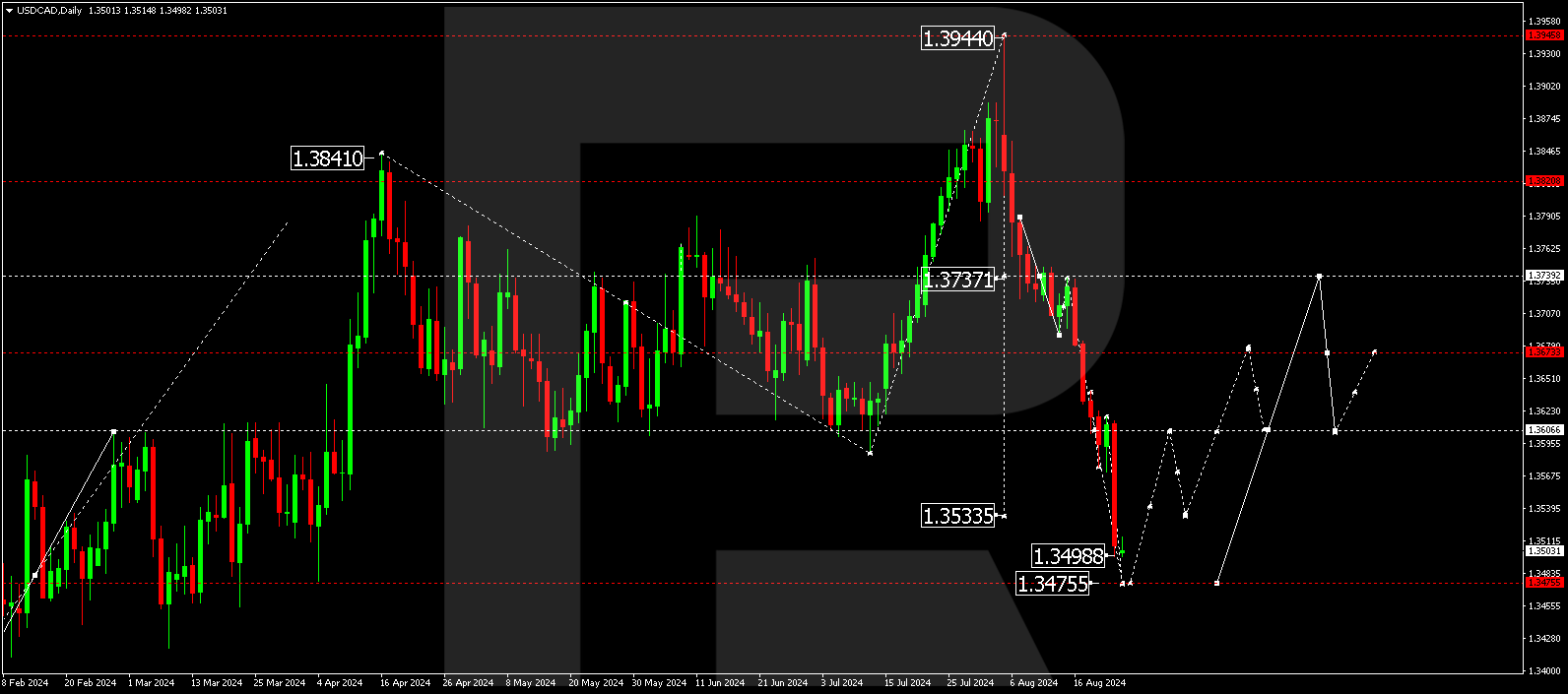

USDCAD forecast

The USDCAD pair has completed a downward wave, reaching 1.3500. The forecast suggests a correction towards 1.3606. Once this correction is complete, the signal indicates the beginning of a new downward wave, aiming for 1.3475, the first target. Subsequently, the analysis suggests a potential correction towards the 1.3600, 1.3670, and 1.3737 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.