EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD technical analysis and forecast for 19-23 August 2024

Here is a detailed forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 19-23 August 2024.

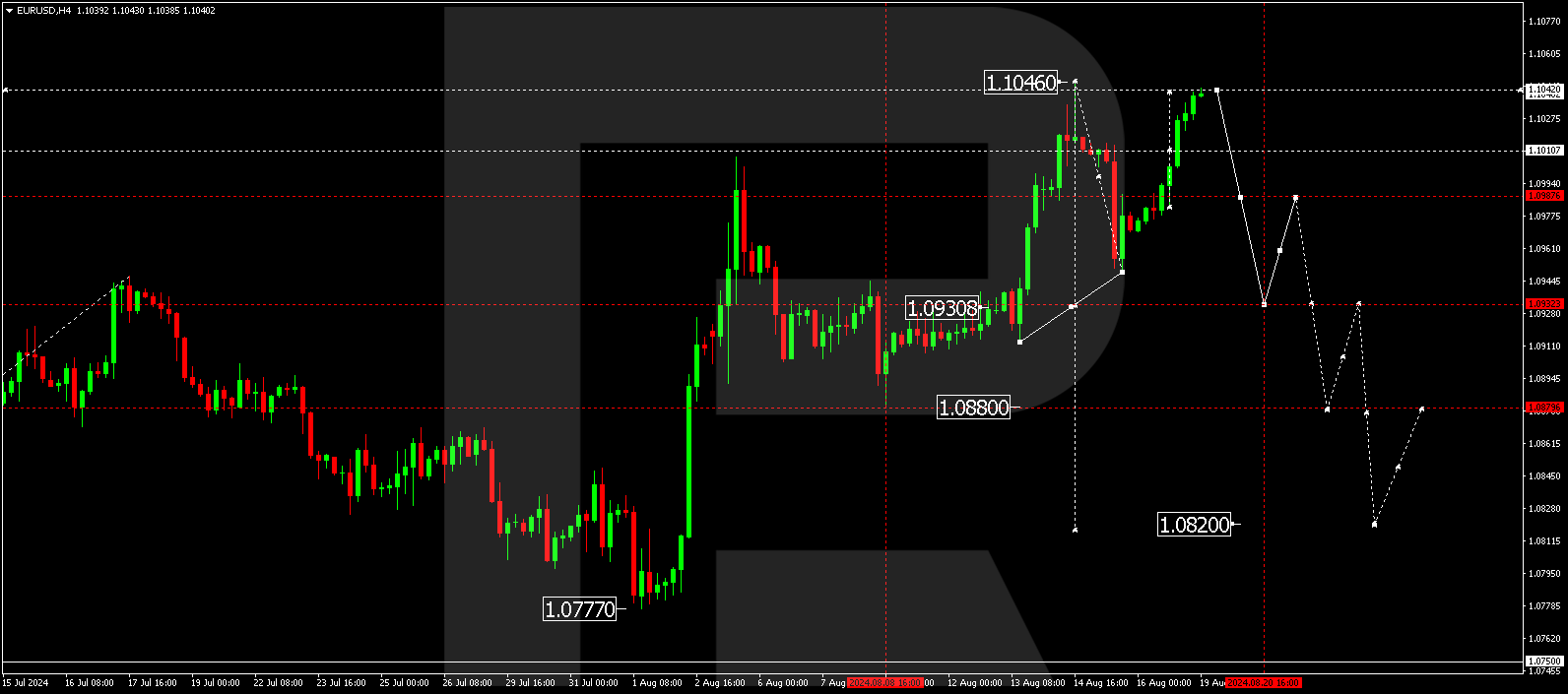

EURUSD forecast

The EURUSD pair has declined to 1.0949, with a rise to 1.1046 possible today. A consolidation range is forming at the top of a growth wave. The main scenario suggests a downward breakout of the range to 1.0744, the first target. Once the price reaches this level, a correction could follow, targeting 1.0880 (testing from below). Subsequently, another downward wave could start, aiming for 1.0570 as the local estimated target.

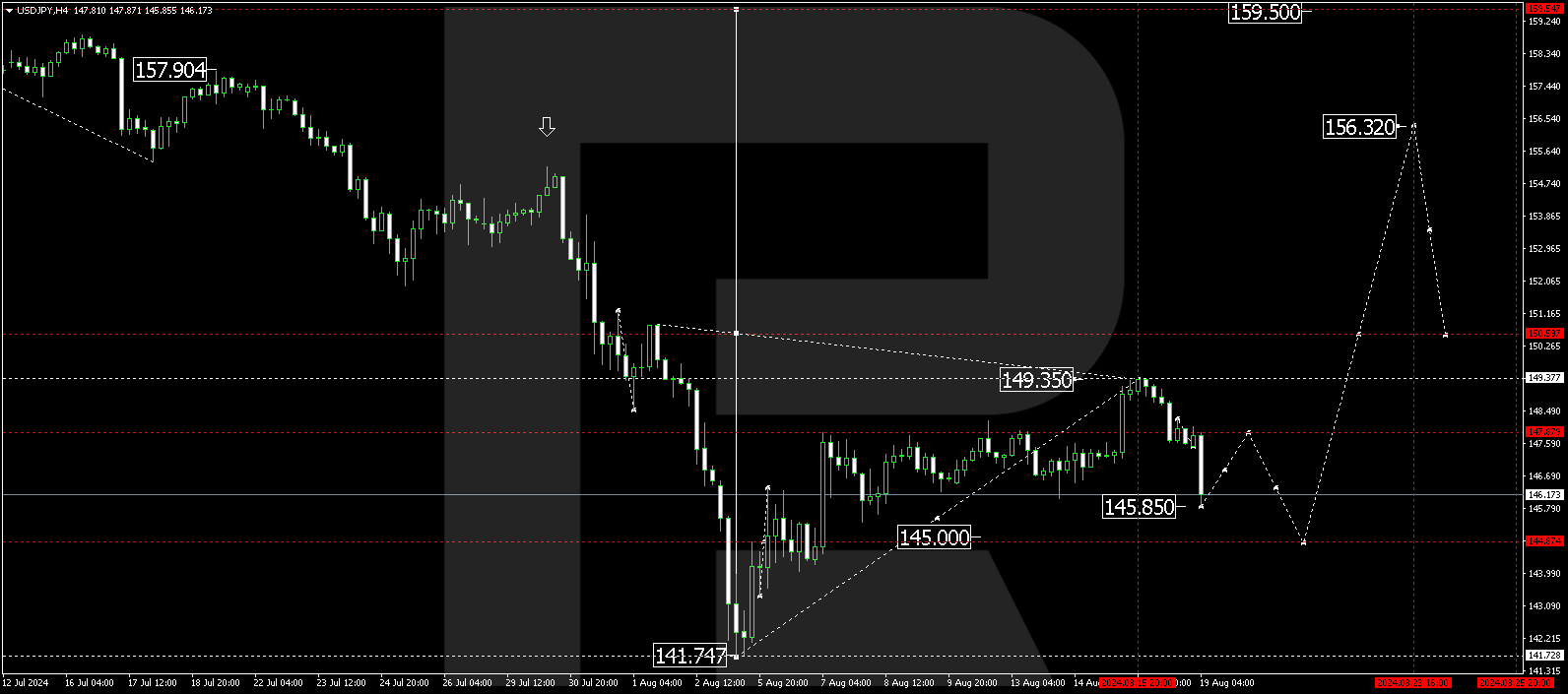

USDJPY forecast

The USDJPY pair has completed the first growth wave, reaching 149.35. A corrective wave is forming towards 145.00 today. Once the correction is complete, a new growth wave could start, targeting 151.85 (testing from below). Subsequently, the price could decline to 141.40, potentially continuing the trend to 131.00.

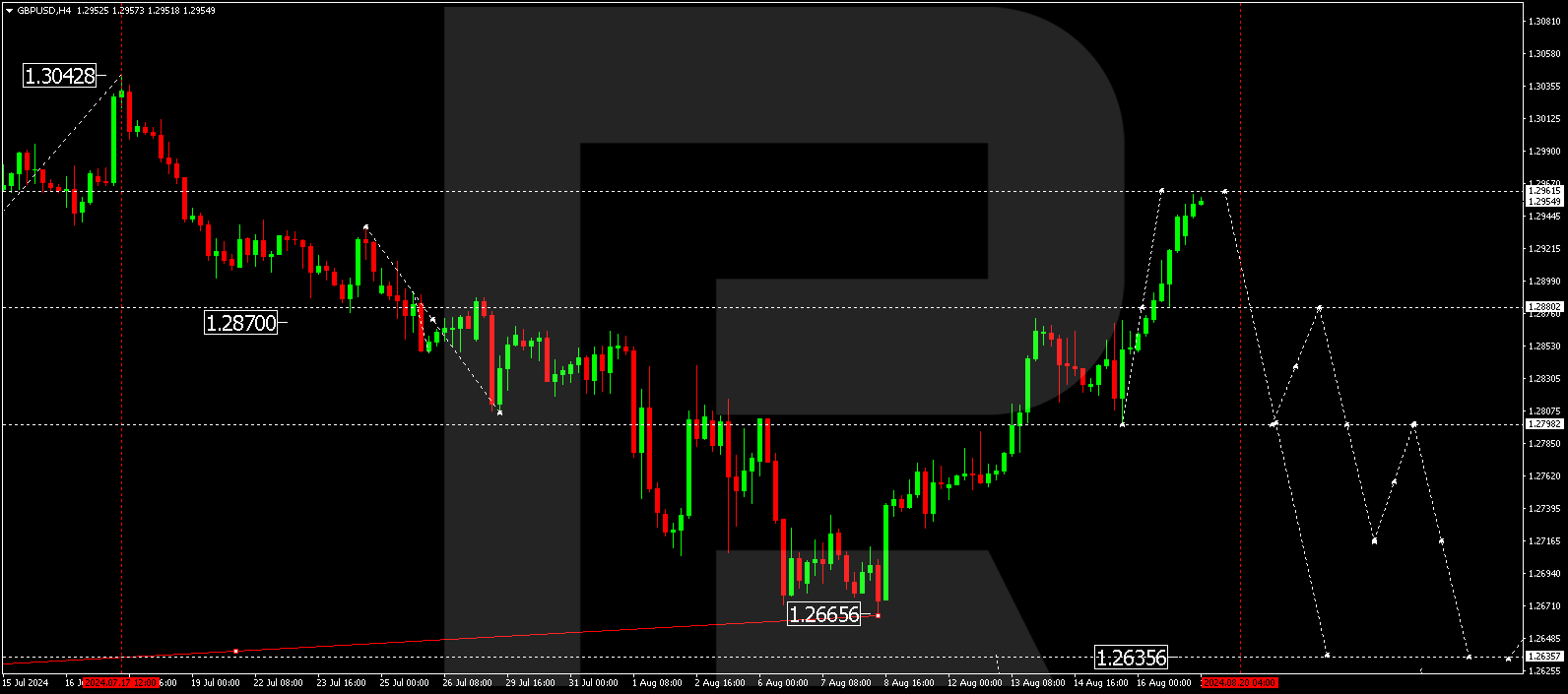

GBPUSD forecast

The GBPUSD pair has declined to 1.2666. The market is completing a corrective wave towards 1.2960. A consolidation range is expected to develop at the current highs. With a breakout below the range, a new downward wave could start, aiming for 1.2635 and potentially continuing to 1.2400 as the local target.

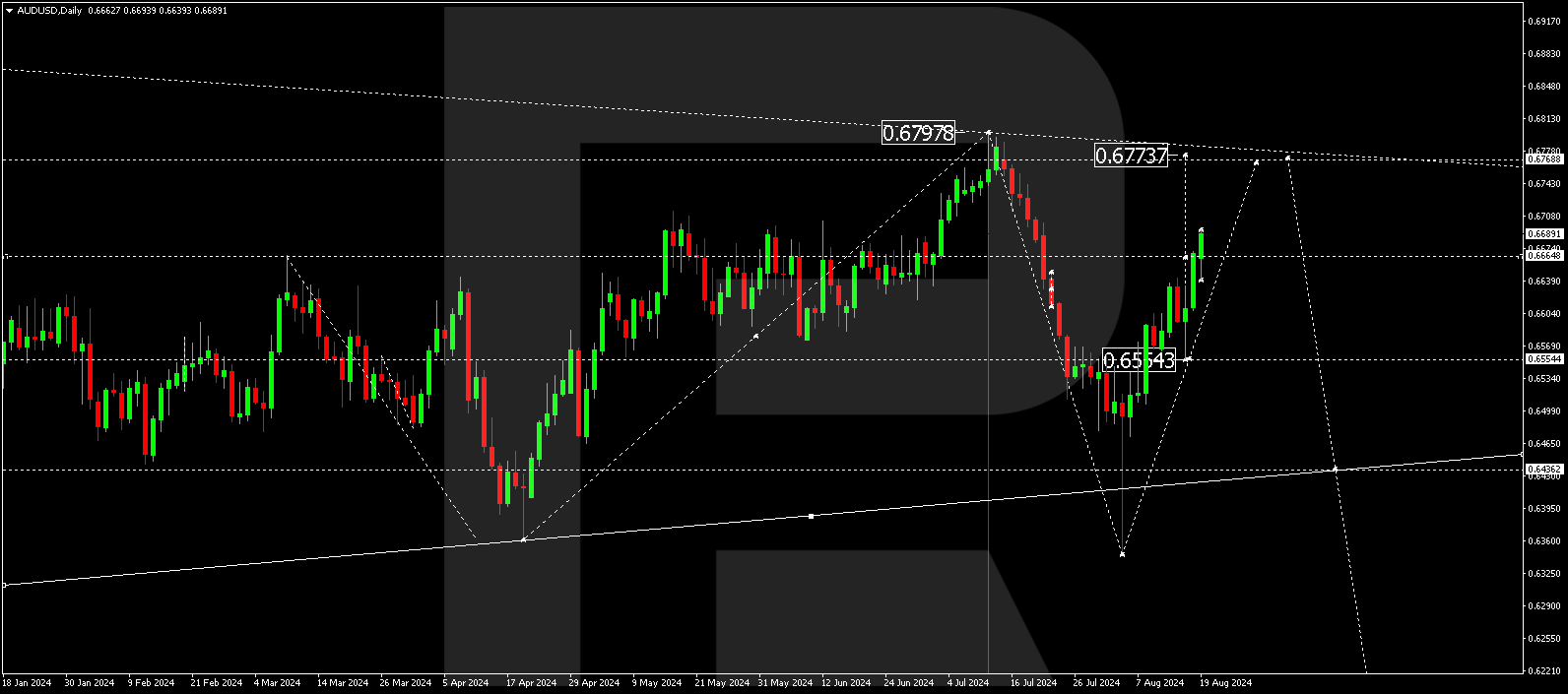

AUDUSD forecast

The AUDUSD pair has corrected towards 0.6666. The market has formed a consolidation range around this level and, with an upward breakout, could extend the range to 0.6777. A rise to the upper boundary of the global triangle is not ruled out. Subsequently, another downward wave is expected to begin, targeting 0.6434 and potentially continuing to 0.6106 as the local target.

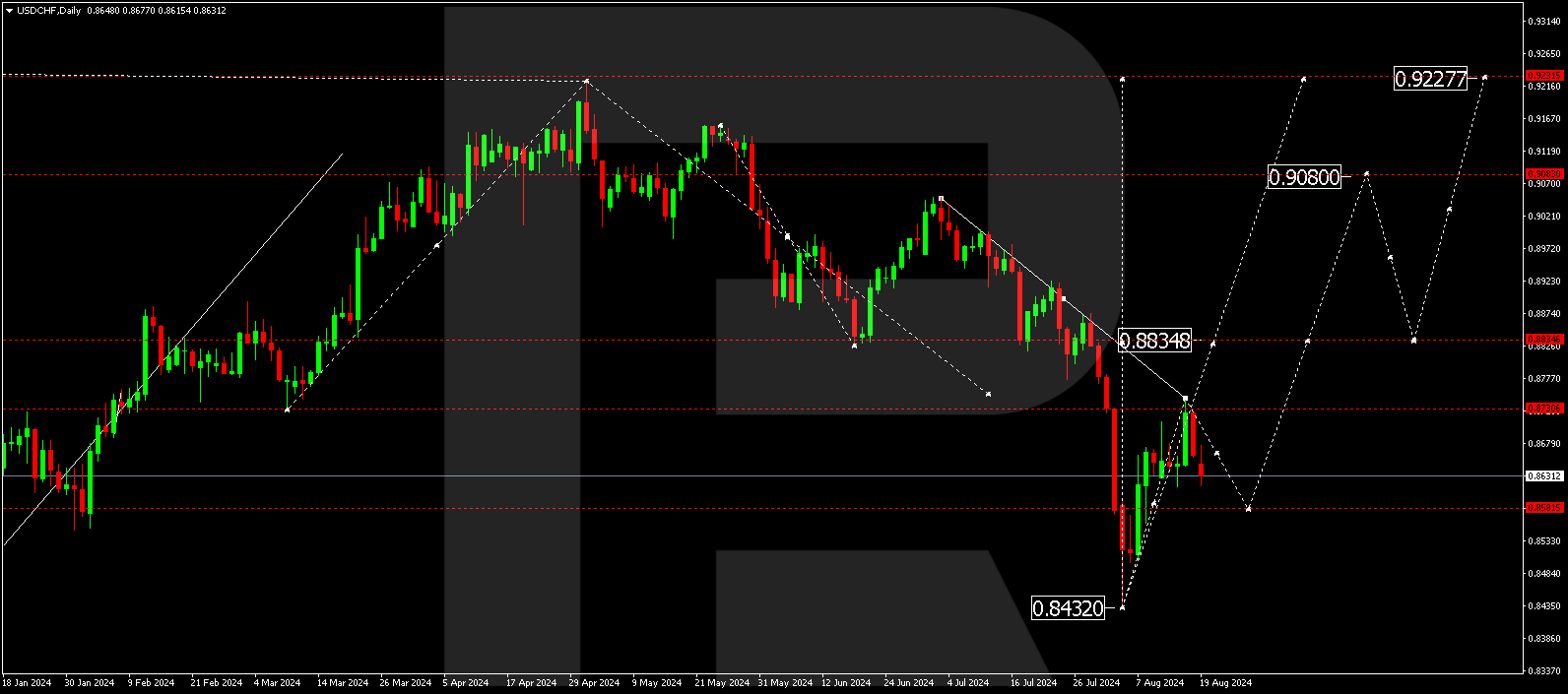

USDCHF forecast

The USDCHF pair has completed a growth wave, reaching 0.8730. A correction could develop today, with a target at 0.8582. Once the correction is complete, a growth wave is expected to start, aiming for 0.8834 and potentially continuing to the local target of 0.9800. Subsequently, a corrective wave towards 0.8834 (testing from above) is possible, followed by a rise to 0.9227.

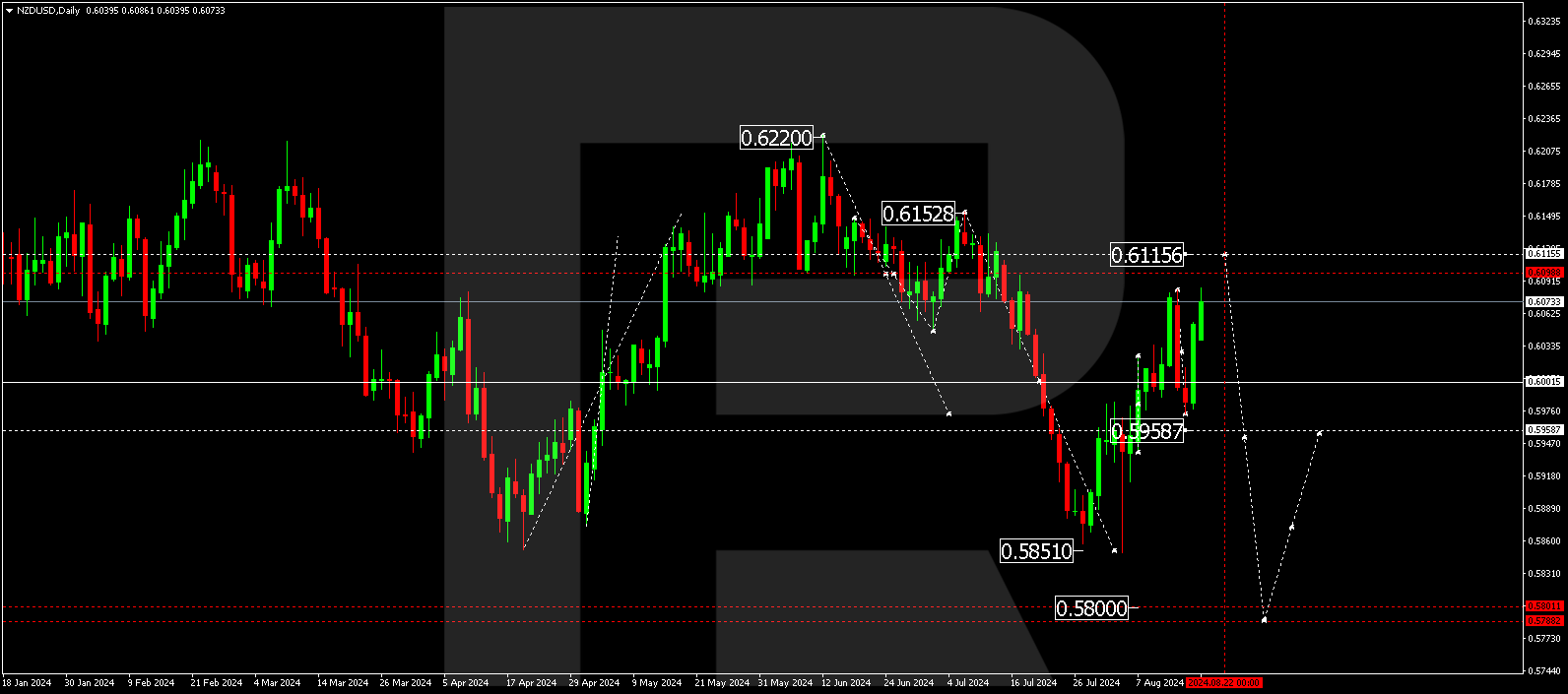

NZDUSD forecast

The NZDUSD pair has reached the growth wave’s estimated target of 0.6080. A consolidation range could form at the top of this wave today. With an upward breakout, the range might extend to 0.6116. A downward breakout will open the potential for a decline to 0.5959, with the trend potentially continuing to 0.5800. A breakout of this level will open the potential for a downward wave towards 0.5700.

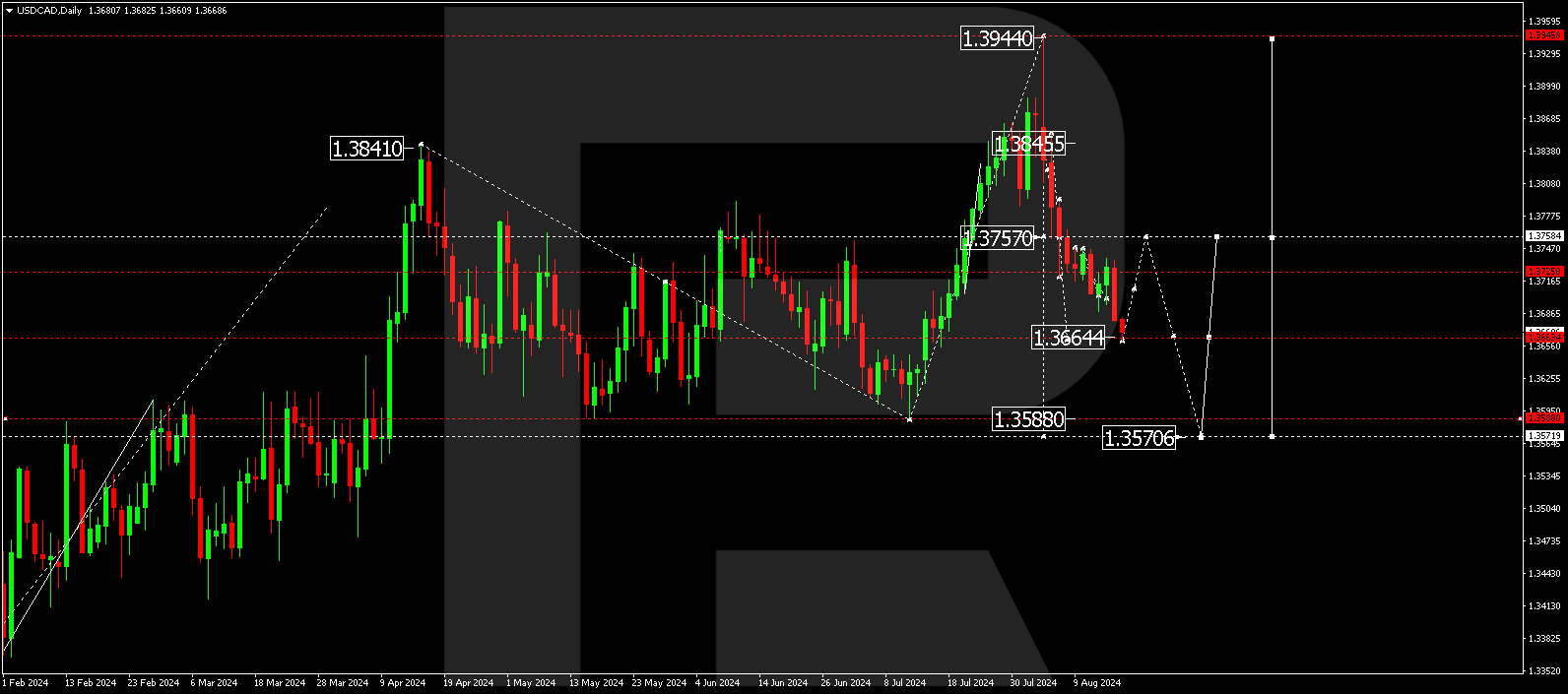

USDCAD forecast

The USDCAD pair has completed a downward wave, reaching 1.3666. A correction towards 1.3725 could follow today. Once the correction is complete, a new wave could begin, aiming for 1.3588 and potentially continuing to 1.3570, the first target. Subsequently, a correction towards 1.3757 is possible.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.