Currencies technical analysis and forecast for August 2024

Here is a detailed August 2024 forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD.

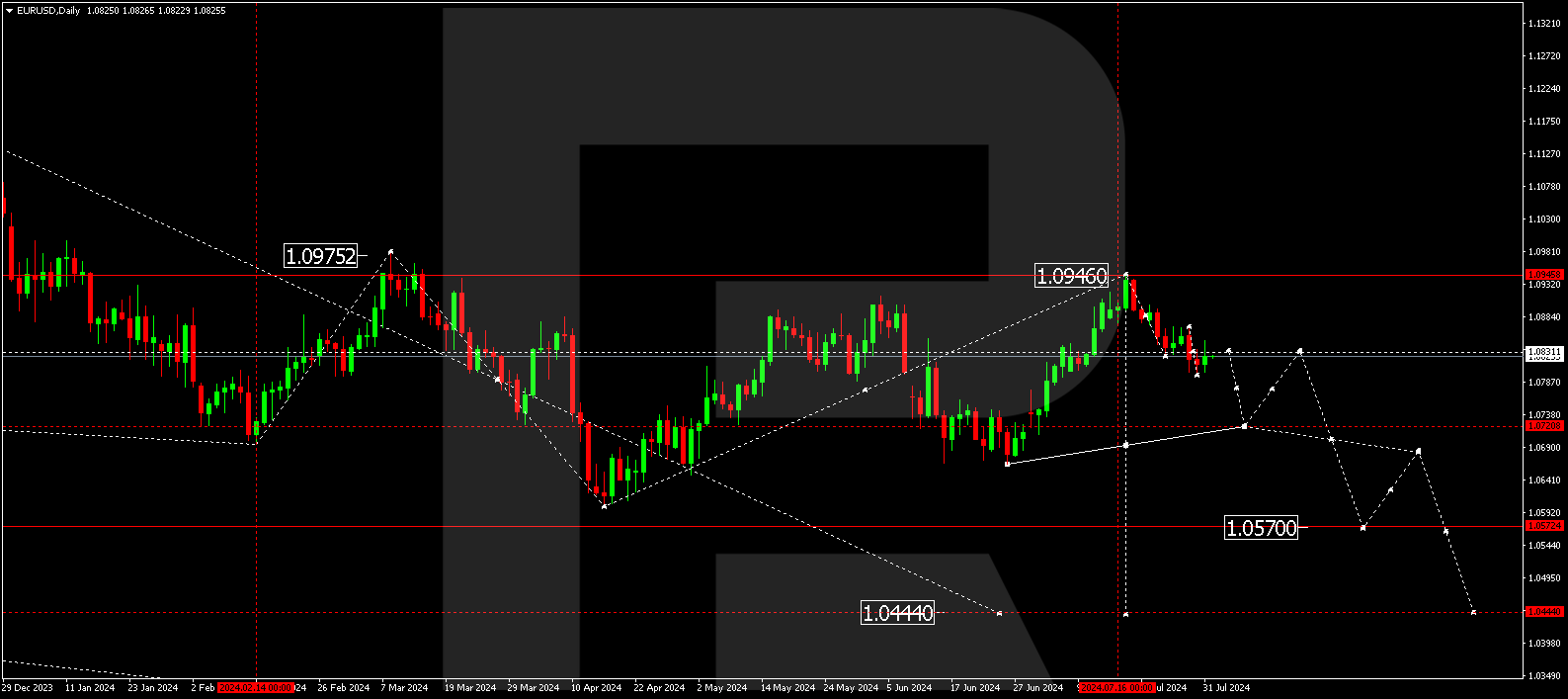

EURUSD

The EURUSD pair has declined to 1.0825 and is forming a consolidation range around this level. A downward breakout from this range could extend the decline to 1.0720, the initial target. Conversely, an upward breakout might lead to a correction towards 1.0880. Subsequently, the downtrend could continue to 1.0720. Once the price reaches this level, a correction towards 1.0830 might begin, followed by a decline to 1.0570, the local estimated target.

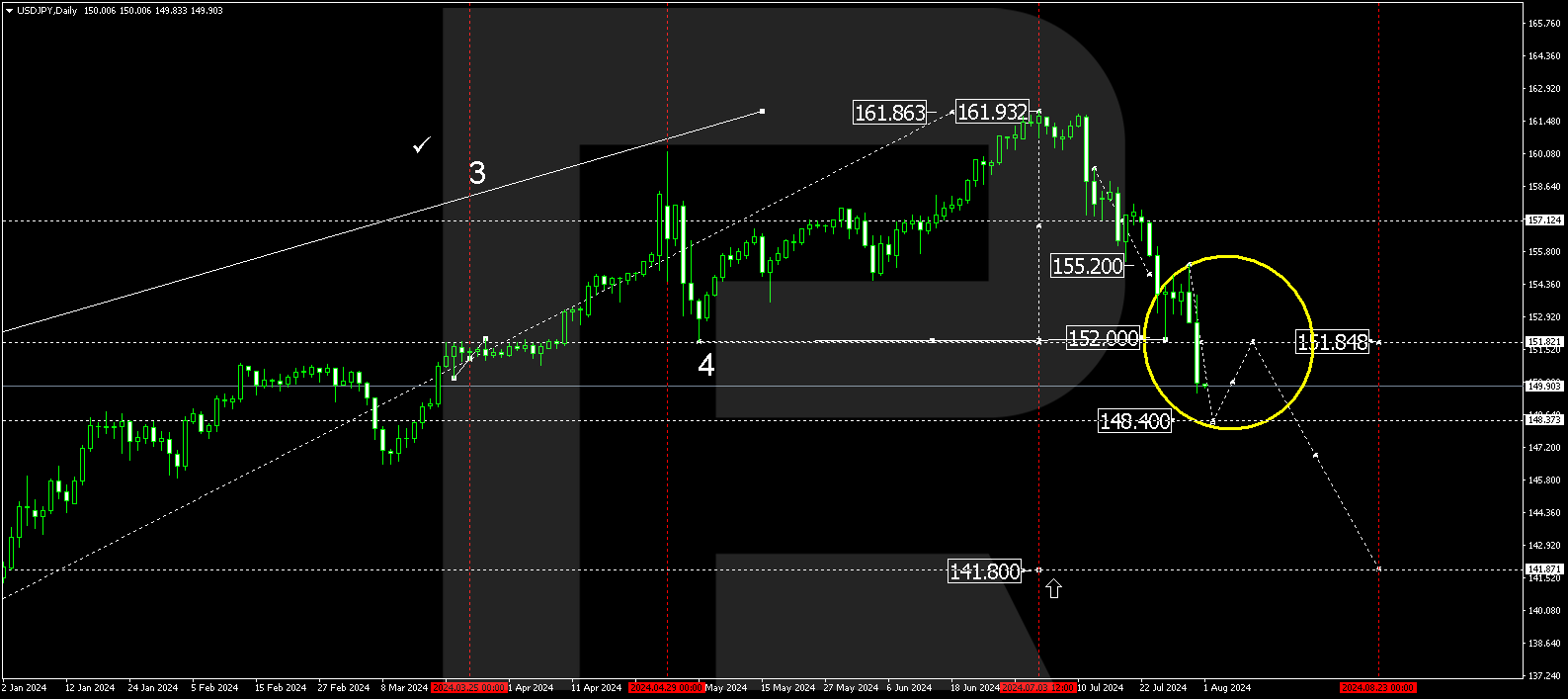

USDJPY

The USDJPY pair has completed the initial decline wave, reaching 152.00. The market is currently forming a broad consolidation range around this level. The price is expected to drop to 148.40 before rising to 152.00 (testing from below). This increase will be a correction of the previous decline wave. Once the correction is complete, a new decline to 141.80, the main target of the wave, is expected.

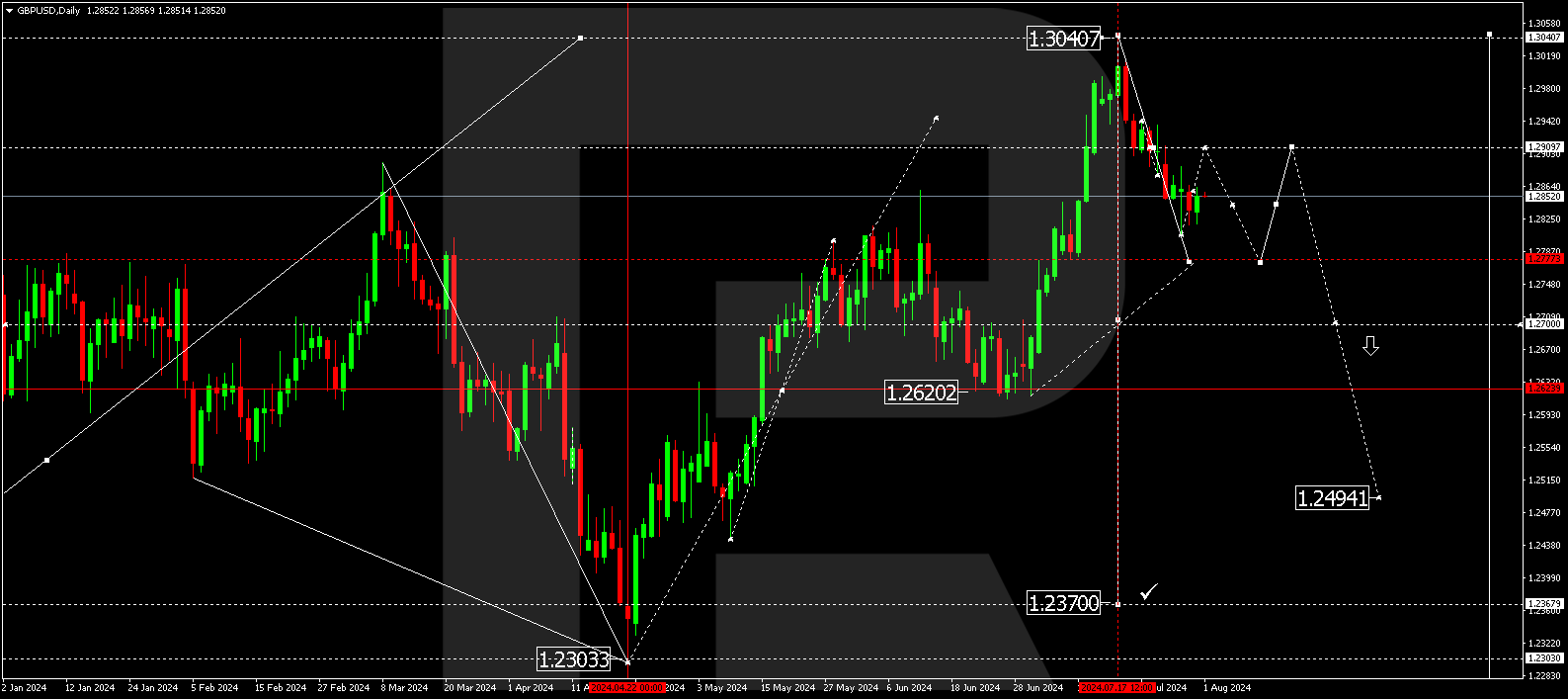

GBPUSD

The GBPUSD pair continues the initial decline wave, with a target at 1.2777. After reaching this target, the price could correct to 1.2909 (testing from below). Subsequently, another decline wave might begin, aiming for 1.2700. A breakout below this level will open the potential to reach 1.2494, the local estimated target.

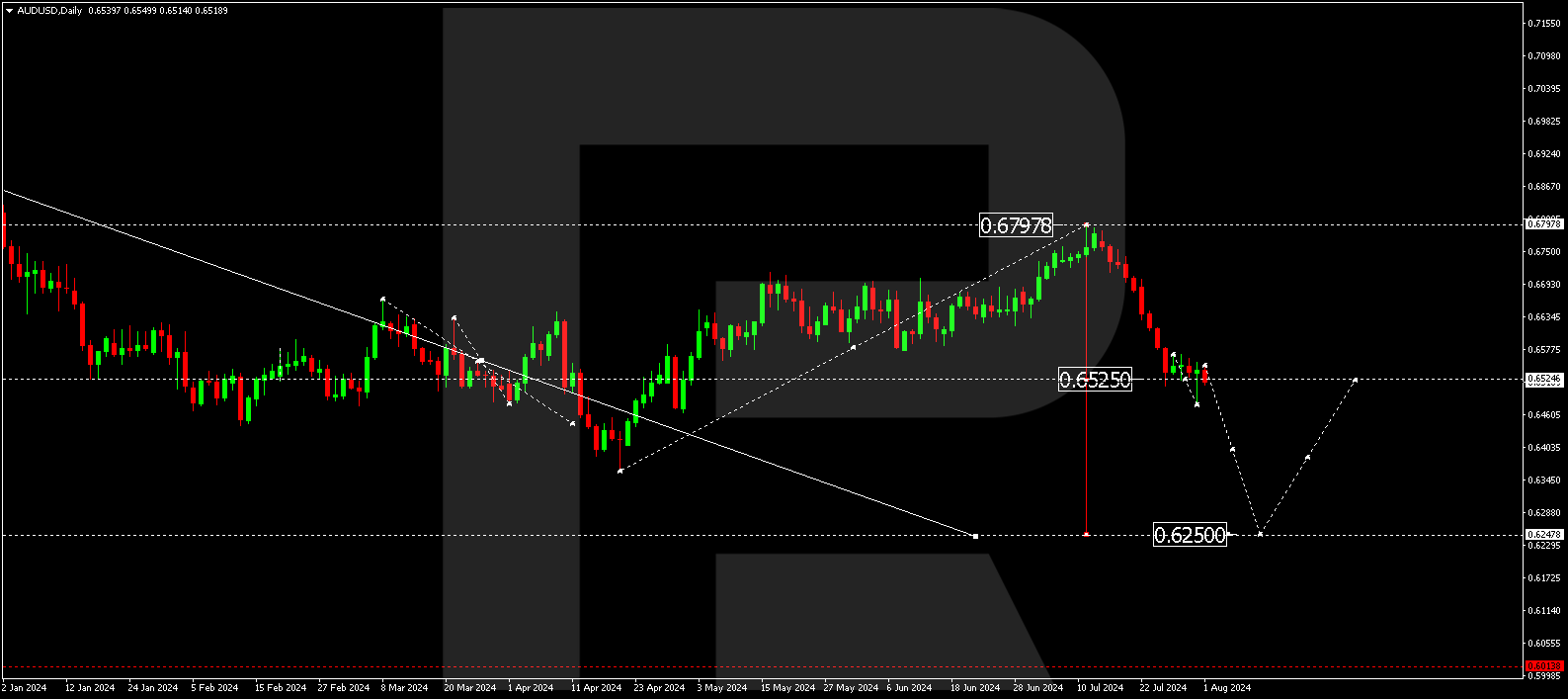

AUDUSD

The AUDUSD pair has corrected towards 0.6797, with a subsequent decline to 0.6525. A compact consolidation range is expected to form around this level. An upward breakout could lead to a correction towards 0.6666. Conversely, a downward breakout might initiate a decline wave towards the local target of 0.6250, which is in line with the trend. After the price hits this level, a correction towards 0.6525 (testing from below) may occur.

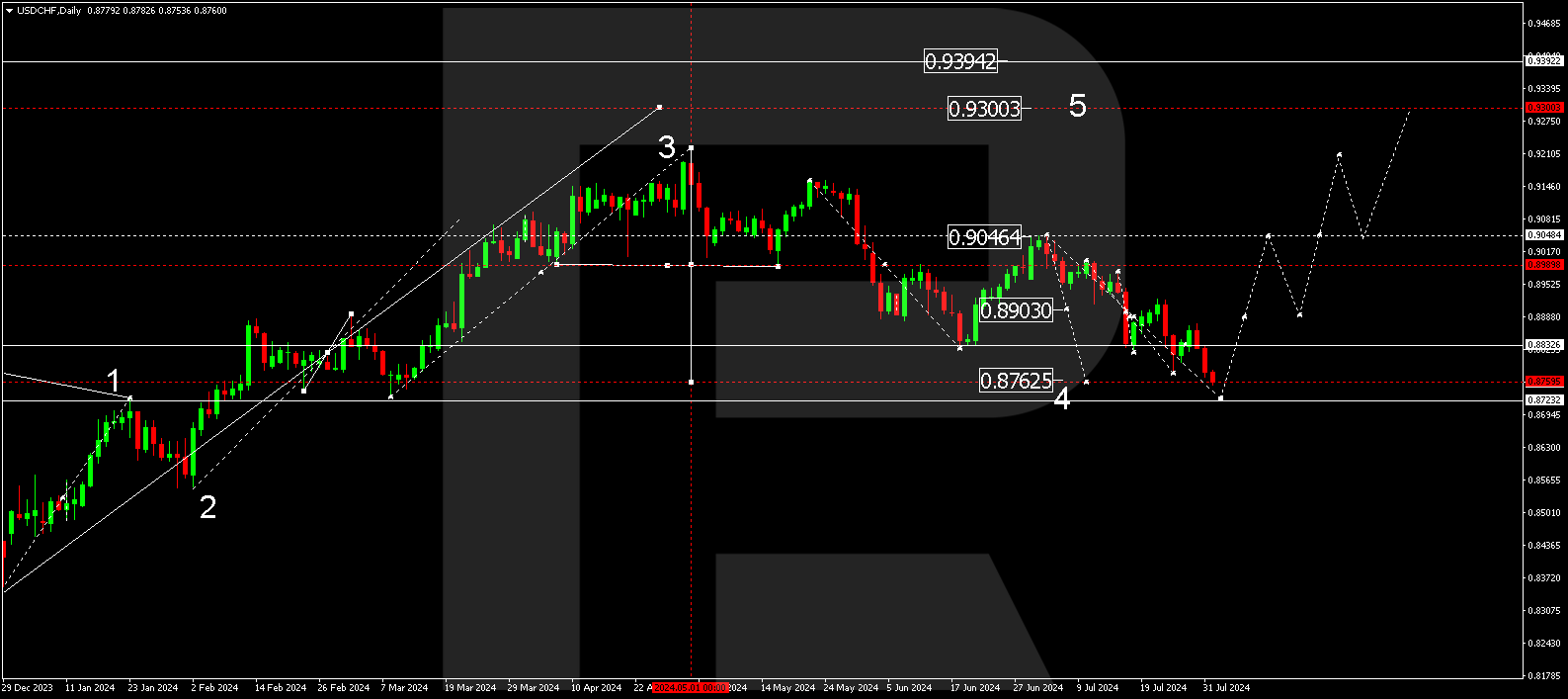

USDCHF

The USDCHF pair has completed a corrective wave, reaching 0.8762. A consolidation range is expected to form at the current lows. An upward breakout could initiate a new growth, aiming for 0.9046 as the trend’s initial target. Once the price reaches this target, a correction towards 0.8888 (testing from above) could follow. Subsequently, a growth wave might begin, aiming for a local target of 0.9200.

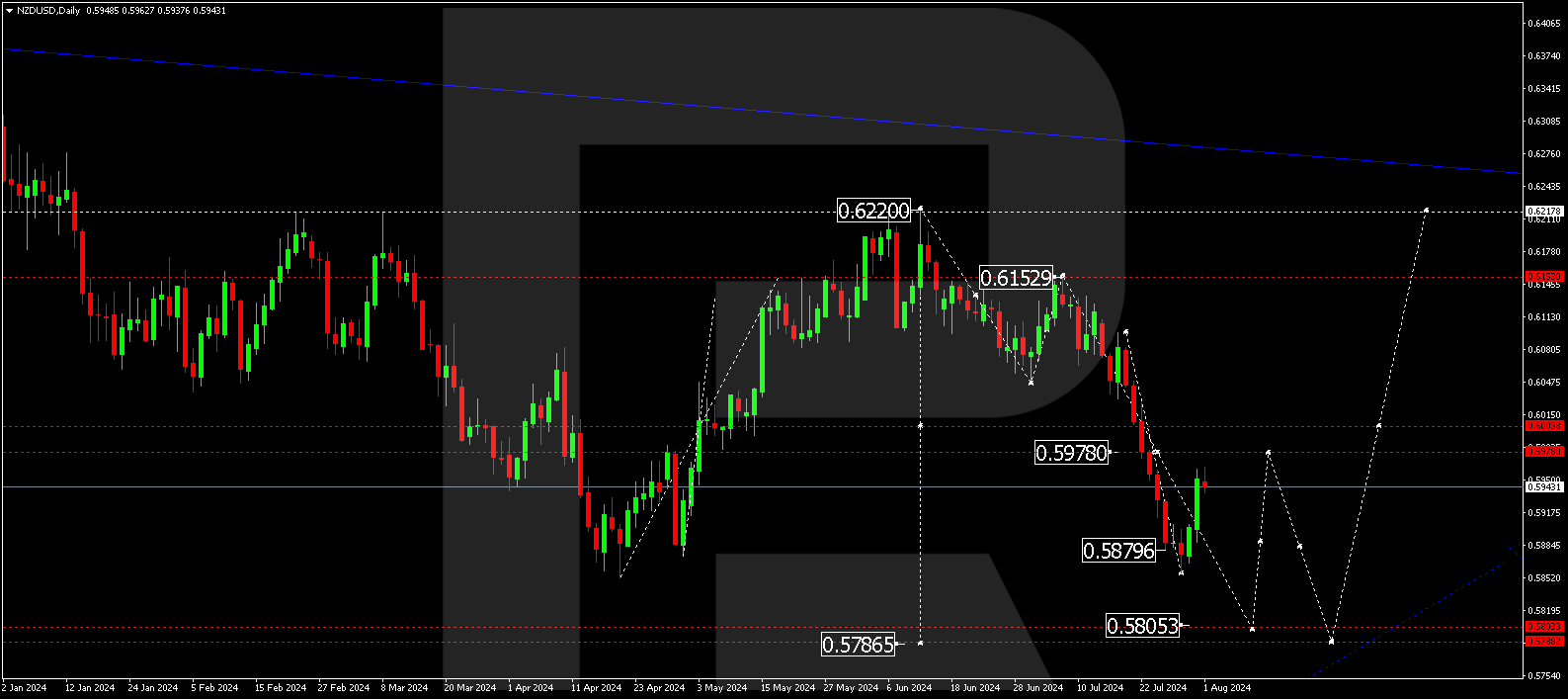

NZDUSD

The NZDUSD pair has completed a decline wave, reaching 0.6048 and correcting towards 0.6152 (testing from below). The market broke below the 0.6048 level and continues the decline towards the local target of 0.5805. After the price reaches this level, a correction towards 0.5978 (testing from below) may be possible. Subsequently, the price could decline to 0.5787, representing the trend’s main target.

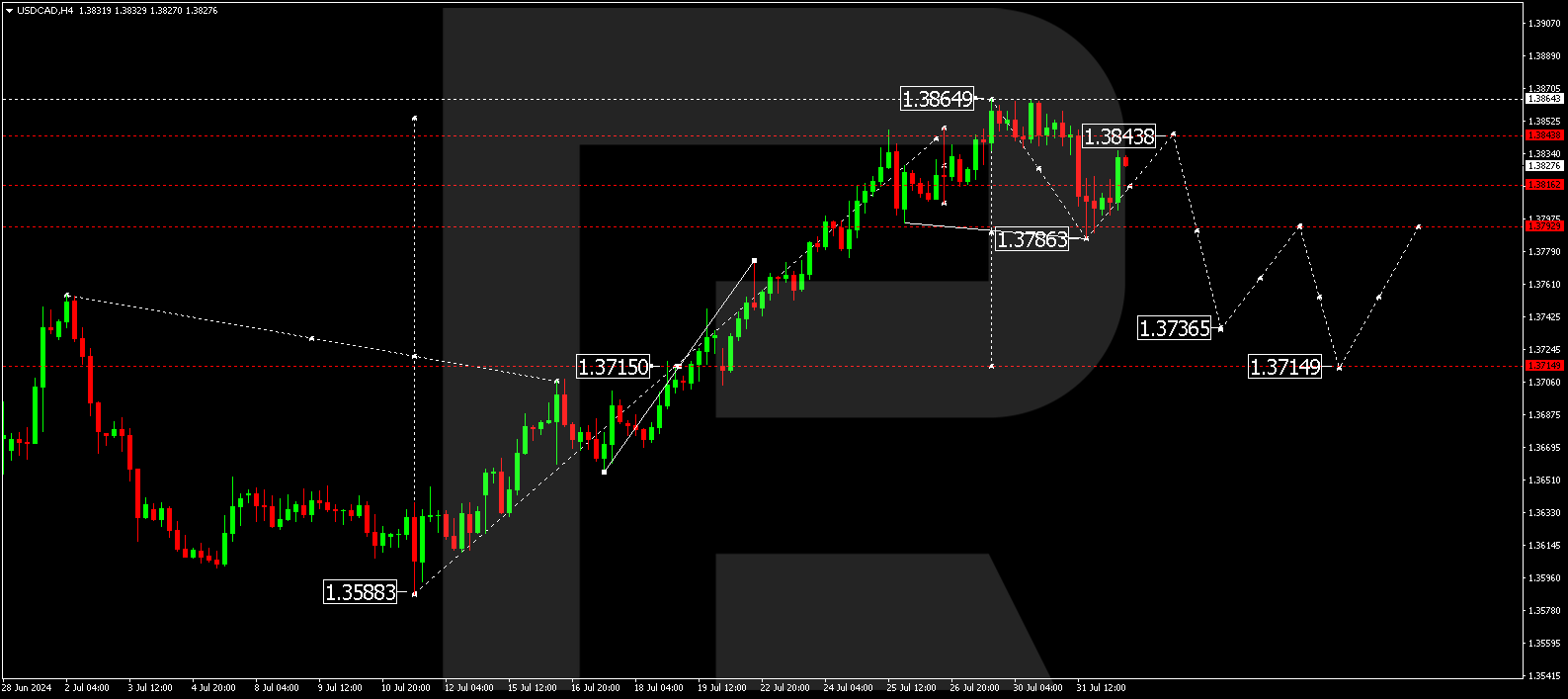

USDCAD

The USDCAD pair has nearly exhausted its growth potential at 1.3864. At this peak, the market formed a consolidation range and, breaking below the range’s lower boundary, completed the first downward impulse, reaching 1.3787. A correction towards 1.3844 (testing from below) is expected. Once the correction is complete, another decline wave could begin, aiming for 1.3737 as the local target.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.