NZD is weakening too fast

The NZDUSD pair has fallen for the fourth consecutive trading session, pressured by the strong US dollar and China’s declining economy.

NZDUSD trading key points

- Negative signals from China work as pressure factors

- It is difficult for the NZD to withstand pressure from the US dollar

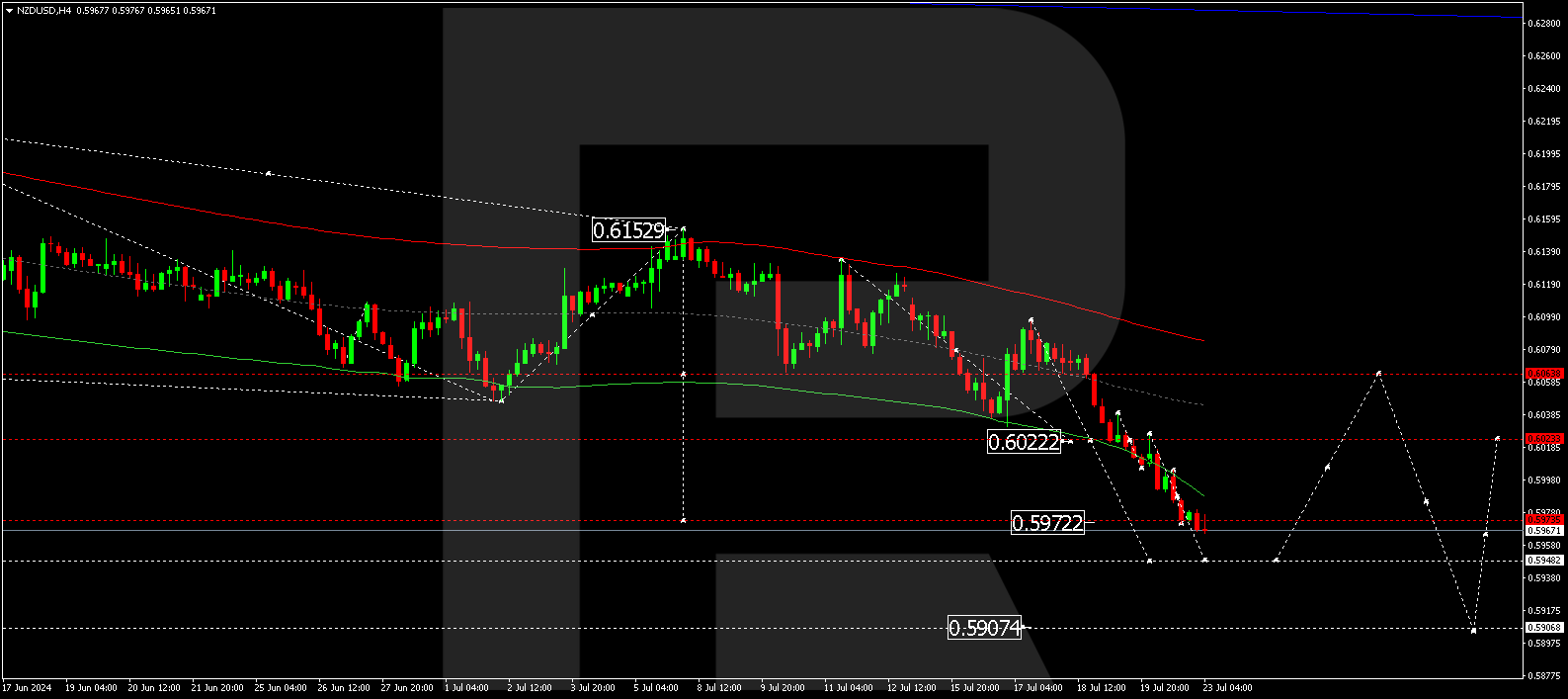

- NZDUSD price targets: 0.5948 and 0.5907

Fundamental analysis

The New Zealand dollar is falling lower against the US dollar. The NZDUSD pair declined to 0.5968 on Tuesday, with active sell-offs underway for the last four trading sessions.

Several factors are putting pressure on the NZD, one of which is an assault from the US dollar.

The other is disappointment over China’s developments. This contributes to worsening attitudes towards NZD and AUD. The Chinese Communist Party’s third plenum had a modest outcome, providing the market with no guidance on supporting the weakening Chinese economy.

A further interest rate reduction by the People’s Bank of China also does not guarantee a rapid economic acceleration. Copper and iron ore prices decreased markedly due to weak Chinese signals. None of these factors favours the stability of the NZD.

NZDUSD technical analysis

On the H4 chart, the NZDUSD currency pair has completed a decline wave, reaching 0.5972. A consolidation range formed around it today, 23 July 2024. A downward breakout of the range will open the potential for the wave extension to 0.5948. After reaching this level, the price could rise at least to 0.6022 (testing from below). Subsequently, a new decline wave might start, aiming for 0.5907 as the estimated target.

Summary

Fundamental factors are pushing down the NZD. Technical analysis for the NZDUSD pair suggests that the trend could continue to the 0.5948 and 0.5907 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.