NZDUSD temporarily strengthens amid signs of stabilisation in the New Zealand economy

The NZDUSD rate rises on Friday after rebounding from the 0.5975 support level. Find out more in our analysis dated 16 August 2024.

NZDUSD forecast: key trading points

- New Zealand's manufacturing PMI increased to 44 points in July

- New Zealand's producer inflation rose by 1.4% in Q2 2024

- The Reserve Bank of New Zealand governor noted that the cash rate could be cut by another 50 basis points

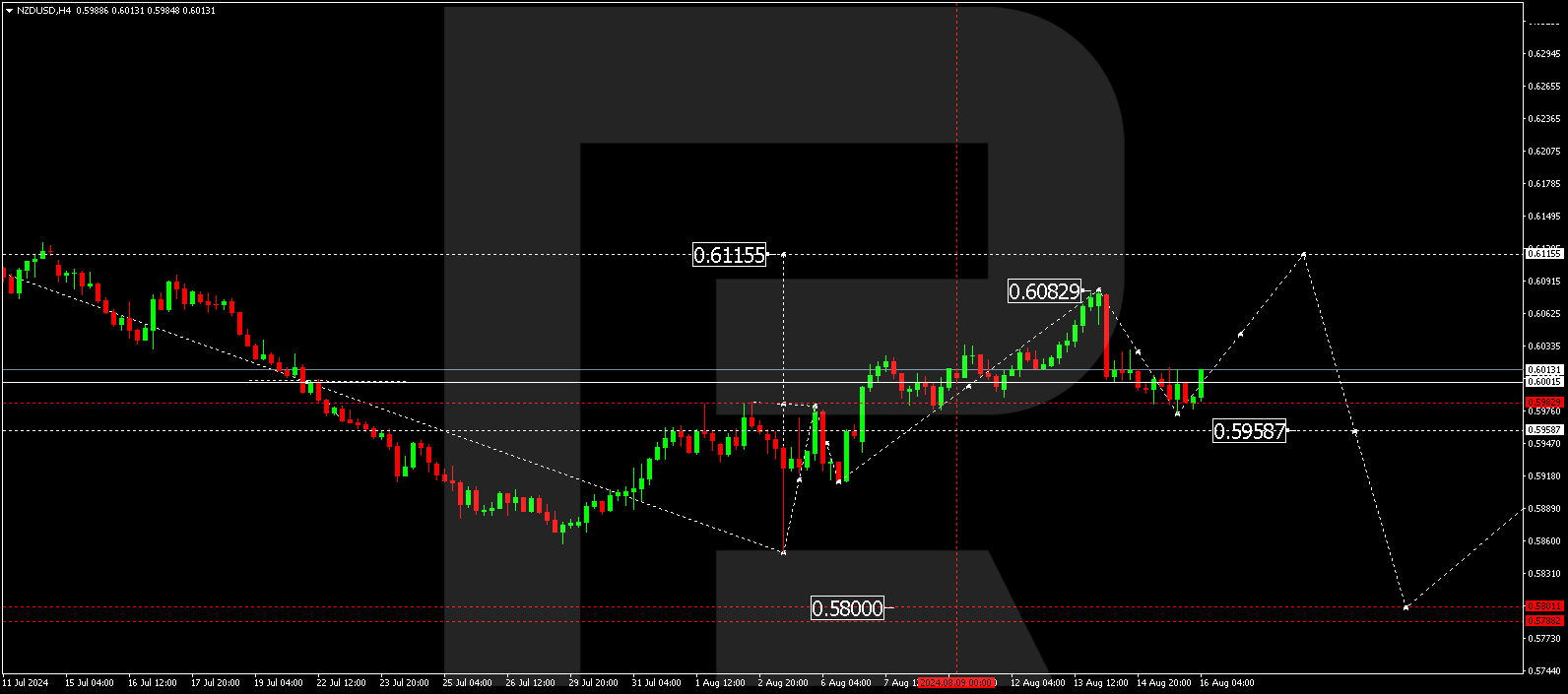

- NZDUSD forecast for 16 August 2024: 0.6115 and 0.5800

Fundamental analysis

Despite the morning’s strengthening of the NZDUSD rate, New Zealand’s manufacturing sector is still facing challenges. Although the BusinessNZ PMI increased to 44.0 points in July from 41.1 in June, it remains significantly below the long-term average of 52.6 points, marking 17 consecutive months of contraction in manufacturing and highlighting serious challenges in the sector.

New Zealand's producer inflation in Q2 2024 was also higher than expected. Prices of production resources rose by 1.4% from the previous quarter mainly due to rising prices for energy and gas supplies. This increases pressure on the industry and may negatively impact the country’s economy as a whole.

Meanwhile, Reserve Bank of New Zealand Governor Adrian Orr noted that the cash rate could be cut by another 50 basis points by the end of the year as inflation is moving towards the 1-3% target range. According to today’s NZDUSD forecast, this statement will help strengthen the New Zealand dollar as it gives hope for a certain stabilisation of the economic environment in the near term.

NZDUSD technical analysis

On the NZDUSD H4 chart, the market has formed a consolidation range around 0.6000 and, breaking above it, reached a local target of 0.6082. There was a technical return to 0.5980 (testing from above) today, 16 August 2024. The growth wave is expected to extend to 0.6115. This growth structure is considered a correction of the previous downward wave. Once the correction is complete, a new downward wave could begin, aiming for (at least) 0.5800.

Summary

While expectations of economic stabilisation have temporarily supported the NZDUSD rate, the potential easing of the RBNZ monetary policy may exert pressure on the New Zealand dollar in the near term. Technical indicators in today’s NZDUSD forecast suggest a correction towards 0.6115, followed by a downward wave towards 0.5800.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.