NZD rises amid easing inflation

The NZDUSD rate is rising on Wednesday, 17 July 2024, after rebounding from the support level. The price earlier reached a two-month low.

NZDUSD trading key points

- New Zealand’s services PMI decreased to 40.2 points in June 2024

- Consumer inflation in Q2 2024 fell to 3.3%, reaching the lowest level in three years

- Markets estimate the likelihood of an interest rate cut at the RBNZ August meeting at 53%

- NZDUSD price targets: 0.6022 and 0.5977

Fundamental analysis

New Zealand’s services PMI decreased by 2.4 points to 40.2 in June 2024, reaching the lowest level in 17 months. This is the fourth consecutive decline, indicating a significant slowdown in the services sector. Due to this, the NZDUSD rate reached a two-month low.

However, today, investors reacted positively to the news that New Zealand’s annual inflation eased to 3.3% in Q2 from 4.0% in the previous quarter, marking the lowest level in three years. The New Zealand dollar recouped some losses, rising above 0.6081. Despite this data, markets are still pricing in about three interest rate cuts by the end of the year.

The RBNZ kept the interest rate at 5.5% last week but hinted at a potential future easing of monetary policy if inflation continues to slow. This increased the chances of an interest rate cut at the August meeting which is currently estimated by markets at 53%.

NZDUSD technical analysis

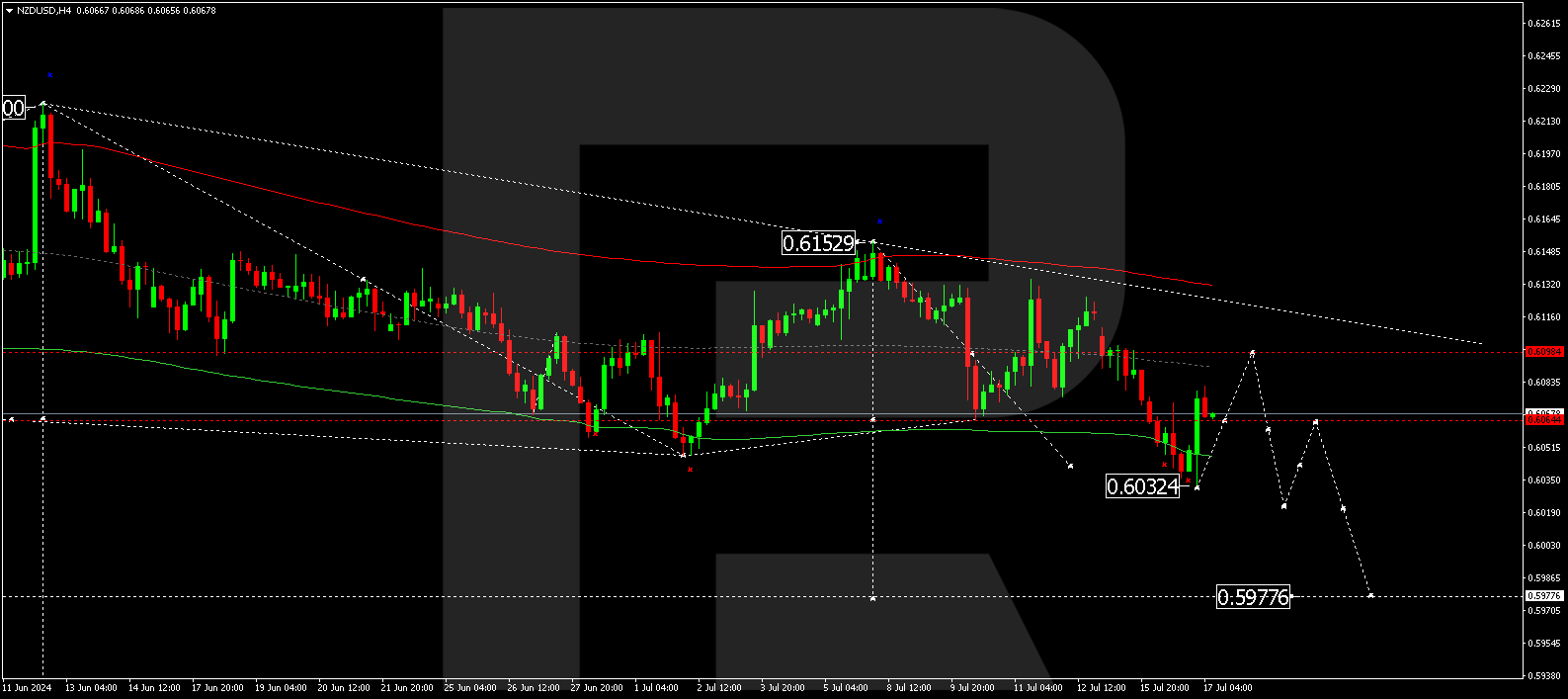

On the H4 chart, the NZDUSD pair completed a decline wave, reaching 0.6031. Today, 17 July 2024, a correction towards 0.6098 is expected. Once the correction is complete, a new decline wave could start, aiming for the local target of 0.6022. Subsequently, the price could rise to 0.6064 (testing from below) before falling to 0.5977, the estimated target.

Summary

Despite growth driven by easing inflation, the New Zealand dollar could weaken due to a significant decline in business activity in the services sector. Technical analysis of the NZDUSD pair suggests that the trend could continue to the 0.6022 and 0.5977 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.