NZD has reached new weekly highs, driven by the weak US dollar

The NZDUSD pair has risen for the fourth consecutive day, driven by the US dollar's weakness.

NZDUSD trading key points

- NZDUSD benefits from the US dollar's fall

- The RBNZ will keep the interest rate unchanged at 5.5% per annum

- NZDUSD price targets: 0.6090, 0.6040

Fundamental analysis

The NZDUSD pair rises for the fourth consecutive day, reaching 0.6116.

The New Zealand dollar gains ground due to the US dollar's weakness. The USD previously declined after the release of the ADP employment data in the US private sector and amid decreasing business activity in the services sector. These factors strengthened the market view that the Federal Reserve will reduce borrowing costs by the end of 2024. The US dollar fell, giving other currencies a chance to rise.

At its previous meeting, the Federal Reserve noted an inflation shift in the right direction but believed prices were not moving fast enough to revise interest rates.

Some Federal Reserve monetary policymakers stress the importance of being patient and consistent when making interest rate decisions. Others believe that it is time to raise rates as inflation is rising.

The Reserve Bank of New Zealand will hold a meeting next week. It will highly likely leave the interest rate unchanged at 5.5% for the eighth consecutive time.

NZDUSD technical analysis

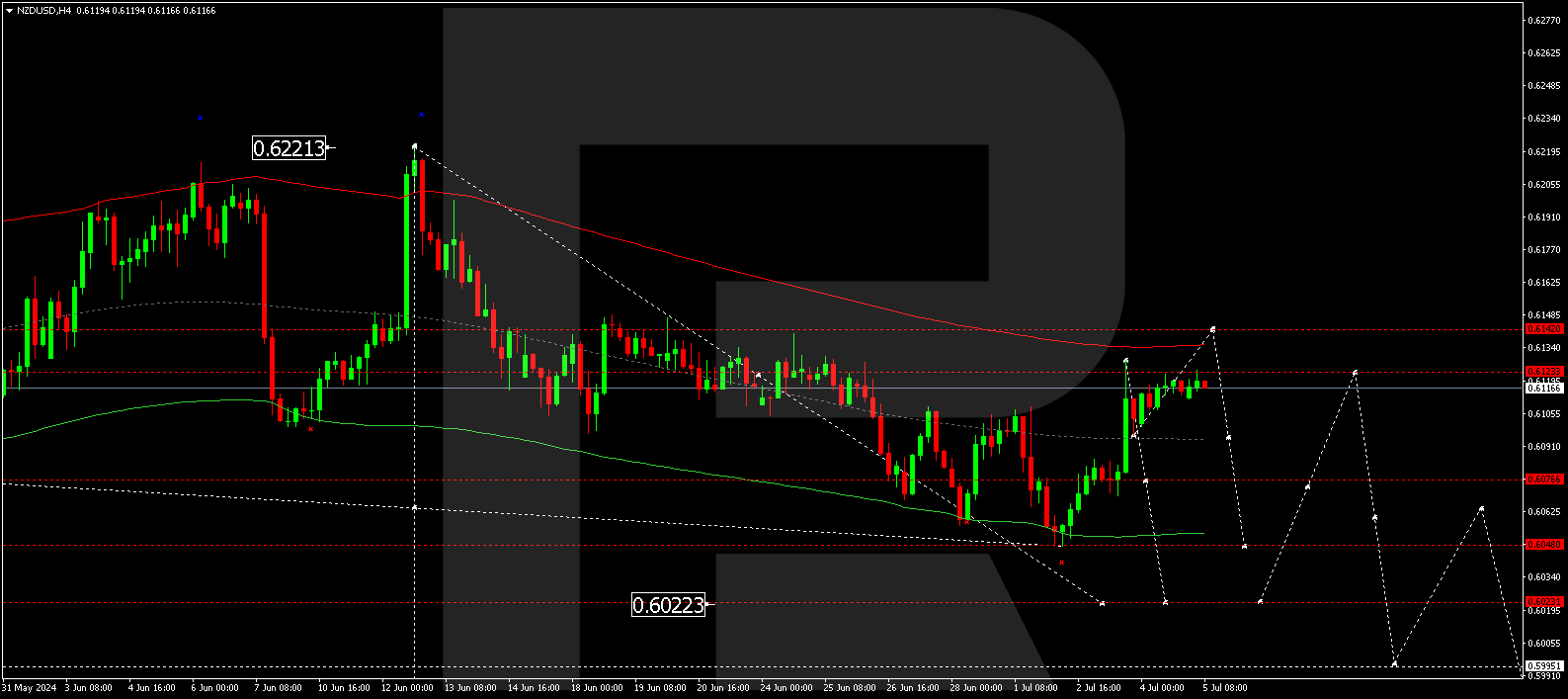

On the H4 chart, NZDUSD has corrected towards 0.6128. The market is forming a consolidation range around 0.6115, which could extend up to 0.6134 today, 5 July 2024. Once the price reaches this level, a new decline wave is expected to start, aiming for 0.6090. Breaking above this level will open the potential for a decline to 0.6040, potentially continuing to 0.6023, the estimated target.

Summary

The New Zealand dollar is strengthening, supported by the weakness of the US currency. The NZDUSD technical analysis suggests the completion of the correction and the beginning of a new decline wave to the 0.6090 and 0.6040 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.