GBPUSD may decline amid criticism of the government from Rachel Reeves

The GBPUSD pair declines further ahead of a speech by the new UK Chancellor of the Exchequer. Speculations about potential tax increases might push the GBPUSD rate further down. Find out more in our analysis dated 29 July 2024.

GBPUSD trading key points

- Bank of England consumer lending: previously at 1.513 billion

- M3 monetary aggregate: previously at 3,040.6 billion

- Dallas Fed manufacturing index (US): previously at -15.1

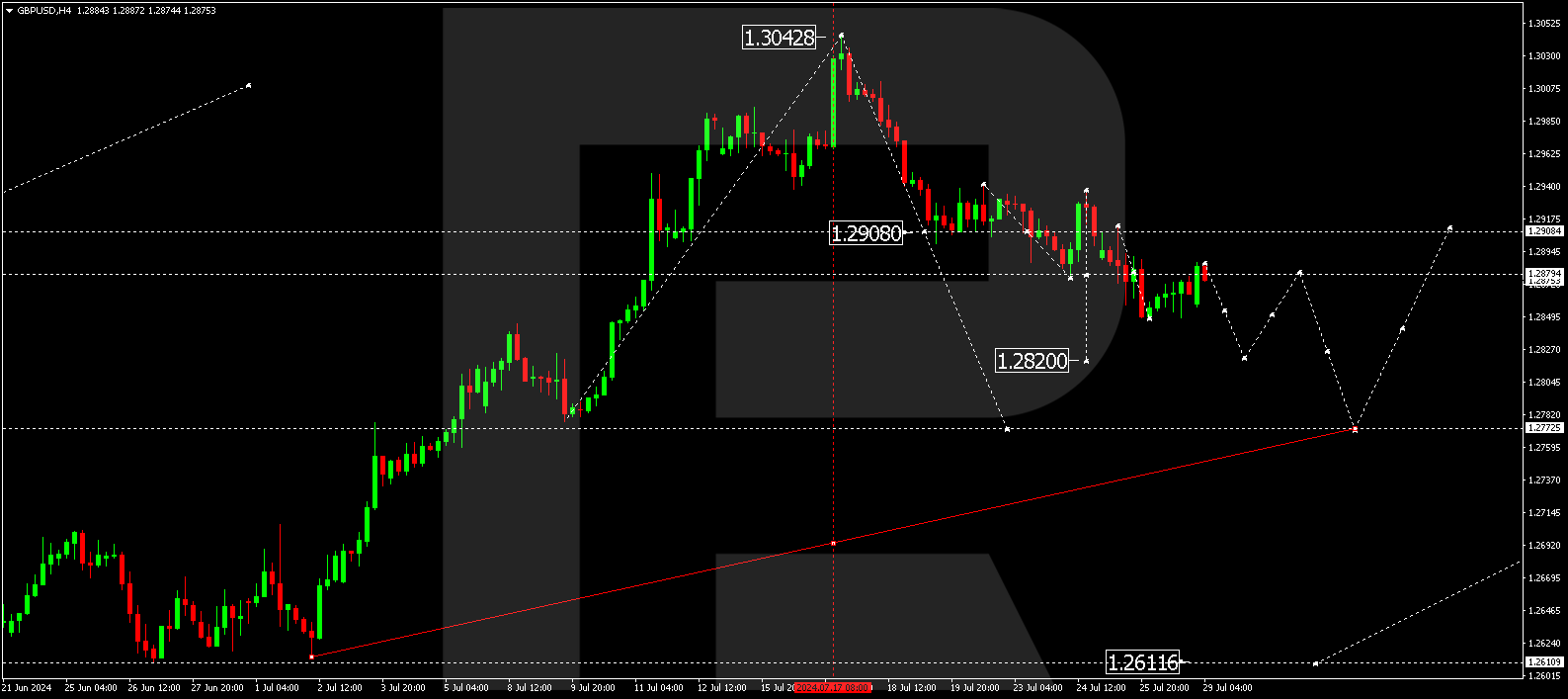

- GBPUSD forecast for 29 July 2024: 1.2840, 1.2800, and 1.2777

Fundamental analysis

The Bank of England consumer lending volume indicates the number of funds granted as loans to individuals over the past month. Higher-than-forecast figures are considered positive for the pound sterling. However, a declining trend in lending volumes over recent months has negatively impacted the GBPUSD rate.

The M3 monetary aggregate, due to be published on Monday, 29 July 2024, reflects the total value of all liquid funds available to the population. A reading above the forecast may be a positive factor for the pound.

The Dallas Fed Manufacturing Index (US) will be published at the start of the US trading session. A reading below zero is expected to impact the US dollar negatively.

UK Chancellor of the Exchequer Rachel Reeves has criticised the previous government, accusing it of concealing the country’s actual financial state. The estimated fiscal deficit is approximately 20 billion pounds. Expectations are that Rachel Reeves’s speech is not optimistic, potentially laying the foundation for future tax hikes.

GBPUSD technical analysis

An analysis of 29 July 2024 shows that the GBPUSD pair is in a consolidation phase around 1.2871. The market has extended the range down to 1.2848 and up to 1.2887. The GBPUSD rate is expected to decline to 1.2840 today. If the price breaks below this level, the decline could reach 1.2800. Subsequently, upward momentum is expected, targeting 1.2910 (testing from below), followed by a decline to 1.2777, the first target of the descending wave.

Summary

Criticism of the previous government, potential tax increases, and technical indicators point to a potential decline in the GBPUSD rate towards the 1.2840, 1.2800, and 1.2777 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.