The fall of the pound continues for the second week

On Monday, the pound keeps losing ground against the US dollar, continuing its decline since 12 June 2024.

The fall of the pound continues

British industrialists expect a slight improvement in the UK Industrial Orders Index (CBI). The CBI came out worse than expected in the last reporting period, but now the analysts are waiting for more favourable data, which will not help improve the GBPUSD rate.

The indicator is expected to settle around the -26 level in the current reporting period compared to -33 in the previous one. Index values below zero indicate a decline in the volume of industrial orders and have a negative impact on the GBPUSD rate.

Also on Monday, the CFTC data on the number of net speculative positions in GBP among traders in the New York and Chicago futures markets will be released. Over the past four weeks, the number of positions in GBPUSD has been growing, which may indicate an increase in demand for this asset among speculators.

GBPUSD technical analysis

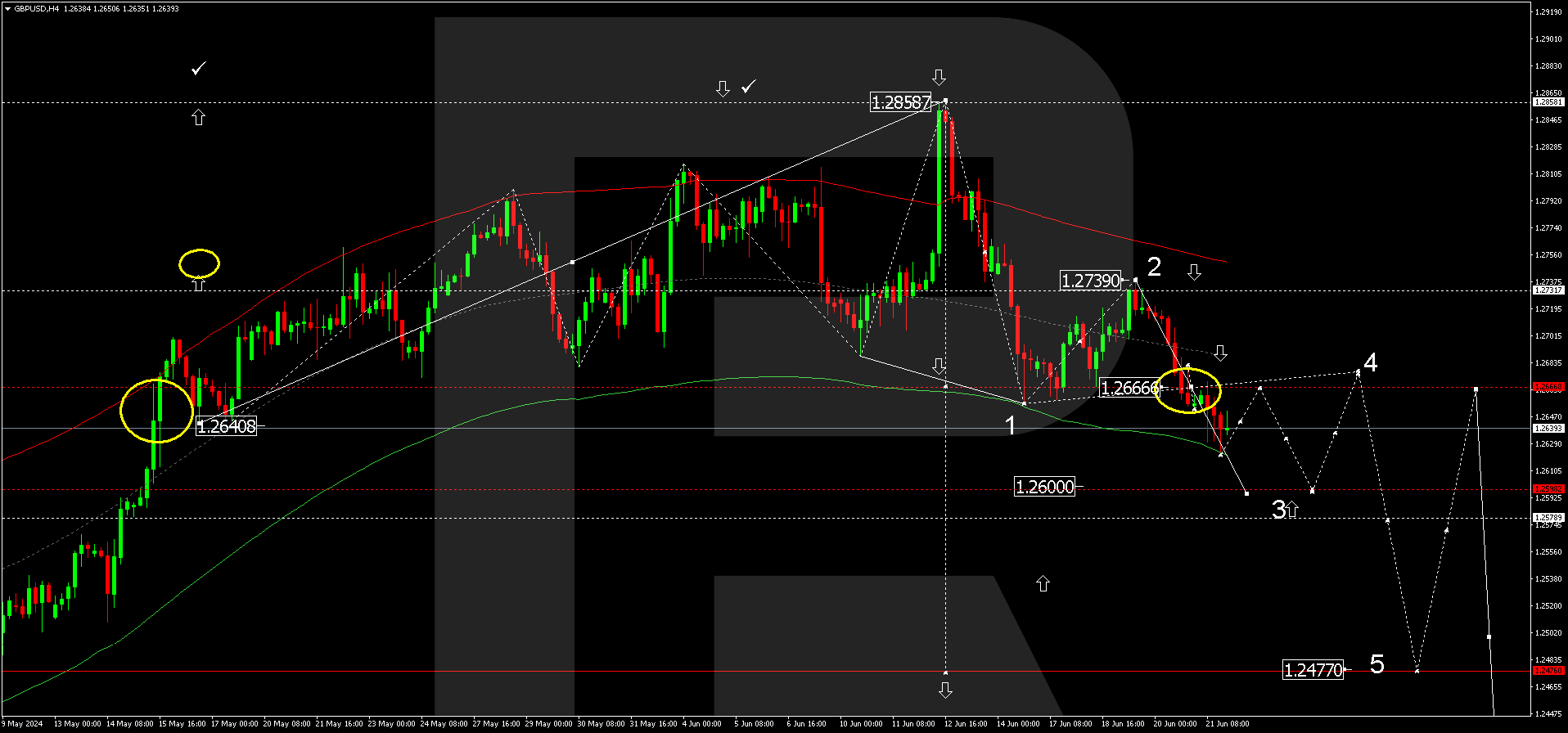

According to the analysis on 24 June 2024, GBPUSD is developing another decline wave towards 1.2600. On the GBPUSD H4 chart, a consolidation range has formed around 1.2666. This level is crucial in the current decline wave.

If the price falls below the range's boundary, another decline wave could develop towards a local target at 1.2600. After this wave is completed, a corrective GBPUSD growth structure towards 1.2666 (test from below) may begin, followed by another decline wave with a first target at 1.2477.

GBPUSD technical analysis 24.06.2024

This scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 1.2666. The market continues to decline to the lower boundary of the Envelope. After reaching 1.2600, a growth wave towards the Envelope's centre at 1.2666 may begin.

After that, a decline to the Envelope's lower boundary at 1.2477 is possible. Only after the price reaches this level may the decline wave be considered complete. A correction to the Envelope's upper boundary may follow.

Summary

A negative news background can confirm the results of the technical analysis of GBPUSD, which suggests the development of a trend towards 1.2600 and 1.2477.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.