GBPUSD may rise further to 1.3000

The British pound continues to strengthen against the US dollar despite scarce UK news. Find out more in our analysis dated 19 August 2024.

GBPUSD forecast: key trading points

- The Rightmove UK house price index (m/m): previously at -0.4%, currently at -1.5%

- A speech by Federal Reserve official Christopher Waller

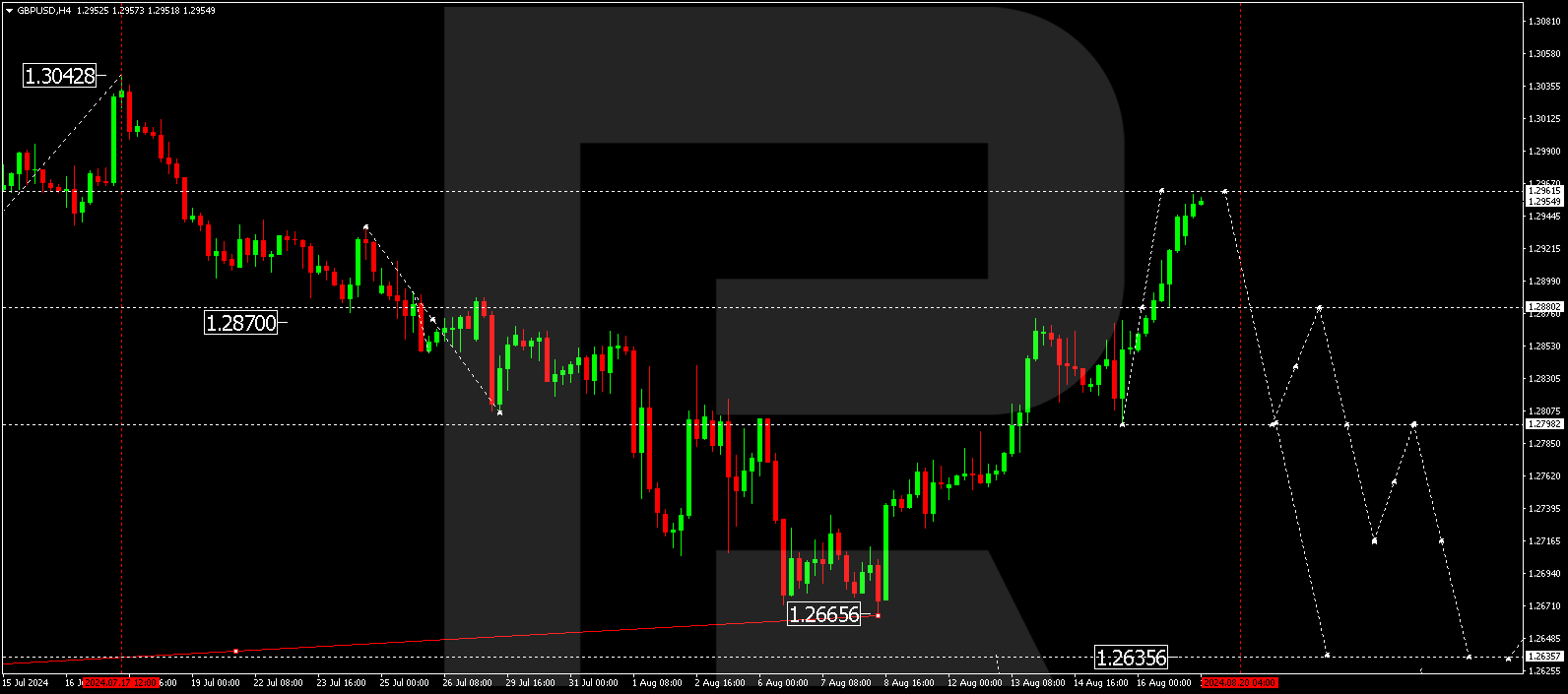

- GBPUSD forecast for 19 August 2024: 1.2798 and 1.2630

Fundamental analysis

A monthly change in the Rightmove UK house price index was published today. The indicator shows how much the average price of housing property for sale has changed over the reporting period. Data above the forecast and the previous value is a positive factor for the pound sterling. Weaker-than-expected statistics reflect negative developments. Although the indicators are currently below the previous readings, they did not have a significant impact on the GBPUSD rate.

Federal Reserve Governor Waller will deliver a speech at the beginning of the US trading session and might shed light on the Fed’s monetary policy. A decision to change the US interest rate is expected in September; a reduction is only likely if inflation indicators stabilise. Analysis for 19 August 2024 shows that if the interest rate changes, this could further weaken the US dollar and push up the GBPUSD pair after a correction.

GBPUSD technical analysis

As analysis for 19 August 2024 shows, the GBPUSD pair has completed a corrective wave, reaching 1.2960. This correction is expected to be complete today, with a downward wave beginning towards 1.2798, the first target. Once the GBPUSD rate reaches this level, it could rise to 1.2880 (testing from below). Subsequently, the downward wave might continue towards 1.2635, the local target.

Summary

Expectations for a US interest rate decision and GBPUSD technical analysis suggest that the GBPUSD rate could decline to the 1.2798 and 1.2630 levels today.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.