The GBPUSD pair hit a monthly peak

The GBPUSD pair is appreciating markedly; market sentiment is positive. The Bank of England is gathering additional arguments in favour of falling inflation.

GBPUSD trading key points

- The GBPUSD pair reached new monthly highs

- The Bank of England needs additional data to evaluate the price environment

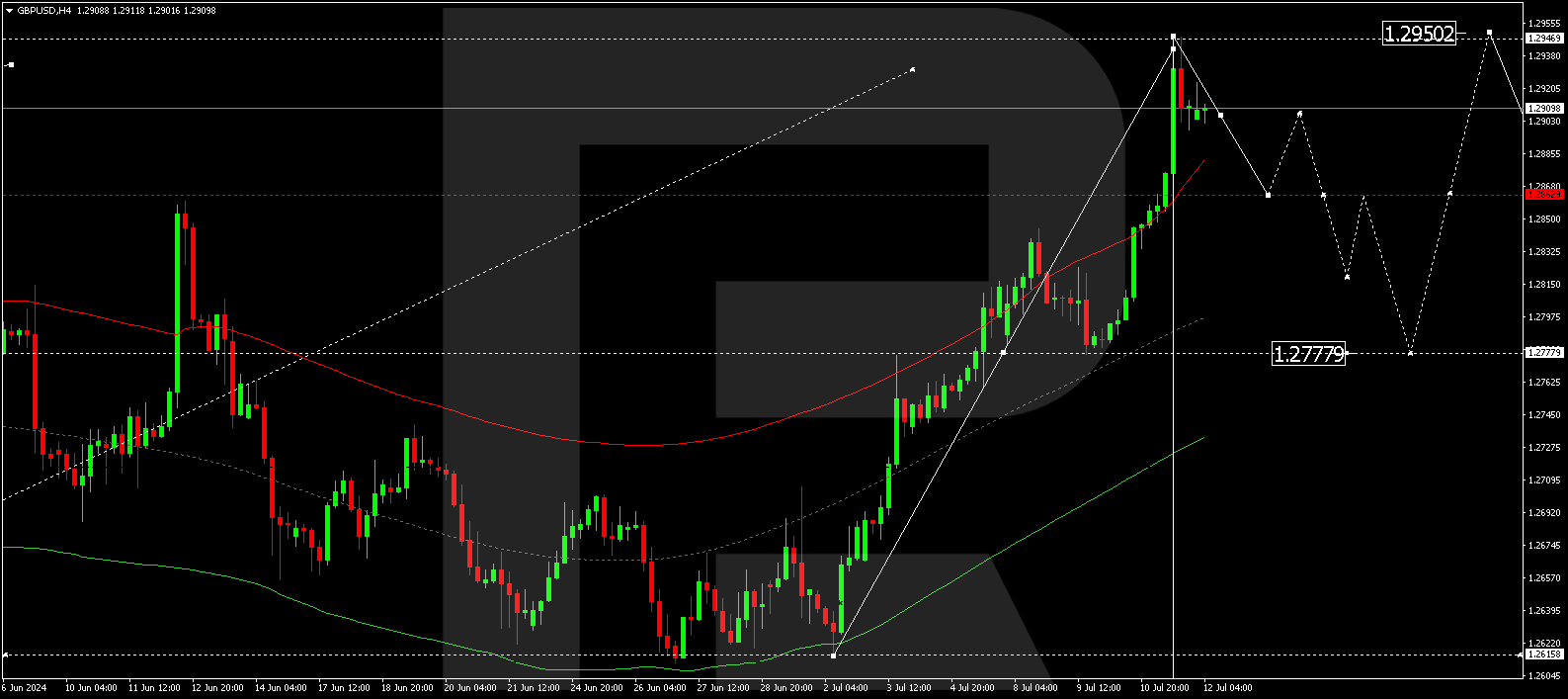

- GBPUSD price targets: 1.2777 and 1.2950

Fundamental analysis

The British pound sterling appears strong against the US dollar. The latest growth impulse was driven by a statement made by Bank of England Chief Economist Huw Pill. He noted that additional evidence of a sustained decline in inflation was necessary before deciding to lower interest rates. Pill believes rising prices in the services sector and overall wage growth negatively impact consumer prices.

UK inflation reached the 2% target in May. However, according to Pill, more is needed as this could be a temporary phenomenon.

The market currently expects borrowing costs to be reduced at the September meeting. According to stock market forecasts, two interest rate cuts of 25 basis points each are possible by the end of the year.

However, the GBP is in no hurry to decline in this environment, and it will take the Bank of England quite a long time to gather statistics.

GBPUSD technical analysis

Based on analysis as of 12 July 2024, the GBPUSD pair has reached the growth wave’s local target of 1.2945. Today, a correction might start, aiming for 1.2777. After the correction, the price could rise to 1.2950, marking the completion of growth potential. Subsequently, a decline wave could begin, targeting 1.2610.

Summary

The pound sterling is rising steadily and has reached a monthly high. Technical analysis suggests that the GBPUSD rate will continue its upward trajectory to the 1.2950 target.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.