EURUSD continues to decline, with the Federal Reserve’s interest rate decision at stake

The EURUSD pair is expected to face a severe shock by the end of the US trading session. The Federal Reserve’s interest rate decision could bring substantial changes. Find out more in our analysis dated 31 July 2024.

EURUSD trading key points

- The eurozone’s consumer price index in July (y/y): previously at 2.5%, forecasted at 2.5%

- US ADP non-farm payrolls: forecasted at 147K, previously at 150K

- The US Federal Reserve’s interest rate decision

- EURUSD forecast for 31 July 2024: 1.0764, 1.0752, and 1.0686

Fundamental analysis

The Consumer Price Index in the eurozone is projected to remain at 2.5%; from the analysts’ perspective, consumers did not see significant changes in the prices of goods and services. An actual value aligned with the forecast and previous data would bolster optimism in the EURUSD forecast for 31 July 2024.

US non-farm payrolls are an early indicator of government employment statistics. The forecast suggests a decline to 147K, which could significantly impact the EURUSD rate.

While a plethora of data and news is due today for the eurozone and the US, the Fed’s interest rate decision is the primary news that will affect today’s EURUSD forecast. Regardless of the outcome, markets will experience increased volatility. An interest rate cut could undermine the entire analysis for 31 July 2024 and trigger a strengthening of the euro against the US dollar. Conversely, keeping the interest rate unchanged will unlikely prevent the US dollar from losing ground.

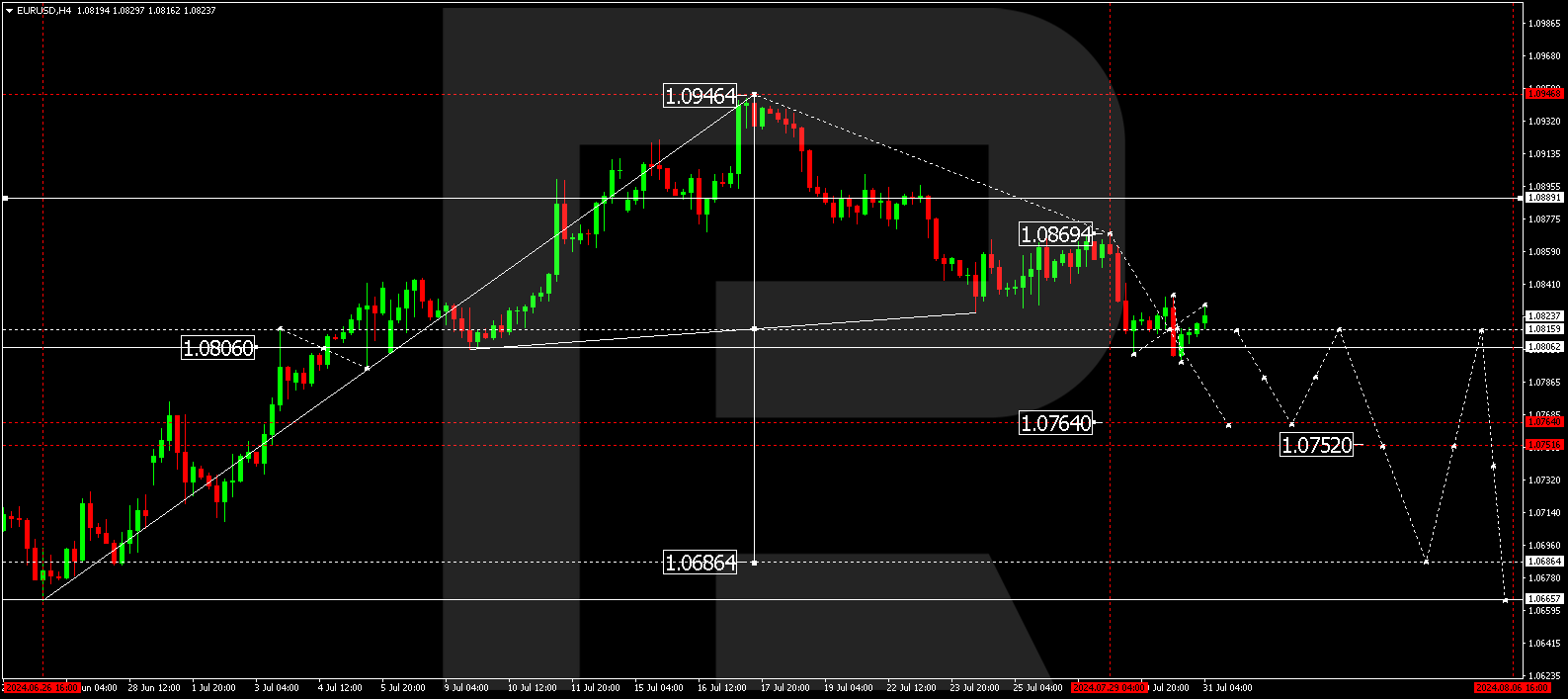

EURUSD technical analysis

On the EURUSD H4 chart, a consolidation range is forming around 1.0815, extended down to 1.0797 and up to 1.0829. Today, 31 July 2024, a break below this range could target 1.0764. An upward breakout might lead to a correction towards 1.0835. Subsequently, the price could decline to the local target of 1.0750.

Summary

The Federal Reserve’s interest rate decision may adjust today’s EURUSD forecast. Technical indicators suggest that the trend might continue further down to the 1.0764, 1.0752, and 1.0686 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.