EURUSD continues to rise: risk appetite supports buyers

The EURUSD pair is rising. The week begins quietly, with the US Federal Reserve meeting lying ahead. Find out more in our forecast dated 29 July 2024.

EURUSD trading key points

- The EURUSD pair maintains its upward trajectory

- The market expects a Federal Reserve interest rate cut in September

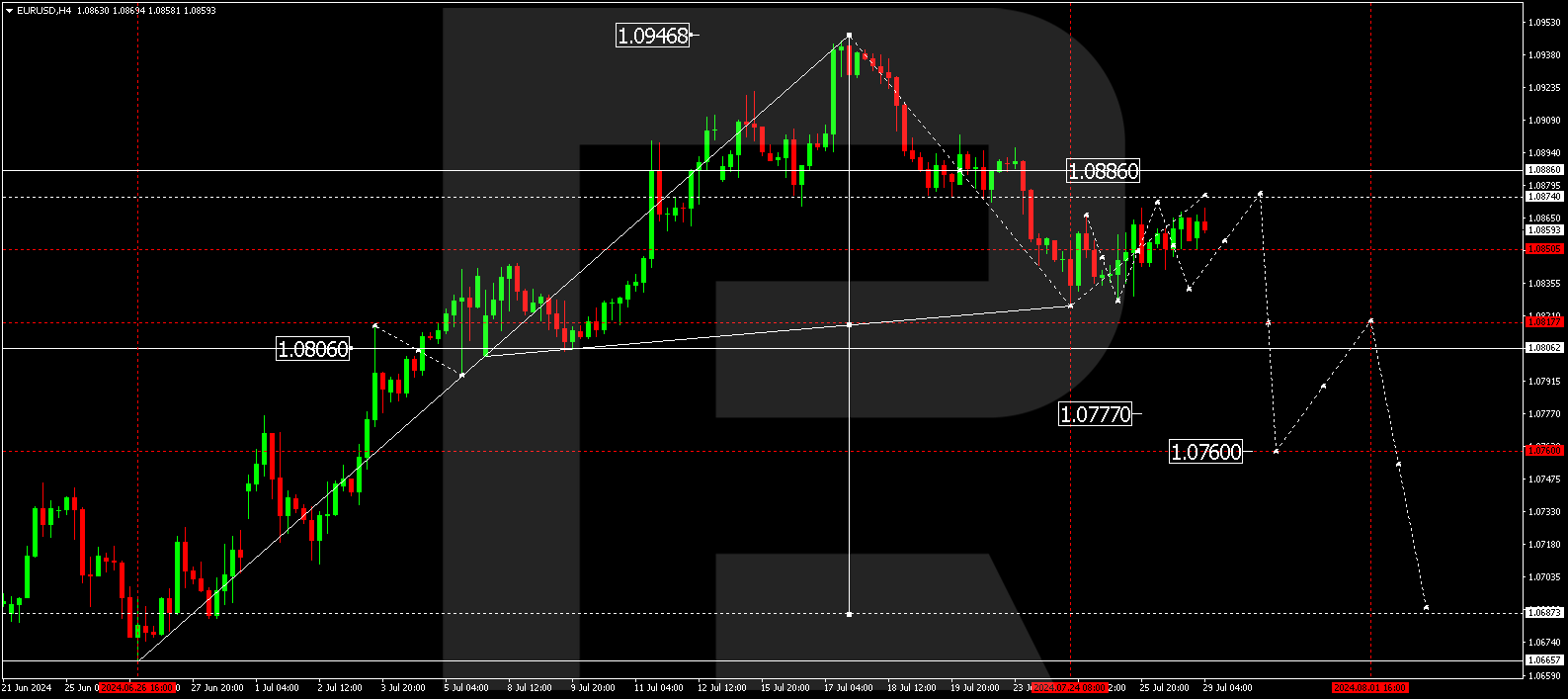

- EURUSD forecast for 29 July 2024: 1.0874, 1.0820, 1.0777, and 1.0760

Fundamental analysis

The EURUSD pair climbs to 1.0859 on Monday.

The focus will be on the US Federal Reserve meeting this week. The Fed must maintain all the fundamentals for a September interest rate cut.

The core Personal Consumption Expenditures (core PCE) price index rose by 0.1% m/m in June after stabilising in May. The indicator increased by 2.5% year-over-year compared to the May reading of 2.6%. All this aligned with expectations. However, a further decline would bolster confidence that the Fed will reduce the rate quickly. The Federal Reserve uses this inflation measure to make its monetary decisions.

The market remains unconcerned and expects monetary conditions to ease in September.

EURUSD technical analysis

On the EURUSD H4 chart, a consolidation range continues to develop around 1.0850 with no clear trend. A rise to 1.0871 remains relevant today, 29 July 2024. Subsequently, the price could fall to 1.0833 and then rise to 1.0874. A price surge to 1.0886 is also possible. This entire growth structure is viewed as a correction of the previous decline wave. Once it is complete, a new decline wave is expected to start, aiming for 1.0820 and potentially continuing to the local targets of 1.0777 and 1.0760.

Summary

Although the EURUSD pair maintained its recovery momentum, it is temporary. The EURUSD forecast for today aligns with technical indicators, suggesting a further corrective wave towards (at least) 1.0874. Once completed, the EURUSD rate is expected to decline to the targets of 1.0818, 1.0777, and 1.0760.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.