EURUSD is correcting ahead of US inflation data

The EURUSD rate is declining on Friday, 28 June 2024, nearly reaching the lower boundary of the weekly range. The current exchange rate is 1.0694.

The PCE index may catalyse a decline in the euro

Today, traders are focused on the US PCE (Personal Consumption Expenditures) price index release, a key inflation gauge for the Federal Reserve. Reuters analysts project a slowdown in annual PCE growth to 2.6%. A lower-than-forecasted reading may heighten expectations of a Federal Reserve interest rate cut this year, temporarily pushing up the EURUSD pair.

The likelihood of further ECB interest rate cuts in 2024 also exerts pressure on the euro. ECB Governing Council member Olli Rehn told Bloomberg that two rate cuts this year seem rational. This statement contrasts with the stance of the Fed’s Michelle Bowman, who does not expect interest rate reductions in the US until the end of the year. The US dollar is also bolstered by an improved US GDP growth estimate in Q1, revised from 1.3% to 1.4%.

Overall, analysts’ forecasts do not suggest Federal Reserve rate hikes until the end of the year, and the average forecast of the Federal Reserve members allows for only one cut, which is hugely beneficial for the US dollar. Thus, the combination of US inflationary expectations and the Federal Reserve and ECB monetary policy exerts pressure on the EURUSD rate, potentially leading to a breakout of the weekly range’s lower boundary.

EURUSD technical analysis

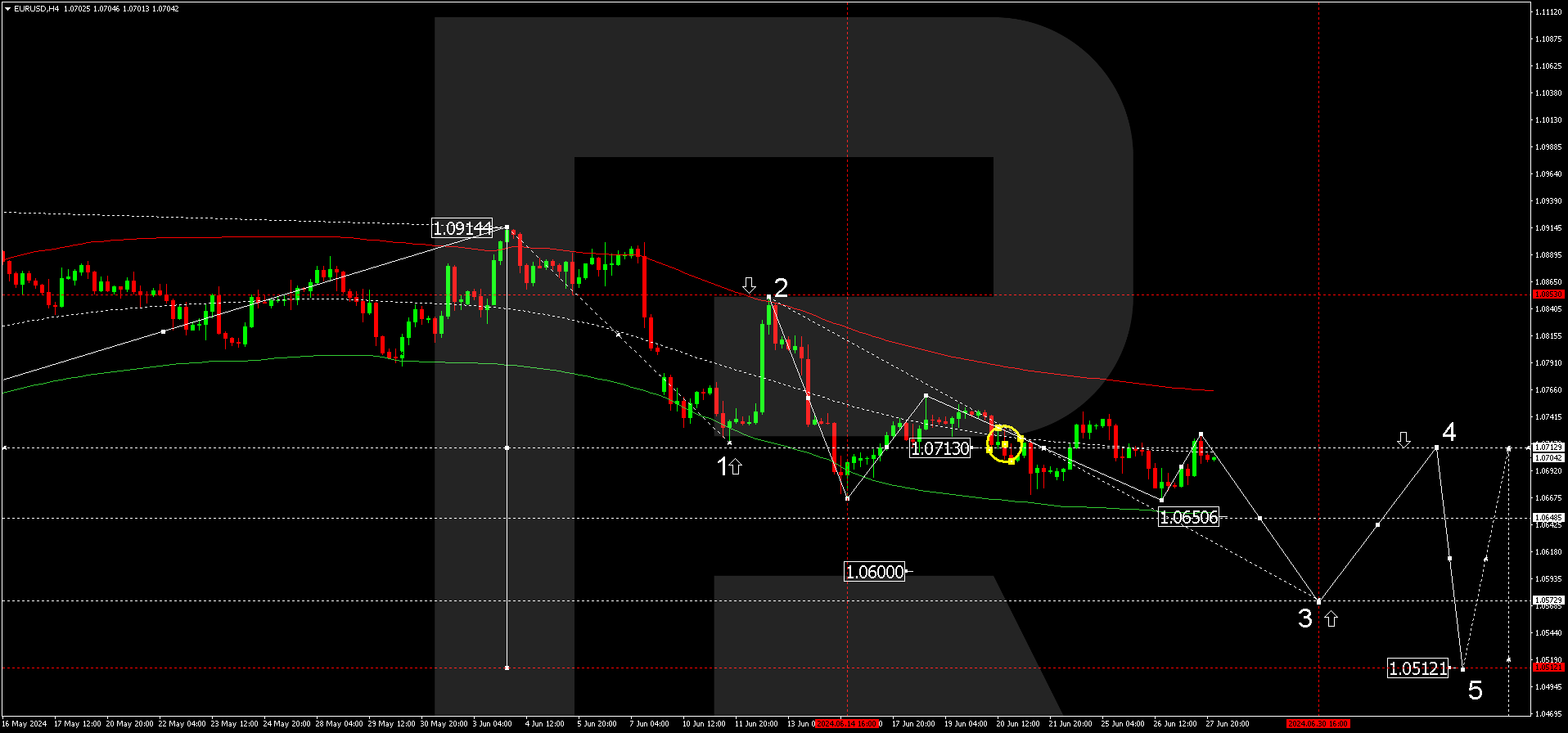

On the H4 chart, EURUSD has completed a corrective wave, reaching 1.0718. A wide consolidation range might form around 1.0713. As of 28 June 2024, it will be relevant to consider the development of another decline wave towards 1.0650, potentially continuing to the local target of 1.0573.

The Elliott Wave structure and a wave matrix with a pivot point at 1.0713 technically confirm this scenario. This level is considered crucial for a downward wave in the EURUSD rate. The market continues to decline to the Envelope’s lower boundary. Today, the downtrend could continue. A growth wave aiming for the Envelope’s upper boundary might start only after the price reaches 1.0573.

Summary

The strong PCE index might prompt a decline in the EURUSD pair due to the expected monetary policy tightening by the Federal Reserve. The EURUSD technical analysis suggests a further decline towards the 1.0650, 1.0600, and 1.0573 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.